Osirium Technologies PLC Update re proposed grant of options (5049W)

18 April 2023 - 4:00PM

UK Regulatory

TIDMOSI

RNS Number : 5049W

Osirium Technologies PLC

18 April 2023

18 April 2023

Osirium Technologies plc

("Osirium", the "Group" or the "Company")

Update re proposed grant of options

Osirium Technologies plc (AIM: OSI), a leading vendor of

cloud-based cybersecurity and IT automation software, provides an

update on the proposed amendments to the Company's share option

scheme to be considered at its forthcoming AGM, details of which

were announced on 3 April 2023 (the "Announcement").

The Company has received feedback from certain key shareholders

in the Company ("Shareholders") regarding the proposed New Options

set out in the Announcement. The Company intends to continue to

seek shareholder approval for the amendments to the Company's

Enterprise Management Incentive (EMI) Share Option Plan 2020-2025

(the "Plan") at the AGM as set out in the AGM notice. However,

Osirium's Remuneration Committee (the "Remuneration Committee") has

taken on board the feedback received and has decided to make

certain amendments to the New Options proposed to be granted,

should the Plan Resolution be passed at the AGM, as follows:

-- the New Options will have a minimum exercise price of 2p

(being the issue price of the Company's most recent fundraise) or,

if higher at the time of grant, the 'Market Price' of an Ordinary

Share as determined under the Plan rules;

-- all New Options will be subject to the following additional

performance based vesting criteria:

o the closing share price of an Ordinary Share must exceed 4p

for a rolling 30-day period; and

o the Company must have achieved annualised recurring revenue

("ARR") of at least GBP3.5 million, when reported in the Company's

full year or half year results.

-- The New Options would still vest equally over three years as set out in the Announcement.

The Remuneration Committee believes that these additional

performance criteria more closely align the targets with the

interests of Shareholders.

The Remuneration Committee has also determined that the New

Options would only be granted to members of the full-time executive

management team and key employees. Therefore, the number of New

Options that are proposed to be granted to Directors of the Company

and persons closely associated with them ("PCAs") are as

follows:

Percentage

of existing

issued share

capital of

No. of existing the Company

options currently No. of New represented

held and to Options to by the New

Director/PCA be surrendered be granted Options

Stuart McGregor (CEO) 218,500 3,676,461 3.00%

Rupert Hutton (CFO) 147,250 1,225,487 1.00%

David Guyatt (Chairman) 1,061,416 - -

Simon Lee (NED) 147,250 - -

Simon Hember (NED) 26,125 - -

Catherine Jamieson

(wife of David Guyatt) 180,000 612,743 0.50%

The Board of Osirium welcomes the opportunity for engagement

with Shareholders and would like to thank those Shareholders who

provided feedback on the original proposals. Full details of the

proposed amendments to the Plan are set out in the explanatory

notes to the notice of AGM. Should the Plan Resolution not be

passed at the AGM, the Company will not be able to make the

proposed amendments to the Plan or grant the New Options. A further

announcement will be made on conclusion of the AGM.

Definitions

Capitalised terms used in this announcement have the meanings

given to them in the Announcement issued by the Company on 3 April

2023, unless otherwise defined herein.

Contacts:

Osirium Technologies plc Tel: +44 (0)1183 242 444

Stuart McGregor, Chief Executive Officer

Rupert Hutton, Chief Financial Officer

Allenby Capital Limited (Nominated adviser and broker) Tel: +44 (0)20 3328 5656

James Reeve / George Payne (Corporate Finance)

Tony Quirke (Sales and Corporate Broking)

Alma PR (Financial PR adviser) Tel: +44 (0)20 3405 0205

Hilary Buchanan osirium@almapr.co.uk

Kieran Breheny

Will Ellis Hancock

About Osirium Technologies Plc

Osirium Technologies plc (AIM: OSI) is a leading UK-based

cybersecurity software vendor delivering Privileged Access

Management (PAM), Privileged Endpoint Management (PEM) and Osirium

Automation solutions that are uniquely simple to deploy and

maintain.

With privileged credentials involved in over 80% of security

breaches, customers rely on Osirium PAM's innovative technology to

secure their critical infrastructure by controlling 3rd party

access, protecting against insider threats, and demonstrating

rigorous compliance. Osirium Automation delivers time and cost

savings by automating complex, multi-system processes securely,

allowing them to be delegated to Help Desk engineers or end-users

and to free up specialist IT resources. The Osirium PEM solution

balances security and productivity by removing risky local

administrator rights from users, while at the same time allowing

escalated privileges for specific applications.

Founded in 2008 and with its headquarters in Reading, UK, the

Group was admitted to trading on AIM in April 2016. For further

information please visit www.osirium.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKDLFFXZLEBBE

(END) Dow Jones Newswires

April 18, 2023 02:00 ET (06:00 GMT)

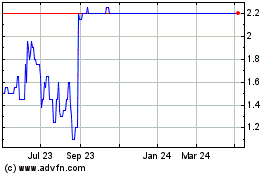

Osirium Technologies (LSE:OSI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Osirium Technologies (LSE:OSI)

Historical Stock Chart

From Jan 2024 to Jan 2025