TIDMARBB TIDMSTB

RNS Number : 5187I

Arbuthnot Banking Group PLC

26 July 2012

26 July 2012

For immediate release

ARBUTHNOT BANKING GROUP ("Arbuthnot" or "the Group")

Results for the six months to 30 June 2012

Transformation continues

Arbuthnot Banking Group has continued with the transformation of

its business and has traded strongly in the first half of 2012.

During this period the Group completed the disposal of the

securities and Swiss businesses, cancelled the share premium

account and considerably expanded the retail banking division

through the acquisition of Everyday Loans. It has recorded a profit

before tax of GBP10.8m and both of its Banks have continued to

demonstrate strong, controlled organic growth.

Arbuthnot Banking Group PLC is the holding company for Arbuthnot

Latham & Co., Limited and Secure Trust Bank PLC.

FINANCIAL HIGHLIGHTS

-- Group pre-tax profit GBP10.8m (2011: GBP0.2m)

-- Gain on acquisition GBP8.5m (net)

-- Customer assets GBP543.4m (2011: GBP356.2m)

-- Group earnings per share (EPS) 50.9p (2011: 8.4p)

-- Interim dividend per share (DPS) 11p (2011: 11p)

OPERATIONAL HIGHLIGHTS

Retail Banking - Secure Trust Bank

-- Pre-tax profit increased to GBP12.5m (2011: GBP5.0m)

-- Acquisition of Everyday Loans has broadened distribution

channels and added further diversification to its lending

portfolios and contributed a gain on acquisition of GBP8.5m

(net)

-- Underlying profit grew by 50%

-- Overall loan book increased to GBP260.3m from GBP123.9m

including GBP71m from Everyday Loans

-- Retail deposits funded loan growth and closed the period at GBP297.9m (2011: GBP217m)

-- Total customer numbers grew by 58% to 198,767.

Private Banking - Arbuthnot Latham

-- Pre-tax profits increased to GBP1.4m (2011: GBP1.0m)

-- James Fleming joined the business as Chief Executive at the end of the first quarter

-- Strong capital base and excess liquidity enabled the business

to maintain its ability to take advantage of the lending

opportunities

-- Gilliat Financial Solutions has consistently increased its

sales volumes and completed its first overseas product offering

Commenting on the results, Henry Angest, Chairman and Chief

Executive of Arbuthnot, said: "This year has been one of continued

transformation where significant milestones across the Group have

been achieved. All of these have enabled the Group to make good

progress.

The current market environment has allowed the Group to attract

high calibre people, who along with strong capital and liquidity

are enabling it to enhance significantly both its banking

businesses. However, we remain cautious and monitor the

developments in the wider economy with some concern."

The interim results and presentation are available at

http://www.arbuthnotgroup.com.

Secure Trust Bank PLC is today releasing its interim statement

and it should be read in conjunction with these results.

ENQUIRIES:

Arbuthnot Banking Group

Henry Angest, Chairman and Chief Executive

Andrew Salmon, Chief Operating Officer

James Cobb, Group Finance Director

David Marshall, Director of Communications 020 7012 2400

Canaccord Genuity Hawkpoint Partners Ltd

(Nominated Advisor)

Lawrence Guthrie

Sunil Duggal 020 7665 4500

Numis Securities Ltd (Broker)

Chris Wilkinson

Mark Lander 020 7260 1000

Pelham Bell Pottinger (Financial PR)

Ben Woodford

Dan de Belder 020 7861 3232

Chairman's Statement

Arbuthnot Banking Group PLC

I am pleased to report that Arbuthnot Banking Group PLC has

traded strongly in the first half of 2012. The Group has reported a

profit before tax of GBP10.8m (2011: GBP0.2m).

In our recent Annual Report I concluded that 2011 had been a

year of transformation. This process continued in 2012. Across the

Group significant objectives have been achieved. In the first part

of the year, the disposals of Arbuthnot Securities and the Swiss

subsidiary were completed. Then in June we finalised the

cancellation of the share premium account and considerably expanded

the business of Secure Trust Bank through the acquisition of

Everyday Loans. These transactions enable the Group to take

advantage of current market conditions.

