Tiger Royalties and Investments PLC Variation of Mandate with Metrock (4461J)

22 December 2020 - 6:00PM

UK Regulatory

TIDMTIR

RNS Number : 4461J

Tiger Royalties and Investments PLC

22 December 2020

For immediate release

22 December 2020

TIGER ROYALTIES AND INVESTMENTS PLC

("Tiger" or the "Company")

Variation of Mandate with Metrock Resources Ltd

Tiger Royalties and Investments PLC is pleased to announce that

it has varied its Mandate with Metrock Resources Ltd ("Metrock"),

details of which were set out in the Company's announcement of 12

October 2020, as a result of which it has inter alia acquired a 2%

Net Smelter Return ("NSR") Royalty in Metrock's Kanye Manganese

project in Botswana which has been conditionally acquired by Bezant

Resources Plc ("Bezant").

Highlights

-- Tiger has acquired a 2% NSR royalty in the Kanye Manganese asset

-- Tiger to receive 28,314,815 shares in Bezant Resources Plc

("Bezant") as part of Bezant's acquisition of Metrock and therefore

Tiger's holding in Bezant will increase to 83,370,371 representing

2.37% equity stake in Bezant

-- Investment consistent with the Company's mission of

accumulating a portfolio of significant equity positions with

royalty streams

Revised terms agreed with Metrock

As announced on 12 October 2020, the Company negotiated an

exclusive mandate to facilitate an IPO for Metrock (the "Mandate").

Metrock and Tiger have now mutually agreed not to proceed with an

IPO (on the basis that the current stage of its development does

not support a stand-alone IPO) and to amend the terms of the

Mandate to facilitate the vending of the Kanye Manganese asset to

an AIM quoted company. The shareholders of Metrock have now entered

into a conditional share purchase agreement ("SPA") with Bezant

Resources Plc ("Bezant") under the terms of which Bezant will

acquire a 100% ownership of Metrock.

Under the amended Mandate agreed with Metrock, Tiger has been

granted a NSR of 2% on the Kanye Manganese asset which may be

purchased from the Company by Metrock for a payment of GBP1 million

or on a partial basis at a buy-out rate of GBP250k per 0.5% of the

NSR. This transaction is well aligned with the Company's strategy

to accumulate a stream of royalty deals in base and precious metals

projects.

Additionally, Metrock has agreed to pay a fee of GBP30,200 to

Tiger, which will also no longer have an obligation to acquire

loans of GBP32,500 owed by Metrock by the issue of a further 12.5

million Tiger ordinary shares of 0.1p each. The grant of the 2% NSR

Royalty and the payment of the fee to Tiger are subject to the

completion of the SPA signed between Bezant and Metrock which is

anticipated to be completed by 15 March 2021. All other

arrangements set out in the original Mandate including any

obligation to fund or issue any further equity are accordingly

cancelled.

As part of Bezant's SPA with the shareholders of Metrock, it has

been agreed that outstanding loans in Metrock's books will be

acquired by Bezant and settled in newly issued Bezant ordinary

shares of 0.002p each at a price of 0.27 pence per share on

completion of the SPA ("Bezant Shares"). Accordingly, Tiger will be

issued 28,314,815 Bezant Shares on completion of the SPA to settle

loans of GBP46,250 which it has made to Metrock and the GBP30,200

fee referred to above. Upon issue of the 28,314,815 Bezant Shares,

Tiger's total shareholding in Bezant will increase to 83,870,371

shares representing 2.37% of the Bezant's enlarged issued share

capital on completion.

Related Party Transaction

As Mr Colin Bird and Mr Raju Samtani are executive directors of

the Company (being respectively Chairman and Finance Director) and

also executive directors and shareholders of Bezant (being

respectively Chairman and Finance Director). In addition, Mr Colin

Bird has 2.7% interest in Metrock and accordingly the proposed

settlement of Tiger's outstanding loan and the fee due from Metrock

through the issue of 28,314,815 Bezant Ordinary shares is a Related

Party transaction pursuant to Rule 13 of the AIM Rules for

Companies. Accordingly, the Company's independent directors, being

Mr Alex Borrelli and Mr Michael Nolan, having consulted with the

Company's Nominated Adviser have opined that the transaction

including the variation of the Mandate and arrangements with Bezant

are fair and reasonable insofar as the Company's Shareholders are

concerned. It is noted that Mr Alex Borrelli has a 4% interest in

Metrock but this is not regarded as material in the context of the

transaction.

Full details of the Company's original agreement between Metrock

and Tiger were set out in the Company's announcement of 12 October

2020 and, unless otherwise defined herein, key definitions used in

this announcement shall have the same meanings as given to them in

such previous announcement.

For further information, please contact:

Tiger Royalties and

Investments Plc Raju Samtani Director +44 (0)20 7581 4477

Roland Cornish

Beaumont Cornish (Nomad) Felicity Geidt +44 (0)20 7628 3369

Email: corpfin@bcornish.co.uk

Novum Securities Plc Jon Belliss +44 (0)20 7399 9425

(Broker)

This announcement contains inside information as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 ("MAR").

Note:

Beaumont Cornish Limited ("Beaumont Cornish"), which is

authorised and regulated in the United Kingdom by the FCA, is

acting as Nominated Adviser ("Nomad") to the Company in connection

with the matters set out in this announcement and will not be

acting for any other person or otherwise be responsible to any

person for providing the protections afforded to clients of

Beaumont Cornish or for advising any other person in respect of the

matters set out in this announcement or any transaction, matter or

arrangement referred to in this announcement. Beaumont Cornish's

responsibilities as the Company's Nomad are owed solely to London

Stock Exchange and are not owed to the Company or to any Director

or to any other person in respect of his or her decision to acquire

any shares in the Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQFEMEDFESSEFE

(END) Dow Jones Newswires

December 22, 2020 02:00 ET (07:00 GMT)

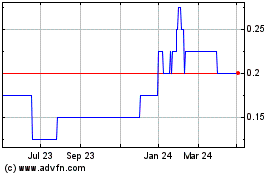

Tiger Royalties And Inve... (LSE:TIR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Tiger Royalties And Inve... (LSE:TIR)

Historical Stock Chart

From Feb 2024 to Feb 2025