TIDMTIR

RNS Number : 6547Z

Tiger Royalties and Investments PLC

25 May 2021

For immediate release 25 May 2021

TIGER ROYALTIES AND INVESTMENTS PLC

(FORMERLY TIGER RESOURCE PLC)

("Tiger" or the "Company")

FINAL RESULTS FOR THE YEARED 31 DECEMBER 2020

AND

NOTICE OF ANNUAL GENERAL MEETING

The Company is pleased to announce its audited results for the

year ended 31 December 2020 and to confirm that the 2020 Annual

Report and Financial Statements ("Annual Report"), together with a

Notice of AGM ("Notice") will be posted to shareholders on 28 May

2021. Pursuant to Rule 20 of the AIM Rules for Companies, copies of

both the Annual Report and the Notice will thereafter be available

for inspection at www.tiger-rf.com.

The AGM will be convened at the Company's registered address

being 2(nd) Floor, 7/8 Kendrick Mews, London SW7 3HG on Tuesday 21

June 2021 at 14:00 pm. The AGM will be a closed meeting and

shareholders will not be allowed to attend in person due to ongoing

restrictions associated with the Covid-19 pandemic. The AGM notice

will contain details on how shareholders will be able to exercise

their voting rights along with other practical details.

Notes:

Extracts from the Annual Report are set out below. The financial

information set out below does not constitute the Company's

statutory accounts for the periods ended 31 December 2020 or 31

December 2019 but it is derived from those accounts. Statutory

accounts for 31 December 2019 have been delivered to the Registrar

of Companies and those for 31 December 2020 will be delivered

following the Company's Annual General Meeting. The auditors have

reported on those accounts, their reports were unqualified and did

not contain statements under section 498(2) or (3) of the Companies

Act 2006.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

For further information please contact:

Tiger Resource Plc Raju Samtani, Director +44 (0)20 7581 4477

Roland Cornish

Beaumont Cornish (Nomad) Felicity Geidt +44 (0)20 7628 3369

Novum Securities Ltd Jon Belliss +44 (0)20 7399 9425

(Broker)

CHAIRMAN'S STATEMENT

Dear Shareholder,

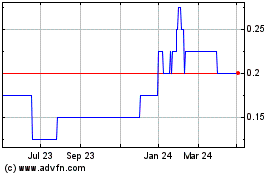

The year under review has seen Tiger's net asset value per share

("NAV") decrease by 26% to 0.23p from 0.31p as at 31 December 2019.

Although natural resource markets recovered during the second half

of 2020, the decrease in NAV has resulted in the main due to

additional shares being issued in September 2020 to recapitalise

the Company. We are pleased to report that the portfolio has

performed better this year with most of the investments in the

portfolio showing an appreciation in value over the period, year to

date.

The year under review, 2020, has been clouded by the tragic

Covid-19 pandemic and our routines of international travel and face

to face meetings came to a standstill. Conversely, during this

period of austerity and uncertainty, the fortunes of commodity

markets improved dramatically and at the time of writing of this

Report, the improved sentiment has continued.

There has been much talk of the shape of the recovery curve and

the bulls and bears both captured investors' attention during the

period under review with their widely differing outlooks. These

forecasts have generally been extreme and often without foundation

or firm analysis. It is surprising to note, that at the time of

writing this Report, forecasts are being made for a global recovery

with associated growth rates generally in excess of anything

previously seen. It is indeed sobering to recognise what the real

economy represents when one sees the decimation of the hotel,

travel and hospitality sectors and its lack of overall impact on

the real recovery. However, these sectors can only add stimulus to

the recovery when activity in these areas of the economy resumes

back to pre-pandemic levels.

Moving to issues specific to our own industry, most commodities

have experienced significant price increases since the start of the

pandemic. The star of the show has been copper, which at the start

of the pandemic was priced at US$5,400 per tonne and at the time of

writing this Report has reached a price of US$10,400 per tonne. The

forecast demand for copper in 2030 is double that of 2020 whilst

the supply side is looking less achievable. Chile supplies 37% of

the world's copper and the country is suffering immense social

unrest, directed taxation increases and technical threats in its

ability to support the expected surge in demand for the metal.

These threats include falling grades of copper, deep and expensive

to operate open pits mines with similar issues being experienced

with underground mining operations. Chile is no longer the location

of choice for global investment when considering the deployment of

exploration capital with the preferred countries now being

Australia, USA, Canada and other emerging copper belts, with

Botswana having outstanding prospectivity in the Kalahari Copper

Belt.

The forecast for the doubling in demand for copper was made

around 2018 and did not fully take into account the astonishing

impetus for electric vehicles (EVs). The economic emergence of

developing countries has added to the global determination to

slowdown climate change and this factor will also trigger a huge

increase in the demand for copper. These issues have been

compounded by President Joe Biden's plan to renew infrastructure in

the USA, where such investment appears to have been on hold for

some 20 years and now a pressing need to build new as well as

refurbish existing infrastructure alongside embracing the

challenges to respond to climate change. We believe that the next

surge in commodity demand will be in metals and minerals which are

used in the storage of energy and as such we also feel very

positive on future prices for nickel, vanadium, manganese, cobalt

and lithium.

Commodity industry analysts are referring to a commodity super

cycle and I personally challenge the use of the word "cycle" in

this context. This is on the basis that a cycle suggests that

underlying economics have changed and that these commodities are

now back in favour. My prognosis is that we are experiencing a

fundamental shift in the demand for many metals, specifically for

those listed above and particularly in the case of copper. The

underlying demand being driven by technological and humanistic

fundamentals which have not been seen since the age of the

Industrial Revolution - all of this at a time of great challenges

posed by the pandemic.