The Board is maintaining the interim dividend at 11p (gross)

which will be paid on 5 October 2012 to shareholders on the

register at 7 September 2012.

Retail Banking Subsidiary - Secure Trust Bank PLC

Pre-tax profits for Secure Trust Bank rose to GBP12.5m (2011:

GBP5.0m). This includes GBP8.5m (net) gain on acquisition, which

arose from the accounting required for the purchase of Everyday

Loans. We expect most of this will be amortised over the next 2-3

years. Excluding the impact of this the underlying profit before

tax rose by 50%.

The acquisition of Everyday Loans continues to broaden Secure

Trust Bank's distribution channels and further diversifies its

lending portfolios.

As at 30 June 2012, the Bank's overall loan book had increased

to GBP260.3m (2011: GBP123.9m) as organic lending also contributed

significantly to the overall growth. The Management are confident

that this growth can be maintained as evidenced by the recent

signing of an affinity agreement with Shop Direct.

The loan book continues to be funded by growth in retail

deposits which closed the period at GBP297.9m (2011: GBP217m), an

increase of 37%.

The total customer numbers increased to 198,767 a 58%

growth.

Private Banking Subsidiary - Arbuthnot Latham & Co.,

Limited

Arbuthnot Latham's profits grew to GBP1.4m (2011:GBP1.0m), a 40%

increase over the corresponding period.

James Fleming joined the business as Chief Executive at the end

of the first quarter.

The business has maintained its ability to take advantage of

good quality lending opportunities, which has been facilitated by

the strong capital base and by utilising some of the excess

liquidity held at the year end.

Gilliat Financial Solutions, the independent provider of

structured products, has consistently increased its sales volumes

as it has developed its brand awareness across the UK IFA network.

It also completed its first overseas product offering during the

period.

Outlook

The outlook for both banks remains favourable as opportunities

for growth continue to present themselves. The current market

environment has allowed the Group to attract high calibre people,

who along with strong capital and liquidity are significantly

enhancing both its banking businesses. However, we remain cautious

and monitor the developments in the wider economy with some

concern.

Consolidated Statement of Comprehensive Income

Six months Six months

ended ended

30 June 30 June

2012 2011

Note GBP000 GBP000

----------------------------------------------------- ----- ----------- -----------

Interest and similar income 22,438 16,507

Interest expense and similar charges (6,840) (4,673)

----------------------------------------------------- ----- ----------- -----------

Net interest income 15,598 11,834

----------------------------------------------------- ----- ----------- -----------

Fee and commission income 10,857 9,766

Fee and commission expense (254) (163)

----------------------------------------------------- ----- ----------- -----------

Net fee and commission income 10,603 9,603

----------------------------------------------------- ----- ----------- -----------

Gains less losses from dealing in securities (314) 24

----------------------------------------------------- ----- ----------- -----------

Operating income 25,887 21,461

----------------------------------------------------- ----- ----------- -----------

Net impairment loss on financial assets (3,679) (1,997)

Other income 2 9,947 408

Operating expenses 3 (21,387) (16,239)

----------------------------------------------------- ----- ----------- -----------

Profit before income tax from continuing operations 10,768 3,633

Income tax expense (133) (1,120)

----------------------------------------------------- ----- ----------- -----------

Profit after income tax from continuing operations 10,635 2,513

Loss from discontinued operations after tax (210) (2,429)

----------------------------------------------------- ----- ----------- -----------

Profit for the period 10,425 84

----------------------------------------------------- ----- ----------- -----------

Foreign currency translation reserve 570 (202)

Revaluation reserve

- Adjustment - (2)

Cash flow hedging reserve

- Effective portion of changes in fair value (97) -

Available-for-sale reserve - 5

----------------------------------------------------- ----- ----------- -----------

Other comprehensive income for the period, net of

income tax 473 (199)

----------------------------------------------------- ----- ----------- -----------

Total comprehensive income for the period 10,898 (115)

----------------------------------------------------- ----- ----------- -----------

Profit attributable to:

Equity holders of the Company 7,783 1,259

Non-controlling interests 2,642 (1,175)

----------------------------------------------------- ----- ----------- -----------

10,425 84

----------------------------------------------------- ----- ----------- -----------

Total comprehensive income attributable to:

