R.E.A. Holdings plc: Half yearly results

19 September 2024 - 4:00PM

EQS Regulatory News

|

R.E.A. Holdings plc (RE.)

R.E.A. Holdings plc: Half yearly results

19-Sep-2024 / 07:00 GMT/BST

R.E.A. Holdings plc (“REA” or

the “company”)

REA today

publishes the group’s half

yearly report for the six months to

30 June 2024. Please click on the link below to view.

The 2024 half

yearly report will shortly be available

at www.rea.co.uk/investors/financial-reports.

Strategic

-

Subscription of further shares in

REA Kaltim by the DSN group in March 2024 with final consideration

determined at $53.6 million, increasing DSN’s investment in the

operating sub-group from 15 per cent to 35 per cent

-

CDM being retained and good

progress made in improving yields and settling plasma

arrangements

-

On target to comply with the EUDR

requirements – processes and control systems now installed in COM

to permit sales of segregated certified CPO

Financial

-

Revenue increased by 10 per cent to

$80.9 million (2023: $73.6 million) primarily reflecting increased

sales volumes

-

Average selling prices (net of

export duty and levy) in line with prior year with CPO at $755 per

tonne (2023: $746) and CPKO at $847 per tonne (2023: $875 per

tonne); current local prices comfortably above the average prices

for the first six months of 2024

-

EBITDA for the period of $21.6

million (2023: $15.7 million), a 40 per cent increase

-

Profit before tax of $8.1 million

(2023: loss before tax of $15.2 million) due to higher revenues and

positive swing in exchange differences

-

Group net indebtedness reduced to

$167.9 million from $178.2 million at 31 December 2023

-

All outstanding arrears of

preference dividend totalling 11.5p per preference share discharged

in April 2024 and semi-annual preference dividend duly paid on 30

June 2024

Agricultural operations

-

FFB production of 326,370 tonnes

(2023: 346,216) reflecting reduced hectarage due to the replanting

programme

-

Improved extraction rates with

further improvements post period end

-

Replanting is proceeding in line

with the previously announced programme for 2024 of 1,300

hectares

-

750 hectares of extension planting

to be completed by year end with the balance of 250 hectares

carried over to 2025

Stone, sand and coal interests

-

Sales at ATP’s stone concession

commenced

-

Arrangements for production of

silica sand being progressed

-

Coal operations

inactive

-

Implementing changes to structure

of group’s interests in stone, sand and coal with application for

necessary approvals to acquire 95 per cent ownership of the stone

interest

Environmental, social and governance

-

Developing projects with

smallholders to encourage and improve the sustainable component of

the group’s supply chain and promote sustainable palm oil

production

Outlook

-

Current firming in CPO prices

likely to be sustained and mitigate the effect of lower crops in

the second half of 2024

-

Encouraging outlook based on

increased sustainability premia, further improvements to

productivity and replanting areas starting to contribute

crop

-

Stone quarrying coming to

fruition

Enquiries:

R.E.A. Holdings

plc

Tel: +44 (0)20

7436 7877

Attachment

File: REA Half yearly report 2024

Dissemination of a Regulatory Announcement that contains inside

information in accordance with the Market Abuse Regulation (MAR),

transmitted by EQS Group.

The issuer is solely responsible for the content of this

announcement.

|

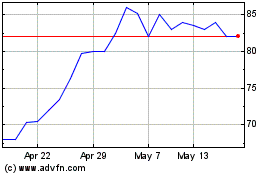

R.e.a (LSE:RE.)

Historical Stock Chart

From Dec 2024 to Jan 2025

R.e.a (LSE:RE.)

Historical Stock Chart

From Jan 2024 to Jan 2025