Tiger's investment portfolio is made up of companies which have

exposure to these commodities and the planned public listing of our

subsidiary company, African Pioneer plc, will further add our

exposure to investment in copper. We are approaching the time, when

major mining companies will need to acquire proven resources to

improve their metal inventories and it is likely that some junior

explorers will deliver excellent returns for their

shareholders.

We are also of the opinion, that the extinction of the "small

miner" and the reduction in the number of single project mining

companies will be reversed, since the process of developing a large

copper mine from commencement of exploration to first copper

production can take up to 12 years and in any case is never less

than 8 years given the time required for systematic exploration,

permitting, financing and site construction. The sheer demand for

copper and other selected base metals requires that all facets of

production are in place from small high-grade operations to huge

tonnage, low grade, ventures. We intend to add to our portfolio and

gain more exposure to these targeted EV and energy storage metals

and look forward to earning superior returns for our investors, an

outcome that they have patiently waited for.

We remain committed to proactive investment and we believe that

the day of the small miner and explorer has re-emerged and that

Tiger's investors will benefit from the changing dynamics in the

industry. I would like to thank my fellow directors for their

dedication and application towards our objectives and sincerely

thank our shareholders for their support over the years. We look

forward to success arising from the emergence of EVs and the

climate change revolution which will no doubt result in a rapidly

changing and very different commodity and investment

environment.

Colin Bird

Executive Chairman

24 May 2021

PORTFOLIO REVIEW

The table below includes investments held by the Group, and are

disclosed in notes 7 to the financial statements.

Number Cost Valuation Valuation Valuation

31/12/20 31/12/20 31/12/20 31/12/19 31/03/21

GBP GBP GBP GBP

Kendrick Resources Plc 2,500,000 50,217 - -

Bezant Resources Plc 55,555,556 250,435 138,889 111,111 176,128

Barkby Group Plc (previously

- Sovereign Mines of Africa

Plc) - - - 5,909

Block Energy Plc 625,000 25,100 20,312 28,125 15,625

Caerus Mineral Resources

Plc 1,000,000 - - - 126,000

Corallian Energy Limited 20,000 30,000 30,000 30,000 30,000

ETFS Copper 760 12,896 17,497 34,436 19,624

Galileo Resources Plc 6,516,667 78,335 107,525 32,583 86,020

Goldquest Mining Corporation 173,500 30,259 28,142 14,392 26,511

Jubilee Metals Group Plc 1,169,600 100,219 149,124 45,614 174,037

Pantheon Resources 31,500 30,340 13,702 5,197 11,246

Australgold (formerly Revelo

Resources Corp) 21,263 62,965 - 637 -

Royal Dutch Shell Plc B

Shares 2,700 73,234 34,004 60,466 36,045

TOTAL FOR THE PARENT COMPANY 744,000 539,195 368,470 701,236

------------ ------------- ------------- ----------

Europa Metals Ltd (previously - - - 26,100 -

Ferrum Crescent Limited)

Jubilee Metals Group Plc 217,802 8,266 27,770 35,794 32,409

Galileo Resources Plc 2,500,000 50,000 41,250 12,500 33,000

Australgold (formerly Revelo - - - 6,614 -

Resources Corp)

South 32 Limited 13,845 28,607 19,297 19,522 21,606

Xtract Resources Plc 606,060 20,217 10,788 5,939 38,182

------------ ------------- ------------- ----------

TOTAL FOR AFRICAN PIONEER

PLC 107,090 99,105 106,469 125,197

------------ ------------- ------------- ----------

TOTAL INVESTMENTS FOR THE

GROUP 851,090 638,300 474,939 826,433

============ ============= ============= ==========

PARENT COMPANY:

The Company sold 1,000 ETFS Copper shares and its holding in

Barkby Group during the year.

AFRICAN PIONEER Plc ("APP"):

APP sold its holding in Europa Metals Ltd and 700,000 shares in

Jubilee Metals Group Plc during the year.

Details of changes in the fair value of investments are shown in

note 7 of the Financial Statements.

African Pioneer Plc

African Pioneer Plc ("APP") is a 50.75% owned subsidiary of The

Company and was formed with a mission to identify investment

opportunities in base metals within the mining sector focussed in

Sub-Saharan Africa. APP has identified suitable exploration assets

in the mining sector based in Zambia, Namibia and Botswana and is

now working to complete the acquisition of these assets and list

APP on the London Stock Exchange by way of Standard Listing.

Further details of the proposed acquisitions are detailed in note

13 of these financial statements.

Bezant Resources Plc (AIM - BZT: LN) www.bezantresources.com

Bezant Resources Plc ("Bezant") is a mineral exploration and

development company quoted on AIM and focused on developing a

pipeline of copper-gold projects to provide a new generation of

economically and socially sustainable mines. The company acquired a

30% interest in the Kalengwa exploration project on 24 April 2020

which is based in the area surrounding the historic, high-grade

Kalengwa open pit copper mine in the Republic of Zambia. Bezant's

copper-gold project is situated in the Matchless Copper Belt in

Namibia and has a resource 10.2 million tonnes JORC category grade

of approx. 1.9% copper and 0.3 g/t of gold (approx. 30% resource

tonnage classified in the "indicated" Mineral Resource category

with the balance in the "inferred" Mineral Resource category). The

company's Eureka Property covers in excess of ten thousand hectares

and is located in the north-west corner of the Jujuy province in

northern Argentina.