Equity holders of the Company 8,256 1,060

Non-controlling interests 2,642 (1,175)

----------------------------------------------------- ----- ----------- -----------

10,898 (115)

----------------------------------------------------- ----- ----------- -----------

Earnings per share for profit attributable to the

equity holders of the Company during the period

(expressed in pence per share):

- basic and fully diluted 4 50.9 8.4

Consolidated Statement of Financial Position

At 30 June

2012 2011

GBP000 GBP000

ASSETS

Cash 129,137 118,629

Loans and advances to banks 50,249 51,669

Loans and advances to customers 543,379 356,162

Trading securities - long positions - 2,148

Debt securities held-to-maturity 32,757 125,192

Current tax asset 483 -

Other assets 10,141 16,984

Financial investments 3,269 5,737

Intangible assets 8,618 3,002

Property, plant and equipment 6,055 5,546

Deferred tax asset 5,967 1,303

--------------------------------------------- -------- --------

Total assets 790,055 686,372

--------------------------------------------- -------- --------

EQUITY AND LIABILITIES

Equity attributable to owners of the parent

Share capital 153 150

Share premium account - 21,085

Retained earnings 48,358 11,647

Other reserves (1,397) (1,546)

--------------------------------------------- -------- --------

Non-controlling interests 8,640 943

--------------------------------------------- -------- --------

Total equity 55,754 32,279

--------------------------------------------- -------- --------

LIABILITIES

Deposits from banks 1,113 2,024

Trading securities - short positions - 999

Derivative financial instruments 1,008 264

Deposits from customers 703,661 624,215

Current tax liability - 414

Other liabilities 16,727 12,821

Deferred tax liability - 126

Debt securities in issue 11,792 13,230

--------------------------------------------- -------- --------

Total liabilities 734,301 654,093

--------------------------------------------- -------- --------

Total equity and liabilities 790,055 686,372

--------------------------------------------- -------- --------

Consolidated Statement of Changes in Equity

Attributable to equity holders of the Group

------------------------------------------------------------------------------------------------------------------

Foreign Cash

Share currency Capital flow

Share premium translation Revaluation redemption Available-for-sale hedging Treasury Retained Non-controlling

capital account reserve reserve reserve reserve reserve shares earnings interests Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------- -------- --------- ------------ ------------ ----------- ------------------- -------- --------- ---------- ---------------- --------

Balance at 1

January

2012 153 21,085 (570) 140 20 - (329) (1,097) 21,571 5,998 46,971

Total

comprehensive

income for the

period

Profit for the

six

months ended

30

June 2012 - - - - - - - - 7,783 2,642 10,425

Other

comprehensive

income, net of

income

tax

Foreign

currency

translation

reserve - - 570 - - - - - - - 570

Revaluation

reserve

Cash flow

hedging

reserve

- Effective

portion

of changes in

fair

value - - - - - - (97) - - - (97)

Total other

comprehensive

income - - 570 - - - (97) - - - 473

--------------- -------- --------- ------------ ------------ ----------- ------------------- -------- --------- ---------- ---------------- --------

Total

comprehensive

income for

the period - - 570 - - - (97) - 7,783 2,642 10,898

--------------- -------- --------- ------------ ------------ ----------- ------------------- -------- --------- ---------- ---------------- --------

Transactions

with

owners,

recorded

directly in

equity

Contributions

by

and

distributions

to owners

Transfer of

share

premium - (21,085) - - - - - - 21,085 - -

Purchase of

own

shares - - - - - - - (34) - - (34)

Final dividend

relating

to 2011 - - - - - - - - (2,081) - (2,081)

Total

contributions

by and

distributions

to owners - (21,085) - - - - - (34) 19,004 - (2,115)

--------------- -------- --------- ------------ ------------ ----------- ------------------- -------- --------- ---------- ---------------- --------

Balance at 30

June

2012 153 - - 140 20 - (426) (1,131) 48,358 8,640 55,754

--------------- -------- --------- ------------ ------------ ----------- ------------------- -------- --------- ---------- ---------------- --------

Attributable to equity holders of the

Group

-------------------------------------------------------------------------------------------------------

