TIDMPEG TIDMWTH

RNS Number : 1423M

Petards Group PLC

13 September 2012

13 September 2012

PETARDS GROUP PLC

INTERIM RESULTS ANNOUNCEMENT

Petards Group plc ('Petards'), the AIM quoted developer of

advanced security and surveillance systems, reports its interim

results for the six months to 30 June 2012.

Highlights

-- Revenues of GBP4.7m (2011: GBP5.2m)

-- Gross margin 41.3% (2011: 40.5%)

-- Operating profit GBP51,000 (2011: GBP44,000)

-- Profit before tax GBP22,000 (2011: GBP5,000)

-- Basic and diluted earnings per share of 0.35p (2011: 0.08p)

-- Net cash inflow from operating activities of GBP0.9m (2011: GBP0.4m inflow)

-- Net debt of GBP0.8m (30 June 2011: GBP1.8m; 31 December 2011: GBP1.5m)

Commenting on the current outlook, Tim Wightman, Chairman,

said:

"Despite the current economic climate, the Board remains

optimistic about the future. The Group has demonstrated its ability

to secure significant contracts from blue chip international

organisations at a time when there is expected to be an increase in

capital investment by operators in the world-wide rail industry.

The Group is also maintaining its level of activity within

specialist niches of the defence and security industries. We were

also pleased that at the recent General Meeting a majority of

shareholders supported the Board by voting in favour of providing

an authority to raise additional equity, and this matter remains

under review.

In recent weeks we have secured some of the orders that we had

been expecting, although they will not now contribute as much to

2012 revenues as we had hoped. In addition other contracts we have

been expecting to receive in the third quarter now seem likely to

be delayed into 2013. As a result the Board presently expects

revenues in the second half year to be slightly ahead of those for

the first half year and the operating performance to be similar to

that achieved in 2011."

Contacts:

Petards Group plc www.petards.com

Andy Wonnacott, Finance Director +44 (0) 191 420 3000

WH Ireland Limited www.wh-ireland.co.uk

Mike Coe / Marc Davies +44 (0) 117 945 3470

Chairman's Statement

Overview of the Results

Petards Group plc is a developer of advanced security and

surveillance systems. It is a leading supplier to the rail

transport, security and defence industries for the supply of

ruggedized video and sensor surveillance systems for mobile

platforms as well as providing design and support services for

legacy systems.

The financial information contained within this interim report

is based upon the Group's unaudited results

for the six months to 30 June 2012.

While revenues for the first six months of 2012 were down over

10% on the comparable period in 2011 at GBP4.7m (2011: GBP5.2m),

profits were slightly ahead of the prior year. Profit before and

after tax for the period was GBP22,000 (2011: GBP5,000) and

earnings per share were 0.35p (2011: 0.08p).

The reduction in revenues was a reflection of a lower level of

contract deliveries of our eyeTrain products than in H1 2011.

However, we achieved an improvement in our overall gross margin to

41.3% over the period (2011: 40.5%) which together with a reduction

in overheads of over 9% to GBP1.9m (2011: GBP2.1m) gave rise to

these results. The lower overhead was a result of action taken in

the first half of 2011 and while we do not consider there to be

significant scope for any further reductions, overheads continue to

be closely monitored.

Our cash performance in the six months to 30 June 2012 was

exceptional with cash generated from operations totalling GBP0.8m

(2011: GBP0.4m). This reflected the beneficial effect of the net

cash flow profile of projects that were in progress at the half

year, which will unwind as those projects complete in the second

half year, and contributed to lower than anticipated net debt at 30

June 2012 of GBP0.8m (31 December 2011: GBP1.5m). The Group elected

to surrender losses relating to a prior year for a cash payment by

way of Research and Development Relief and a tax refund of GBP162k

was received during the period.

Operating Review

In the first half year the Group continued to make good progress

in marketing eyeTrain to a wider customer base which culminated in

July in the Group being awarded a multi-million pound contract to

supply Petards eyeTrain on-board digital CCTV systems to a new

customer. The contract is worth in the region of GBP8m and although

initial revenues have commenced, the main equipment deliveries are

scheduled to take place from 2014 onwards and to be completed by

2017. Consequently it will not contribute materially to revenues in

2012. However, by securing this order the Group has taken a major

step forward in its development and by demonstrating our expertise

in the delivery of this order it should open up further

opportunities for us to work with this and similar customers in the

future.

While the timescales for securing large projects within the rail

industry tend to be long, the present level of global investment in

major rail projects is very significant. Within the UK the large

number of franchise renewals taking place over the next two or

three years will lead to train refurbishment programmes which are

likely to include the upgrade of on-board systems such as those we

supply. These programmes are in addition to the new rolling stock

being introduced on the UK network that I outlined in my June

statement.