Block Energy Plc (AIM - BLOE: LN) www.blockenergy.co.uk

Block Energy Plc ("Block Energy") is an AIM-listed exploration

and production which has a strategy of applying innovative

technology to realise the full potential of previously discovered

fields in Georgia. In November 2020, Block Energy concluded a sale

and purchase agreement with Schlumberger to acquire its subsidiary

Schlumberger Rustaveli Company Limited (SRCL) representing a major

milestone towards its objective of becoming the leading independent

oil and gas producer in Georgia. The acquisition comprised of the

producing Block XI(B) - Georgia's most productive block and the

exploration Block IX and this transaction significantly increased

the company's access to production, reserves and resources. The

acquisition was completed by issuing options over shares conserving

the company's cash resources.

Caerus Mineral Resources Plc (LSE: CMRS)

www.caerusmineralresources.co m

Caerus Mineral Resources Plc ("Caerus") is a European-focused

exploration and development company targeting mineral resources to

supply the global Clean Energy Transition which whose shares were

admitted to the main market of the London Stock Exchange under the

Standard Segment of the Official on 19 March 2021. The company was

established to target Mineral Resources in Europe in response to

the transition and drive towards Clean Energy economies globally

with the current focus being on copper-gold opportunities in

Cyprus, a region with a long mining history and significant

untapped value. Caerus recently announced a binding and exclusive

option agreement with Jubilee Metals Group Plc ("Jubilee") which

will enable Caerus and Jubilee to engage in an agreed work

programme to investigate and assess the remnant ore and multiple

waste stockpiles from the 16 mines that operated historically on

Caerus' concessions to identify and define projects within the

Caerus portfolio that can be targeted to production using modern

designs and waste processing technologies guided and financed by

Jubilee.

Corallian Energy Limited www.corallian.co.uk

Corallian Energy Limited ("Corallian") is a private UK oil and

gas exploration and appraisal company. The Company holds interests

in 4 basins in the UK; West of Shetland, Central Graben, Inner

Moray Firth and Viking Graben. A proportion of the Corallian

investment has been exchanged in recent weeks for a direct equity

interest in Reabold Resources plc, an AIM listed investment

company.

Galileo Resources Plc (AIM - GLR - LN)

www.galileoresources.com

Galileo Resources PLC ("Galileo") is an AIM quoted natural

resource exploration company specializing in the acquisition and

development of base metal projects with a focus on copper. The

company recently completed a High-Resolution Helicopter-Borne

Electromagnetic and Magnetic Survey over several of its prospecting

licenses in the Kalahari Copper Belt in western Botswana which

include PL40/2018 and PL39/2018. Galileo has announced that it has

recently contracted a drilling program totalling a minimum of

2,500m of drilling which is due to commence shortly. The company

also announced on 3 March 2021 that it entered into a conditional

agreement with Siege Mining Limited ("Siege") in relation to the

ceding of ownership and operations in the Star Zinc Project for a

consideration of US$750,000. Galileo will also be paid a royalty

based on future sales of zinc from the Star Zinc Project for

allowing Siege to use Galileo's information, know-how and

commercial experience in relation to the Star Zinc Project.

Jubilee Metals Group Plc (AIM - JLP: LN)

www.jubileemetalsgroup.com

Jubilee Metals Group Plc ("Jubilee") is an industry leading

metal recovery business focussed on the retreatment and metals

recovery from mine tailings, waste, slag, slurry and other

secondary materials generated from mining operations. The company's

expanding multi-project portfolio across South Africa and Zambia

provides exposure to a broad commodity basket including platinum

group metals ('PGMs'), chrome, lead, zinc, vanadium, copper and

cobalt. Jubilee's shares are traded on the AIM Market of the London

Stock Exchange (JLP) and the South African Alt-X of JSE Limited

(JBL). The company's last reported attributable earnings for the

six-month period to 31 December 2020 increased by 212 %, to a

record GBP 30.9 million (2019: GBP 9.9 million), driven mainly by

increased operational output with PGM production surging by 34 %

and increased metal prices over the period.

Royal Dutch Shell Plc (LSE - RDSB: LN) www.shell.com

Royal Dutch Shell Plc's ("Shell") mission is to thrive in the

energy transition cycle by responding to society's desire for

additional, cleaner, convenient and competitive energy and to make

a positive contribution to society through the company's

operations. Shell continuously seeks to improve its operating

performance and maximise sustainable free cash flow, with an

emphasis on health, safety, security, environment and asset

performance, as well as adhering to ethics and compliance

principles. The group made a loss of $21,534 million in the year

ended 31 December 2020, compared with earnings of $16,432 million

in 2019. After current cost of supplies adjustment, total segment

earnings made a loss of $(19,701) million in 2020, compared with

earnings of $15,827 million in 2019.