Foreign

Share currency Capital

Share premium translation Revaluation redemption Available-for-sale Treasury Retained Non-controlling

capital account reserve reserve reserve reserve shares earnings interests Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------- -------- -------- ------------ ------------ ----------- ------------------- --------- ---------- ---------------- --------

Balance at 1

January

2011 150 21,085 (558) 146 20 142 (1,097) 12,142 2,118 34,148

Total

comprehensive

income for the

period

Profit /

(loss) for

the six

months ended

30 June 2011 - - - - - - - 1,259 (1,175) 84

Other

comprehensive

income, net of

income

tax

Foreign

currency

translation

reserve - - (202) - - - - - - (202)

Revaluation

reserve

- Adjustment - - - (2) - - - - - (2)

- Amount

transferred

to profit and

loss on

sale - - - - - 5 - - - 5

--------------- -------- -------- ------------ ------------ ----------- ------------------- --------- ---------- ---------------- --------

Total other

comprehensive

income - - (202) (2) - 5 - - - (199)

--------------- -------- -------- ------------ ------------ ----------- ------------------- --------- ---------- ---------------- --------

Total

comprehensive

income for

the period - - (202) (2) - 5 - 1,259 (1,175) (115)

--------------- -------- -------- ------------ ------------ ----------- ------------------- --------- ---------- ---------------- --------

Transactions

with owners,

recorded

directly in

equity

Contributions

by and

distributions

to owners

Final dividend

relating

to 2010 - - - - - - - (1,754) - (1,754)

Total

contributions

by and

distributions

to owners - - - - - - - (1,754) - (1,754)

--------------- -------- -------- ------------ ------------ ----------- ------------------- --------- ---------- ---------------- --------

Balance at 30

June 2011 150 21,085 (760) 144 20 147 (1,097) 11,647 943 32,279

--------------- -------- -------- ------------ ------------ ----------- ------------------- --------- ---------- ---------------- --------

Consolidated Statement of Cash Flows

Six months Six months

ended ended

30 June 30 June

2012 2011

GBP000 GBP000

------------------------------------------------------ ----------- -----------

Cash flows from operating activities

Interest and similar income received 22,540 16,445

Interest and similar charges paid (7,302) (4,668)

Fees and commissions received 10,603 13,430

Net trading and other income 9,516 693

Cash payments to employees and suppliers (29,061) (23,649)

Taxation paid (159) (866)

------------------------------------------------------ ----------- -----------

Cash flows from operating profits before changes in

operating assets and liabilities 6,137 1,385

Changes in operating assets and liabilities:

- net decrease in trading securities - 1,308

- net decrease in derivative financial instruments 1,959 80

- net increase in loans and advances to customers (156,946) (57,724)

- net decrease in other assets 2,178 964

- net increase/(decrease) in deposits from banks 1,105 (1,682)

- net increase in amounts due to customers 9,861 120,958

- net increase in other liabilities 543 3,288

------------------------------------------------------ ----------- -----------

Net cash (outflow)/inflow from operating activities (135,163) 68,577

------------------------------------------------------ ----------- -----------

Cash flows from investing activities

Disposal of financial investments 567 -

Purchase of computer software (152) (260)

Purchase of property, plant and equipment (1,251) (66)

Proceeds from sale of property, plant and equipment - 23

Purchases of debt securities (43,127) (159,847)

Proceeds from redemption of debt securities 50,449 177,772

------------------------------------------------------ ----------- -----------

Net cash from investing activities 6,486 17,622

------------------------------------------------------ ----------- -----------

Cash flows from financing activities

Dividends paid (2,081) (1,754)

------------------------------------------------------ ----------- -----------

Net cash used in financing activities (2,081) (1,754)

------------------------------------------------------ ----------- -----------

Net (decrease)/increase in cash and cash equivalents (130,758) 84,445

Cash and cash equivalents at 1 January 310,144 85,853

------------------------------------------------------ ----------- -----------

Cash and cash equivalents at 30 June 179,386 170,298

------------------------------------------------------ ----------- -----------

1. Operating segments

The Group is organised into two main operating segments,

arranged over two separate companies with each having its own

specialised banking service, as disclosed below:

1) Retail banking - incorporating household cash management,

personal lending and banking and insurance services.