While Ministry of Defence (MOD) budgets remain tight, we were

pleased when in June the MOD exercised its option to extend the

Group's existing enabling contract to supply it with private mobile

radio equipment, ancillaries and engineering services. This

contract will now run until September 2014 and as well as supplying

commercially available equipment, the contract also utilises

Petards design engineering skills to identify and supply solutions

to complex military communications requirements.

Research and Development

During the period we invested GBP0.2m in product development

(2011: GBP0.1m) and net of amortisation, capitalised development

expenditure at 30 June 2012 remained at GBP0.6m (31 Dec 2011:

GBP0.6m).

I reported at the time of the 2011 full year results that the

pace at which the Company's product development programme can

progress is limited by the resources available to it, and as I

indicated in my letter to shareholders of 23 July 2012, any future

additional capital raised would be partly utilised to accelerate

our programme.

Outlook

Despite the current economic climate, the Board remains

optimistic about the future. The Group has demonstrated its ability

to secure significant contracts from blue chip international

organisations at a time when there is expected to be an increase in

capital investment by operators in the world-wide rail industry.

The Group is also maintaining its level of activity within

specialist niches of the defence and security industries. We were

also pleased that at the recent General Meeting a majority of

shareholders supported the Board by voting in favour of providing

an authority to raise additional equity, and this matter remains

under review.

In recent weeks we have secured some of the orders that we had

been expecting, although they will not now contribute as much to

2012 revenues as we had hoped. In addition other contracts we have

been expecting to receive in the third quarter now seem likely to

be delayed into 2013. As a result the Board presently expects

revenues in the second half year to be slightly ahead of those for

the first half year and the operating performance to be similar to

that achieved in 2011..

Tim Wightman

13 September 2012

Condensed Consolidated Income Statement

for the six months ended 30 June 2012

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 June 30 June 31 December

Note 2012 2011 2011

GBP000 GBP000 GBP000

Revenue 4,667 5,229 12,127

Cost of sales (2,741) (3,112) (7,706)

Gross profit 1,926 2,117 4,421

Administrative expenses (1,875) (2,073) (4,086)

Operating profit 51 44 335

Financial income - 27 -

Financial expenses (29) (66) (120)

Profit before income tax 22 5 215

Income tax 2 - - 97

Profit for the period attributable

to equity

holders of the company 22 5 312

Earnings per share

Basic and diluted 3 0.35p 0.08p 4.90p

The above results are derived from continuing operations.

Condensed Consolidated Statement of Comprehensive Income

for the six month period ended 30 June 2012

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2012 2011 2011

GBP000 GBP000 GBP000

Profit for period 22 5 312

Other comprehensive income

Currency translation on foreign

currency net investments - 27 10

Total comprehensive income for

the period 22 32 322

Condensed Consolidated Statement of Changes in Equity

for the six month period ended 30 June 2012

Currency

Share Share Retained translation Total

capital premium earnings differences equity

GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 January 2011

(audited) 6,367 23,255 (29,342) (224) 56

Profit for the period - - 5 - 5

Other comprehensive income - - - 27 27

Total comprehensive income

for the period - - 5 27 32

Equity-settled share based

payments - - 7 - 7

Capital reorganisation

costs - (25) - - (25)

Balance at 30 June 2011

(unaudited) 6,367 23,230 (29,330) (197) 70

Balance at 1 January 2011

(audited) 6,367 23,255 (29,342) (224) 56

Profit for the year - - 312 - 312

Other comprehensive income - - - 10 10

Total comprehensive income

for the year - - 312 10 322

Equity-settled share based

payments - - 14 - 14

Capital reorganisation

costs - (32) - - (32)

Balance at 31 December

2011 (audited) 6,367 23,223 (29,016) (214) 360

Balance at 1 January 2012

(audited) 6,367 23,223 (29,016) (214) 360

Profit for the period - - 22 - 22

Other comprehensive income - - - - -

Total comprehensive income

for the period - - 22 - 22

Equity-settled share based

payments - - 1 - 1

Balance at 30 June 2012

(unaudited) 6,367 23,223 (28,993) (214) 383

Condensed Consolidated Balance Sheet

at 30 June 2012

Unaudited Unaudited Audited

30 June 30 June 31 December

2012 2011 2011

ASSETS GBP000 GBP000 GBP000

Non-current assets

Property, plant and equipment 192 149 155

Goodwill 401 401 401

Development costs 575 651 577

Deferred tax assets 669 790 842

1,837 1,991 1,975

Current assets

Inventories 823 1,030 1,237

Trade and other receivables 1,662 2,542 3,087

Cash and cash equivalents -

escrow deposits 77 - 77

Cash and cash equivalents 23 3 21

2,585 3,575 4,422

Total assets 4,422 5,566 6,397

EQUITY AND LIABILITIES

Equity attributable to equity

holders of the parent

Share capital 6,367 6,367 6,367

Share premium 23,223 23,230 23,223

Currency translation reserve (214) (197) (214)

Retained earnings deficit (28,993) (29,330) (29,016)