CONSOLIDATED AND PARENT COMPANY STATEMENTS OF COMPREHENSIVE

INCOME YEARED 31 DECEMBER 2020

Notes Group 2020 Group 2019 Company 2020 Company 2019

(Restated)

GBP GBP GBP GBP

Change in fair

value of investments 7 250,740 142,768 194,216 169,009

Revenue:

Investment income 2,330 12,230 1,989 11,210

Interest receivable 38 109 37 106

Administrative

expenses 2 (488,017) (316,227) (345,755) (285,887)

Impairment charge 6(a) - - - (67,686)

Negative goodwill 6(b) 63,437 - - -

LOSS BEFORE TAXATION (171,472) (161,120) (149,513) (173,248)

Taxation 4 - - - -

TOTAL COMPREHENSIVE

LOSS FOR THE YEAR (171,472) (161,120) (149,513) (173,248)

----------- ----------------------- ------------- ---------------

LOSS FOR THE YEAR ATTRIBUTABLE

TO:

Shareholders of

the company (127,070) (133,892) (149,513) (173,248)

Non-controlling

interest (44,402) (27,228) - -

----------- ----------------------- ------------- ---------------

(171,472) (161,120) (149,513) (173,248)

----------- ----------------------- ------------- ---------------

TOTAL COMPREHENSIVE LOSS ATTRIBUTABLE TO:

Shareholders of

the company (127,070) (133,892) (149,513) (173,248)

Non-controlling

interest (44,402) (27,228) - -

----------- ----------------------- ------------- ---------------

(171,472) (161,120) (149,513) (173,248)

----------- ----------------------- ------------- ---------------

Basic earnings

per share 5 (0.05) p (0.07) p

Diluted earnings

per share 5 (0.05) p (0.07) p

All profits are derived from continuing operations.

The comparative information has been restated as a result of

prior period adjustment as detailed in note 1.

The notes on pages 30 to 49 are an integral part of these

financial statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY YEARED 31 DECEMBER

2020

Other components of equity

Share capital Share Capital Retained Equity Non-controlling Total

premium redemption earnings attributable interest Equity

reserve to owners

GBP GBP GBP GBP GBP GBP GBP

As at 1 January 2019 1,474,334 1,669,216 1,100,000 (3,516,229) 727,321 25,853 753,174

-

Minority interest prior period

adjustment (27,118) (27,118) 27,118 -

Total comprehensive income for

the year - As restated - - - (133,892) (133,892) (27,228) (161,120)

As at 31 December 2019 - As

restated 1,474,334 1,669,216 1,100,000 (3,677,239) 566,311 25,743 592,054

---------- ---------- ----------- ------------ ------------- ---------------- ----------

As at 1 January 2020 - As restated 1,474,334 1,669,216 1,100,000 (3,677,239) 566,311 25,743 592,054

Shares issued during the year 250,596 280,655 - - 531,251 - 531,251

Total comprehensive income for

the year (127,070) (127,070) (44,402) (171,472)

Minority's share of equity

injection

in APP (note 6b) - 61,563 61,563

As at 31 December 2020 1,724,930 1,949,871 1,100,000 (3,804,309) 970,492 42,904 1,013,396

---------- ---------- ----------- ------------ ------------- ---------------- ----------

The comparative information has been restated as a result of

prior period adjustment as detailed in note 1.

The notes on pages 30 to 49 are an integral part of these

financial statements.

PARENT COMPANY STATEMENT OF CHANGES IN EQUITY YEARED 31 DECEMBER

2020

Other components of equity

Share capital Share Capital Retained Total

premium redemption earnings Equity

reserve

GBP GBP GBP GBP GBP

As at 1 January 2019 1,474,334 1,669,216 1,100,000 (3,475,194) 768,356

Total comprehensive income

for the year - - - (173,248) (173,248)

As at 31 December 2019 1,474,334 1,669,216 1,100,000 (3,648,442) 595,108

---------- ---------- ------------ ------------ ----------

As at 1 January 2020 1,474,334 1,669,216 1,100,000 (3,648,442) 595,108

Shares issued during the

year 250,596 280,655 - 531,251

Total comprehensive income

for the year (149,513) (149,513)

As at 31 December 2020 1,724,930 1,949,871 1,100,000 (3,797,955) 976,846

---------- ---------- ------------ ------------ ----------

The comparative information has been restated as a result of

prior period adjustment as detailed in note 1.

The notes on pages 30 to 49 are an integral part of these

financial statements.

CONSOLIDATED AND PARENT COMPANY STATEMENTS OF FINANCIAL POSITION AS AT 31 DECEMBER 2020

Notes Group Group Company Company

2020 2019 2020 2019

(Restated)

GBP GBP GBP GBP

NON- CURRENT ASSETS

Investment in subsidiaries 6 - - - -

Investments in financial assets at

fair value through profit or loss 7 638,300 474,939 539,195 368,470

----------------- ------------ ------------ -------------

Total Non-Current Assets 638,300 474,939 539,195 368,470

CURRENT ASSETS

Trade and other receivables 8 51,521 11,756 169,486 109,988

Cash and cash equivalents 508,161 142,622 420,699 142,394

----------------- ------------ ------------ -------------

Total Current Assets 559,682 154,378 590,185 252,382

----------------- ------------ ------------ -------------

TOTAL ASSETS 1,197,982 629,317 1,129,380 620,852

----------------- ------------ ------------ -------------

CURRENT LIABILITIES

Trade and other payables 10 (184,586) (37,263) (152,534) (25,744)

Total Current Liabilities (184,586) (37,263) (152,534) (25,744)

----------------- ------------ ------------ -------------

NET ASSETS 1,013,396 592,054 976,846 595,108

----------------- ------------ ------------ -------------

EQUITY

Share capital 11 1,724,930 1,474,334 1,724,930 1,474,334

Share premium 1,949,871 1,669,216 1,949,871 1,669,216

Other components of equity 1,100,000 1,100,000 1,100,000 1,100,000

Retained earnings (3,804,309) (3,677,239) (3,797,955) (3,648,442)

----------------- ------------ ------------ -------------

EQUITY ATTRIBUTABLE TO THE OWNERS 970,492 566,311 976,846 595,108

Equity interest of non-controlling

interests 42,904 25,743 - -

----------------- ------------ ------------ -------------

TOTAL EQUITY 1,013,396 592,054 976,846 595,108

----------------- ------------ ------------ -------------

The comparative information has been restated as a result of

prior period adjustment as detailed in note 1.

