Business

Update

- Current contracted value

signed in 2023 of £124 million, an increase of 47% compared to £85

million in the year ending 31 December 2022 (excluding COVID-19

vaccine manufacturing)

- On track to achieve 2023

guidance provided at the Interim Results and

reiteration of medium term guidance; growth supported by new orders

recently signed across lentivirus, adeno-associated virus (AAV) and

adenoviral vectors

- Progress towards

multi-vector multi-site model with transfer of lentiviral vector

capabilities to Bedford, Massachusetts site and acquisition of ABL

Europe

- Recruitment of UK and US

Site Heads with extensive CDMO experience to support move to

site-based structure and strategic shift to a pure-play

CDMO

- Significant progress in

streamlining of operations to become a pure-play CDMO resulting in

annualised cost-savings of c.£30 million

Oxford, UK – 7 December

2023: Oxford Biomedica plc (LSE:OXB) (“Oxford

Biomedica” or “the Company”), a quality and innovation-led cell and

gene therapy CDMO, today announces a business update for the year

ending 31 December 2023.

Becoming a pure-play CDMO in cell and

gene therapy

Oxford Biomedica has made significant progress

in its streamlining of operations to become a pure-play quality and

innovation-led global cell and gene therapy CDMO. The Company has

concluded the reorganisation of its workforce, which, among other

measures to increase efficiencies, includes a more streamlined

structure across the UK and US. This organisational restructuring

is tailored to boost efficiency and client-centricity, aligning

roles and operations with the specific requirements of a pure-play

CDMO. These strategic changes will result in a reduction of the

ongoing cost base from 1 January 2024 by c.£30 million on an

annualised basis compared to 2023.

Positive momentum in commercial

activity

The Company continues to demonstrate robust

business development activity, a testament to its strong position

in the viral vector space. This year, Oxford Biomedica has more

than doubled the number of contracts and client orders signed

compared to the previous year, reflecting a growing demand for its

services from a diverse array of pharmaceutical and biotech

clients. Current contracted value of client orders

signed in 2023 is £124 million, an increase of 47% compared to £85

million in the year ending 31 December 2022 (excluding COVID-19

vaccine manufacturing). Furthermore, the pipeline of opportunities

continues to progress as anticipated, not only in lentivirus, AAV,

and adenoviral vectors but also in other vector types. Work with

these additional vector types now account for more than 10% of the

weighted pipeline.

Current trading and medium term

guidance

In line with guidance provided at the Interim

Results in September, the Company is on track to deliver revenues

for the year ending 31 December 2023 of approximately £90

million.

Also in line with guidance provided at the

Interim Results, Operating EBITDA loss for the second half of 2023

is on track to be approximately £10 million better than the first

half.

The Company also remains on track to deliver

broadly breakeven Operating EBITDA in 2024, bolstered by positive

momentum in business development activities and new orders recently

secured across lentivirus, adenoviral vectors and AAV, with both

new and existing clients. This momentum will further support the

Company’s medium term guidance of a three-year revenue CAGR in

excess of 30%, and at least a doubling of revenues by the end of

2026.

The above guidance excludes the financial impact

of the acquisition of ABL Europe SAS (“ABL Europe”). The Company

will provide further financial guidance after the completion of

this transaction, currently expected in the first quarter of

2024.

Multi viral vector CDMO capabilities

across multiple sites

Oxford Biomedica has achieved significant

progress in transferring its lentiviral vector capabilities to its

Bedford, Massachusetts site. The transfer of its 5L process is

already underway. This will be followed shortly by the introduction

of 7L scale and 50L pilot scale capabilities. The material produced

from these pilot scale batches will be instrumental in supporting

assay qualification for pre-clinical activities as well as for IND

(Investigational New Drug) and IMPD (Investigational Medicinal

Product Dossier) enabling studies.

In October 2023, Oxford Biomedica welcomed

Thierry Cournez, formerly of Merck Life Science, as Chief Operating

Officer & Site Head of UK Operations, to lead the integration

of Oxford Biomedica’s sites and take direct responsibility for the

Company’s UK operations in Oxford. This appointment follows the

earlier recruitment of Mark Caswell who brings extensive CDMO

experience from his previous roles at Rentschler Biopharma and

Lonza. In July 2023, he took on the role of Site Head of US

Operations. The shift to a site-based structure allows the Company

to maximise efficiencies as well as be better adapted to serve

client’s needs.

On 4 December 2023, Oxford Biomedica announced

it had entered into a sale and purchase agreement with Institut

Mérieux for the acquisition of ABL Europe for a consideration of

€15 million. This will support the future growth of all viral

vector segments and allow the Company to expand its international

footprint into the European Union with sites in Lyon and

Strasbourg, France.

Completion of the

transaction is currently expected to take place in the first

quarter of 2024 subject to the satisfaction and/or waiver of

outstanding conditions, including obtaining the necessary

regulatory approvals.

Dr. Frank Mathias, Chief Executive

Officer of Oxford Biomedica, commented: “Oxford Biomedica

is successfully delivering on its strategic vision to become a

pure-play CDMO. The streamlining of our operations has involved a

strategic shift towards a CDMO mindset and we are now focused on

being entirely client-centric. We remain encouraged by our increase

in client orders, which have doubled since 2022 and we are now

well-positioned to drive robust revenue growth while targeting

broadly breakeven Operating EBITDA by the end of 2024.”

Attendance at

the Annual J.P. Morgan Healthcare ConferenceOxford

Biomedica is attending the Annual J.P. Morgan Healthcare

Conference. Frank Mathias, Chief Executive Officer, will give

a presentation, which will be available on the Oxford Biomedica

website after the conference at

www.oxb.com/investors/results-reports-presentations-webcasts

.

-Ends-

Enquiries:

Oxford Biomedica plc:

Sophia Bolhassan, VP, Corporate Affairs and IR –

T: +44 (0) 7394 562 425 / E: ir@oxb.com

ICR Consilium:

Mary-Jane Elliott / Matthew Neal / Davide

SalviT: +44 (0)20 3709 5700 / E:

oxfordbiomedica@consilium-comms.com

About Oxford Biomedica

Oxford Biomedica (LSE: OXB) is a quality and

innovation-led cell and gene therapy CDMO with a mission to enable

its clients to deliver life changing therapies to patients around

the world.

One of the original pioneers in cell and gene

therapy, the Company has more than 25 years of experience in viral

vectors; the driving force behind the majority of gene therapies.

The Company collaborates with some of the world’s most innovative

pharmaceutical and biotechnology companies, providing viral vector

development and manufacturing expertise in lentivirus,

adeno-associated virus (AAV) and adenoviral vectors. Oxford

Biomedica’s world-class capabilities span from early-stage

development to commercialisation. These capabilities are supported

by robust quality-assurance systems, analytical methods and depth

of regulatory expertise.

Oxford Biomedica, a FTSE4Good constituent, is

headquartered in Oxford, UK. It has locations across Oxfordshire,

UK and near Boston, MA, US. Learn more at www.oxb.com, and follow

us on LinkedIn and YouTube.

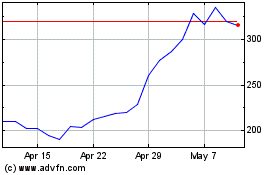

Oxford Biomedica (LSE:OXB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Oxford Biomedica (LSE:OXB)

Historical Stock Chart

From Jan 2024 to Jan 2025