Total equity 383 70 360

Non-current liabilities

Interest-bearing loans and

borrowings - 295 42

Deferred tax liabilities 132 189 144

132 484 186

Current liabilities

Interest-bearing loans and

borrowings 814 1,471 1,459

Trade and other payables 3,093 3,541 4,392

3,907 5,012 5,851

Total liabilities 4,039 5,496 6,037

Total equity and liabilities 4,422 5,566 6,397

Condensed Consolidated Statement of Cash Flows

for the six month period ended 30 June 2012

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2012 2011 2011

GBP000 GBP000 GBP000

Cash flows from operating activities

Profit for the period 22 5 312

Adjustments for:

Depreciation 33 45 73

Amortisation of intangible assets 158 155 325

Financial income - (27) -

Financial expense 29 66 120

Equity settled share-based payment expenses 1 7 14

Income tax credit - - (97)

Operating cash flows before movement in

working capital 243 251 747

Change in trade and other receivables 1,425 (134) (679)

Change in inventories 414 (119) (326)

Change in trade and other payables (1,299) 450 1,259

Cash generated from operations 783 448 1,001

Interest paid (29) (66) (125)

Income tax received 162 - -

Net cash from operating activities 916 382 876

Cash flows from investing activities

Acquisition of property, plant and equipment (70) (12) (46)

Capitalised development expenditure (156) (105) (201)

Cash deposits held in escrow - - (77)

Net cash outflow from investing activities (226) (117) (324)

Cash flows from financing activities

Capital reorganisation costs - (25) (32)

Repayment of bank borrowings (210) (250) (503)

Net cash outflow from financing activities (210) (275) (535)

Net increase/(decrease) in cash and cash

equivalents 480 (10) 17

Cash and cash equivalents at start of

period (933) (953) (953)

Effect of exchange rate fluctuations on

cash held (1) - 3

Cash and cash equivalents at end of period (454) (963) (933)

Cash and cash equivalents comprise:

Cash and cash equivalents per balance

sheet 23 3 21

Overdraft (477) (966) (954)

(454) (963) (933)

Notes

1 Basis of preparation

The interim financial information set out in this statement for

the six months ended 30 June 2012 and the comparative figures for

the six months ended 30 June 2011 are unaudited. This financial

information does not constitute statutory accounts as defined in

Section 435 of the Companies Act 2006.

The comparative figures for the financial year ended 31 December

2011 are not the Company's statutory accounts for that financial

year. Those accounts have been reported on by the Company's

auditors and delivered to the Registrar of Companies. The report of

the auditors was (i) unqualified, (ii) did not contain an emphasis

of matter paragraph, and (iii) did not contain a statement under

section 498(2) or (3) of the Companies Act 2006.

This interim statement, which is neither audited nor reviewed,

has been prepared in accordance with the measurement and

recognition criteria of Adopted IFRSs. It does not include all the

information required for the full annual financial statements, and

should be read in conjunction with the financial statements of the

Group as at and for the year ended 31 December 2011. It does not

comply with IAS 34 'Interim Financial Reporting' as is permissible

under the rules of the AIM Market ("AIM").

The accounting policies applied in preparing these interim

financial statements are the same as those applied in the

preparation of the annual financial statements for the year ended

31 December 2011, as described in those financial statements other

than standards, amendments and interpretations which became

effective after 1 January 2012 and were adopted by the Group. These

have had no significant impact on the Group's profit for the period

or equity. The Board approved these interim financial statements on

13 September 2012.

Copies of this interim statement will be available on the

Company's website (www.petards.com) and from the Company's

registered office at 390 Princesway, Team Valley, Gateshead, Tyne

and Wear, NE11 0TU.

2 Taxation

No provision for taxation has been made in the Condensed

Consolidated Income Statement for the six months to 30 June 2012

based on the estimated tax provision required for the year ending

31 December 2012. No provision was required in the six months to 30

June 2011.

3 Earnings per share

Basic earnings per share is calculated by dividing the profit

for the period attributable to the shareholders by the weighted

average number of shares in issue. The calculation of diluted

earnings per share assumes conversion of all potentially dilutive

ordinary shares, all of which arise from share options.

The calculation of earnings per share is based on the profit for

the period and on the weighted average number of ordinary shares

outstanding in the period.

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2012 2011 2011

Earnings

Profit for the period (GBP000) 22 5 312

Number of shares

Weighted average number of ordinary shares

('000) 6,367 6,367 6,367

Diluted earnings per share is identical to the basic earnings

per share. None of the share options are dilutive as the exercise

prices are higher than the average market price of the shares.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR QLLFFLKFLBBV

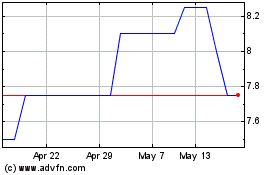

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

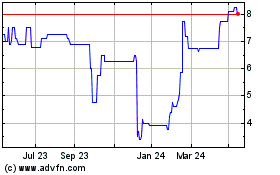

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024