The notes on pages 30 to 49 are an integral part of these

financial statements.

The financial statements of Tiger Royalties and Investments Plc

(registered number 02882601) were approved by the Board on 24 May

2021 and signed on its behalf by:

Colin Bird - Executive Chairman R Samtani - Finance Director

CONSOLIDATED AND PARENT COMPANY CASH FLOW STATEMENTS YEARED 31 DECEMBER 2020

Notes Group Group Company 2020 Company 2019

2020 2019

GBP (Restated)GBP GBP GBP

CASH FLOW FROM OPERATIONS

Loss before taxation (171,472) (161,120) (149,513) (173,248)

Adjustments for:

Interest receivable (38) (109) (37) (106)

Dividends receivable (2,330) (12,230) (1,989) (11,210)

Change in fair value

of investments (250,740) (142,768) (194,216) (101,323)

Negative goodwill (63,437) - - -

----------- -------------- ------------- -------------

Operating loss before

movements in working

capital (488,017) (316,227) (345,755) (285,887)

(Increase)/Decrease

in receivables (8,515) (2,645) (28,246) (1,248)

Increase/(Decrease)

in payables 147,324 (5,239) 126,789 (12,687)

NET CASH OUTFLOW FROM

OPERATING ACTIVITIES (349,208) (324,111) (247,212) (299,822)

----------- -------------- ------------- -------------

1

CASH FLOW FROM INVESTING

ACTIVITIES

Interest received 38 109 37 106

Dividends received 2,330 12,230 1,989 11,210

Sale of investments 87,379 387,615 23,491 387,615

Purchase of investments - - - -

----------- -------------- ------------- -------------

NET CASH INFLOW FROM

INVESTING ACTIVITIES 89,747 399,954 25,517 398,931

----------- -------------- ------------- -------------

CASH FLOW FROM FINANCING

ACTIVITIES

Issue of shares 500,000 - 500,000 -

Issue of convertible 125,000 - - -

loan notes - APP

NET CASH INFLOW FROM

FINANCING ACTIVITIES 625,000 - 500,000 -

----------- -------------- ------------- -------------

Net decrease in cash

and cash equivalents

in the year 365,539 75,843 278,305 99,109

Cash and cash equivalents

at the beginning of

the year 142,622 66,779 142,394 43,285

----------- -------------- ------------- -------------

Cash and cash equivalents

at the end of the year 508,161 142,622 420,699 142,394

=========== ============== ============= =============

The comparative information has been restated as a result of

prior period adjustment as detailed in note 1.

The notes on pages 30 to 49 are an integral part of these

financial statements.

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEARED 31 DECEMBER

2020

1. ACCOUNTING POLICIES

Basis of preparation

Tiger Royalties and Investments Plc ("Tiger" or the "Company")

is a public investment company limited by shares incorporated and

domiciled in England and Wales. Tiger and African Pioneer Plc's

(subsidiary company) principal activities are discussed in the

Strategic Report and the address of the registered office is

included on page 1 of the annual report. The functional currency

for the Group is Sterling as that is the currency of the primary

economic market in which the Company and Group operates. The

financial statements have been prepared under the historical cost

convention except for the measurement of certain non-current asset

investments at fair value. The measurement bases and principal

accounting policies of the Group are set out below. The financial

statements have been prepared using International Financial

Reporting Standards (IFRS) issued by the International Accounting

Standards Board (IASB) and endorsed by the European Union.

New and amended IFRS Standards that are effective for the

current year

A number of new standards and interpretations have been adopted

by the Group for the first time in line with their mandatory

adoption dates, but none are applicable to the Group and hence

there would be no impact on the financial statements.

New and revised IFRS Standards in issue but not yet

effective

At the date of approval of these financial statements, the Group

has not applied the following new and revised IFRS Standards that

have been issued but are not yet effective:

IFRS 17 Insurance Contracts

----------------------------------------------------------

IFRS 10 and IAS 28 Sale or Contribution of Assets between an Investor

(amendments) and its Associate or Joint

Venture

----------------------------------------------------------

Amendments to IAS Classification of Liabilities as Current or Non-current

1

----------------------------------------------------------

Amendments to IFRS Reference to the Conceptual Framework

3

----------------------------------------------------------

Amendments to IAS Property, Plant and Equipment-Proceeds before Intended

16 Use

----------------------------------------------------------

Amendments to IAS Onerous Contracts - Cost of Fulfilling a Contract

37

----------------------------------------------------------

Annual Improvements Amendments to IFRS 1 First-time Adoption of International

to IFRS Standards Financial Reporting Standards, IFRS 9 Financial

2018-2020 Cycle Instruments, IFRS 16 Leases, and IAS 41 Agriculture

----------------------------------------------------------

The directors do not expect that the adoption of the Standards

listed above will have a material impact on the financial

statements of the Group in future periods.