2) UK Private banking - incorporating private banking and wealth

management.

Transactions between the operating segments are on normal

commercial terms. Centrally incurred expenses are charged to

operating segments on an appropriate pro-rata basis. Segment assets

and liabilities comprise operating assets and liabilities, being

the majority of the statement of financial position.

Discontinued

operations Continuing operations

------------- ------------------------------------------------

Group

Investment Retail UK Private (reconciling Group

banking banking banking items) Total Total

Six months ended 30 June 2012 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------------------------- ------------- --------- ----------- -------------- -------- --------

Interest revenue - 15,647 6,943 162 22,752

Inter-segment revenue - (73) (79) (162) (314)

--------------------------------- ------------- --------- ----------- -------------- --------

Interest revenue from external

customers - 15,574 6,864 - 22,438

--------------------------------- ------------- --------- ----------- -------------- --------

Fee and commission income - 5,390 5,467 - 10,857

--------------------------------- ------------- --------- ----------- -------------- --------

Revenue from external customers - 20,964 12,331 - 33,295

--------------------------------- ------------- --------- ----------- -------------- --------

Interest expense - (4,222) (2,573) 217 (6,578)

Subordinated loan note interest - - - (262) (262)

Segment operating income - 16,815 9,583 (511) 25,887

Impairment losses - (3,070) (609) - (3,679)

Segment profit / (loss) before

tax (210) 12,523 1,437 (3,192) 10,768

Income tax (expense) / income - (717) - 584 (133)

--------------------------------- ------------- --------- ----------- -------------- -------- --------

Segment profit / (loss) after

tax (210) 11,806 1,437 (2,608) 10,635 10,425

--------------------------------- ------------- --------- ----------- -------------- -------- --------

Segment total assets - 342,162 480,438 (32,545) 790,055 790,055

Segment total liabilities - 312,480 457,346 (35,525) 734,301 734,301

Other segment items:

Capital expenditure - (975) (379) (12) (1,366) (1,366)

Depreciation and amortisation - (324) (172) (8) (504) (504)

--------------------------------- ------------- --------- ----------- -------------- -------- --------

The "Group" segment above includes the parent entity and all intercompany

eliminations and fulfils the requirement of IFRS8.28.

Discontinued

operations Continuing operations

------------- ----------------------------------------------------------------

International Group

Investment Retail Private UK Private (reconciling Group

banking banking banking banking items) Total Total

Six months ended 30 June GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

2011

--------------------------- ------------- --------- -------------- ----------- -------------- -------- --------

Interest revenue 4 9,895 - 6,720 131 16,746

Inter-segment revenue - (32) - (72) (135) (239)

--------------------------- ------------- --------- -------------- ----------- -------------- --------

Interest revenue from

external

customers 4 9,863 - 6,648 (4) 16,507

--------------------------- ------------- --------- -------------- ----------- -------------- --------

Fee and commission income 3,991 5,560 - 4,206 - 9,766

--------------------------- ------------- --------- -------------- ----------- -------------- --------

Revenue from external

customers 3,995 15,423 - 10,854 (4) 26,273

--------------------------- ------------- --------- -------------- ----------- -------------- --------

Interest expense (63) (1,903) (27) (2,576) 103 (4,403)

Subordinated loan note

interest - - - - (270) (270)

Segment operating income 4,025 13,552 (27) 8,187 (247) 21,465

Impairment losses - (1,548) - (449) - (1,997)

Segment profit / (loss)

before tax (3,391) 5,020 (20) 983 (2,350) 3,633 242

Income tax (expense) /

income 962 (1,222) - (133) 235 (1,120)

--------------------------- ------------- --------- -------------- ----------- -------------- -------- --------

Segment profit / (loss)

after tax (2,429) 3,798 (20) 850 (2,115) 2,513 84

--------------------------- ------------- --------- -------------- ----------- -------------- -------- --------

Segment total assets 12,851 237,473 85 489,170 (53,207) 673,521 686,372

Segment total liabilities 9,373 219,538 2,634 465,974 (43,426) 644,720 654,093

Other segment items:

Capital expenditure (10) (65) - (240) (12) (317) (327)

Depreciation and

amortisation (38) (303) (5) (220) (7) (535) (573)

--------------------------- ------------- --------- -------------- ----------- -------------- -------- --------

Segment profit is shown prior to any intra-group

eliminations.