Prior period adjustments

At the date of signing the 2019 audited consolidated financial

statements for the Company, the audit of financial statements of

its subsidiary company African Pioneer Plc ("APP") had not been

completed. On the basis that the APP figures were considered to be

immaterial, the unaudited APP numbers were used to prepare Tiger's

consolidated financial statements to 31 December 2019. Upon

completion of APP's audit, some differences were identified between

APP's audited financial statements and the figures used for the

2019 Tiger consolidation. These differences related primarily to an

additional accrual and the classification of an intercompany loan

from Tiger to APP as equity contribution in APP's audited financial

statements. Due to these differences, the prior year consolidated

profit, and minority interest have been restated.

Additionally, there were some differences in the classification

of investments between listed and unlisted securities and between

currencies, in note 7 of the prior year financial statements. These

differences relating to the year ending 31 December 2019 have been

corrected and restated in the current year. This restatement has

not affected the loss, net assets and taxation in the current or

prior year.

The following table summarizes the impact of the prior period

adjustment on the financial statements of the Group. There is no

impact on balances at 1 January 2019. The impact of the prior

period adjustment is immaterial for both basic and diluted earnings

per share.

Period ended 31

December 2019

Consolidated Statement of Comprehensive

Income

----------------

Other admin expenses 6,500

----------------

Increase/(decrease) in profit for the

financial year (6,500)

----------------

Consolidated statement of financial position

----------------

Accruals 6,500

----------------

Increase/(decrease) in net assets (6,500)

----------------

Increase/(Decrease) in minority interest 27,118

----------------

Increase/(Decrease) in consolidated reserves (27,118)

----------------

Basis of consolidation

The Group financial statements incorporate the financial

statements of the Company and entities controlled by the Company

(its subsidiaries). Control is achieved where the Company has the

power to govern the financial and operating policies of an entity

so as to obtain benefits from its activities. The subsidiary has a

reporting date of 31 December.

The results of subsidiaries acquired or disposed of during the

year are included in the consolidated statement of comprehensive

income from the effective date of acquisition or up to the

effective date of disposal, as appropriate.

Where necessary, adjustments are made to the financial

statements of subsidiaries to bring their accounting policies in

line with those used by other members of the Group.

All intra-group transactions, balances, income and expenses are

eliminated in full on consolidation.

Non-controlling interests in the net assets of consolidated

subsidiaries are identified separately from the Group's equity

therein. Non-controlling interests consist of the amount of those

interests at the date of the original business combination and the

minority's share of changes in equity since the date of the

combination. Losses applicable to the non-controlling interests in

excess of the minority's interest in the subsidiary's equity are

recorded as a debit to non-controlling interest regardless of

whether there is an obligation in the part of the holders of

non-controlling interests for losses.

Negative goodwill can arise if the interest in the net amount of

identifiable assets, liabilities and contingent liabilities exceeds

the cost of the business combination. The credit balance is

released to profit or loss.

Going concern

The operations of the Group have been financed mainly through

operating cash flows. As at 31 December 2020, the Group held cash

balances of GBP508,161 (2019: GBP142,622) and an operating loss has

been reported. Historically, the Group has been generating cash

flow from the appreciation and subsequent sale of investments in

quoted natural resource companies. The Directors anticipate net

operating cash flows to be neutral for the Group in the next twelve

months from the date of signing these financial statements.

The Directors have assessed the working capital requirements for

the forthcoming twelve months and have undertaken assessments which

to consider cash forecasts until June 2022. Upon reviewing those

cash flow projections for the forthcoming twelve months, the

Directors consider that the Group should not require additional

financial resources in the twelve-month period from the date of

approval of these financial statements to enable the Group to fund

its current operations and to meet its commitments.

Notwithstanding the above and given the ongoing uncertainties

with the ongoing Covid19 pandemic, the Directors may require to

raise some funds through equity fund raising in extremely worsening

economic circumstances. To this end, the Board has substantial

experience with capital markets within the smaller cap space and

would be in a position to access markets in such a scenario.

Nevertheless, after making enquiries and considering the

uncertainties described above, the Directors have a reasonable

expectation that the Company has adequate ability to manage its

portfolio and raise resources if necessary, to continue in

operational existence for the foreseeable future. The Directors

therefore continue to adopt the going concern basis of accounting

in preparing the annual financial statements.

Valuation of available-for-sale Investments and adoption of

IFRS9

Available-for-sale investments under both IFRS9 and IAS39 are

initially measured at fair value plus incidental acquisition costs.

Subsequently, they are measured at fair value in accordance with

IFRS 13. This is either the bid price or the last traded price,

depending on the convention of the exchange on which the investment

is quoted.

All gains and losses are taken to profit and loss. In proceeding

periods gains and losses on available-for-sale investments were

recognised in other comprehensive income and accumulated in the

available-for-sale assets reserve except for impairment losses,

until the assets are derecognised, at which time the cumulative

gains and losses previously recognised in other comprehensive

income are recognised in profit or loss.

Investments in subsidiaries

In its separate financial statements, the Company recognises its

investments in subsidiaries at cost, less any provision for

impairment. The cost of acquisition includes directly attributable

professional fees and other expenses incurred in connection with

the acquisition.

Revenue

Dividends receivable from equity shares are taken to profit or

loss on an ex-dividend basis. Income from bank interest received is

recognised on a time-apportionment basis. Dividends are stated net

of related tax credits.

Expenses

All expenses are accounted for on accruals basis.

Cash and cash equivalents

This consists of cash held in the Group's bank accounts.

Foreign currency

Assets and liabilities denominated in foreign currency are

translated into sterling at the rates of exchange ruling at balance

sheet date. Exchange gains or losses on monetary items are recorded

in profit or loss. Exchange gains or losses on investments in

financial assets are recorded in other comprehensive income.

Treasury shares

The cost of purchasing treasury shares and the proceeds from the

sale of treasury shares up to the original price is taken to the

retained earnings reserve; any surplus on the disposal of treasury

shares (measured against the weighted average purchase price) is

taken to the share premium account.

Reserves

Share premium account

The share premium account is used to record the aggregate amount

or value of premiums paid in excess of the nominal value of share

capital issued, less deductions for issuance costs.

Capital Redemption Reserve

The Capital redemption reserve is used to redeem or purchase of

Group's own shares.

Geographical segments

The internal management reporting used by the chief operating

decision maker consists of one segment. Hence in the opinion of the

Directors, no separate disclosures are required under IFRS 8. The

Group's revenue in the year is not material and consequently no

geographical segment information has been disclosed.

Deferred tax

Deferred tax liabilities are generally recognised for taxable

temporary differences and deferred tax assets are generally

recognised for all deductible temporary differences to the extent

that it is probable that taxable profits will be available against

which those deductible temporary differences can be utilised except

for differences arising on investments in subsidiaries where the

Group is able to control the timing of the reversal of the

difference and it is probable that the difference will not reverse

in the foreseeable future.

Deferred tax is also based on rates enacted or substantively

enacted at the reporting date and expected to apply when the

related deferred tax asset is realised or liability settled.

Deferred tax is charged or credited in the statement of

comprehensive income, except when it relates to items charged or

credited directly to equity, in which case the deferred tax is also

dealt within equity.

Current tax

The tax currently payable is based on taxable profit for the

year. Taxable profit differs from profit as reported in the

consolidated income statement because it excludes items or expenses

that are taxable or deductible in other years and it further

excludes items that are never taxable or deductible. The Group's

liability for current tax is calculated using tax rates that have

been enacted or substantively enacted by the end of the reporting

period.

Significant management judgement in applying accounting policies

and estimation uncertainty

When preparing the financial statements, management makes a

number of judgements, estimates and assumptions about the

recognition and measurement of assets, liabilities, income and

expenses.

Fair value of financial assets

Establishing the fair value of financial assets may involve

inputs other than quoted prices. As is further disclosed in note 7,

all of the Group's financial assets which are measured at fair

value are based on level 1 inputs, which reduces the level of

estimation involved in their valuation.

Recognition of deferred tax assets

The extent to which deferred tax assets can be recognised is

based on an assessment of the probability of the Group's future

taxable income against which the deductible temporary differences

can be utilised. In addition, significant judgement is required in

assessing the impact of any legal or economic limits or

uncertainties in various tax jurisdictions. In the opinion of the

directors a deferred tax asset has not been recognised as future

profits cannot be forecasted with reasonable certainty.

2. OPERATING EXPENSES

Operating profit is stated after charging:

Group Company Company

Group 2020 2019 2020 2019

GBP (Restated)GBP GBP GBP

Auditor's remuneration:

* Audit of the financial statements 17,167 17,167 15,000 15,000

* Taxation compliance services 1,500 1,500 1,500 1,500

---------- ------------------------ -------- -------

18,667 18,667 16,500 16,500

Notes

Legal fees 13,536 7,218 13,536 7,218

Corporate finance costs 27,600 25,200 27,600 25,200

Directors' fees 3 99,000 120,000 99,000 120,000

Director of subsidiary company 3,600 3,600 - -

Occupancy and support costs 82,800 82,800 72,000 72,000

Other administrative overheads 123,004 49,538 101,677 35,755

Stock Exchange costs 15,442 9,204 15,442 9,204

APP listing related expenses 104,368 - - -

- - -

Administrative expenses 488,017 316,227 345,755 285,877

---------- ------------------------ -------- -----------

3. DIRECTORS' EMOLUMENTS

Group 2020 Group 2019 Company 2020 Company 2019

GBP GBP GBP GBP

Directors' fees 102,600 123,600 99,000 120,000

---------- ---------- ------------ ------------

Other than directors, there were no employees in the current or

prior year. No pensions or other benefits were paid to the

Directors in the current or prior period.

The emoluments of each director during the year were as follows:

Group 2020 Group 2019 Company 2020 Company 2019

GBP GBP GBP GBP

James Cunningham-Davis 3,600 3,600 - -

Colin Bird 39,500 50,000 39,500 50,000

Michael Nolan 27,500 35,000 27,500 35,000

Raju Samtani 31,250 35,000 31,250 35,000

Alex Borrelli 750 - 750 -

4. TAXATION

Group 2020 Group Company 2020 Company

GBP 2019 GBP 2019

GBP GBP

Corporation tax:

Current year - - - -

---------- -------------- ------------ ------------

The major components of tax expense and the reconciliation of the expected

tax expense based on the domestic effective tax rate of 19% (2019 - 19%)

and the reported tax expense in the statement of comprehensive income are

as follows:

Company 2020 Company 2019

Group 2020 Group 2019 GBP

GBP (Restated)GBP GBP

Loss on ordinary activities before

tax (171,472) (161,120) (149,513) (173,248)