Other than the international private banking operations which

were in Switzerland, all the Group's other operations are conducted

wholly within the United Kingdom and geographical information is

therefore not presented.

2. Other income

On 20 March 2012 Arbuthnot Banking Group PLC ("ABG") agreed

terms for the sale of Arbuthnot AG. The company was sold to

Ducartis Holding AG for a total cash consideration of CHF 2.0m

which resulted in a profit for the Group of approximately GBP0.7m,

which is recorded in other income. Up to the date of sale, the

purchaser funded most of the running costs for this entity. This is

also included in other income, and amounted to GBP0.3m.

On 8 June 2012 Secure Trust Bank PLC ("STB") acquired 100% of

the shares in Everyday Loans Holdings Limited and its wholly owned

subsidiaries Everyday Loans Limited and Everyday Lending Limited

(together "EDL"). STB acquired EDL for consideration of GBP1. Upon

acquisition STB provided funding so that EDL could redeem the

remaining GBP34 million of subordinated debt and also provided a

loan facility of GBP37 million to refinance EDL's existing bank

debt and to fund future loans. A payment of up to a maximum of

GBP1.5 million will be made to the management team of EDL in March

2013, subject to achieving certain performance targets in 2012.

Included in other income is a gain on acquisition of GBP8.9m, which

arose from fair value adjustments and the recognition of

intangibles assets. This is expected to amortise through the profit

and loss account over the next 2 to 3 years.

Acquired Recognised

assets Fair values

/ value on

liabilities adjustments acquisition

GBP000 GBP000 GBP000

----------------------------------------- ------------ ------------ ------------

Intangible assets 50 5,115 5,165

Property, plant and equipment 491 - 491

Loans and advances to customers 63,720 7,545 71,265

Cash at bank 991 - 991

Other assets 24 - 24

Prepayments and accrued income 2,939 - 2,939

Deferred tax asset - 5,400 5,400

------------ ------------ ------------

Total assets 68,215 18,060 86,275

Loans and debt securities 71,618 - 71,618

Other liabilities 960 - 960

Accruals and deferred income 1,741 - 1,741

Deferred tax liabilities - 3,039 3,039

------------ ------------ ------------

Total liabilities 74,319 3,039 77,358

Net identifiable (liabilities) / assets (6,104) 15,021 8,917

------------ ------------ ------------

Consideration - GBP1 -

Gain on acquisition 8,917

----------------------------------------- ------------ ------------ ------------

3. Operating expenses

Included in operating expenses are GBP0.5m acquisition costs,

GBP0.1m amortisation cost, GBP0.3m management incentive provisions

and GBP0.7m normal operating costs relating to EDL. Also included

in operating expenses are GBP0.5m increased property costs due to

excess floor space after the sale of Arbuthnot Securities and

GBP0.3m of unrealised losses on equity securities.

4. Earnings per ordinary share

Basic and fully diluted

Earnings per ordinary share are calculated on the net basis by

dividing the profit attributable to equity holders of the Company

of GBP7,783,000 (2011: GBP1,259,000) by the weighted average number

of ordinary shares 15,279,322 (2011: 14,999,619) in issue during

the year. There is no difference between basic and fully diluted

earnings per ordinary share.

5. Basis of reporting

The interim financial statements have been prepared on the basis

of accounting policies set out in the Group's 2011 statutory

accounts as amended by standards and interpretations effective

during 2012. The statements were approved by the Board of Directors

on 25 July 2012 and are unaudited. The interim financial statements

will be posted to shareholders and copies may be obtained from The

Company Secretary, Arbuthnot Banking Group PLC, Arbuthnot House, 20

Ropemaker Street, London EC2Y 9AR.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EELFLLDFZBBD

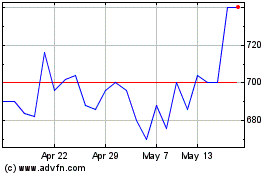

Secure Trust Bank (LSE:STB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Secure Trust Bank (LSE:STB)

Historical Stock Chart

From Feb 2024 to Feb 2025