---------- -------------- ------------ ------------

Expected tax charge at 19% (2019 -

19%) (32,580) (30,612) (28,407) (32,917)

Effects of:

Exempt dividend income 443 2,324 378 2,130

Impairment adjustment - - - 12,860

Difference between accounting gain

and taxable gain on investment 2,817 12,244 7,803 34,618

Excess management expenses carried

forward 26,839 41,459 17,749 54,319

Non-trade loan relationship deficit

carried forward 2,478 2,487 2,478 2,486

Actual tax charge - - - -

---------- -------------- ------------ ------------

5. EARNINGS PER SHARE

Basic 2020 2019

(Restated)

Loss after tax for the purposes of earnings

per share attributable to equity shareholders

of the parent (127,070) GBP (133,892)

Weighted average number of shares 241,054,411 188,847,070

Basic earnings per ordinary share (0.05) p (0.07) p

Diluted

Loss for year after tax (127,070) GBP (133,892)

Weighted average number of shares 241,054,411 188,847,070

Dilutive effect of options - -

Diluted weighted average number of shares 241,054,411 188,847,070

Diluted earnings per ordinary share (0.05) p (0.07) p

Potentially dilutive options

There were no share options outstanding at 31 December 2020 or

31 December 2019.

6. INVESTMENT IN SUBSIDIARIES

a) On 20 July 2012, Tiger made an investment in African Pioneer

Plc ("APP"), an Isle of Man company registered at 31-37 North Quay,

Douglas, Isle of Man, IM1 4LB. African Pioneer Plc is an investment

vehicle which was incorporated to facilitate pro-active investments

being undertaken by The Company in the resource sector. At 31

December 2019, the Group had an interest of 50.75% of the voting

equity rights in its subsidiary, African Pioneer Plc.

The subsidiary company was incorporated on 20 July 2012, and

later issued shares through a placing of shares for cash and there

were, therefore, no assets or liabilities acquired at the time

acquisition. No acquisition costs were incurred. African Pioneer

Plc issued 4,998,258 Ordinary shares of nil par on 2 June 2015 at 1

pence per share. The Company subscribed for a further 2,529,130

shares in this placing and held 5,952,913 shares representing a

holding of 50.75% in African Pioneer Plc. On 7 December 2020, APP

consolidated its share capital 10:1 for existing shares. This

resulted in 1,172,982 total issued number of shares, with the

Company holding 595,291 shares at 31 December 2020.

2020 2019

GBP GBP

At 1 January 2020 - 67,686

Impairment - (67,686)

--------- -----------------

Total at 31 December 2020 - -

--------- -----------------

African Pioneer Plc's capital and reserves were as follows:

2020 2019

GBP (Restated)GBP

Share capital 452,983 452,983

Loss for the year (90,156) (55,286)

Reserves (275,713) (345,427)

---------------- --------------------

Total equity 87,114 52,270

---------------- --------------------

b) On 21 October 2020, APP entered into a convertible loan note

agreement with Sanderson Capital Partners ("Sanderson") for a total

investment of GBP150,000. Sanderson advanced the sum of GBP125,000

under this agreement prior to 31 December 2020 and the balancing

GBP25,000 was received by the Company on 4 February 2021. In

accordance with IAS 32, the funds received from Sanderson were

classified as equity in APP's financial statements for the year

ended 31 December 2020. Tiger's share being GBP63,437

(GBP125,000*50.75%) has been recognised as negative goodwill in the

consolidated statement of comprehensive income. Additionally, an

amount of GBP61,563 (GBP125,000*49.25%) has been credited to

minority interest.

The loan notes do not have a fixed repayment term and carry a

zero-coupon rate and may be converted by Sanderson into Ordinary

shares of zero par value in APP at any time at a conversion price

1.75p per share but in any case, no later than when APP has listed

its shares on a recognised exchange. Upon listing, Sanderson will

receive one warrant per each share received on conversion of the

loan notes into Ordinary shares in African Pioneer Plc to subscribe

for shares at a strike price being the lower of 3.5 pence or the

listing price of the shares at the time of admission for trading on

a recognised market. These warrants will be valid for a period of 3

years from the date of issue of the convertible loan note.

7. INVESTMENTS IN FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

GROUP

2020

Listed Investments Other Investments Total

(Quoted/Others)

GBP GBP GBP

Canada 28,142 - 28,142

UK 70,799 539,359 610,158

98,941 539,359 638,300

--------------------- -------------------- -------------

2019 (Restated)

Listed Investments Other Investments Total

(Quoted/Others)

GBP GBP GBP

Canada 21,643 - 21,643

UK 114,423 338,873 453,296

136,066 338,873 474,939

-------------------------------- -------------------- -------------

Listed Investments Other Investments Total

(Quoted)

GBP GBP GBP

Opening book cost - As restated 278,490 834,947 1,113,437

Opening unrealised gains(losses)

- As restated (142,424) (496,074) (638,498)

Valuation at 1 January 2020

- As restated 136,066 338,873 474,939

Movements in the year:

Purchase at cost - - -

Sales proceeds (39,267) (48,112) (87,379)

Realised gains/(losses) on sales

based on historic cost (31,262) (143,705) (174,967)

Increase/(Decrease) in unrealised

gains 33,404 392,303 425,707

98,941 539,359 638,300

------------------- ------------------ -----------

Book cost at year end 207,961 643,129 851,090

Closing unrealised depreciation (109,020) (103,770) (212,790)

------------------- ------------------ -----------

Valuation at 31 December 2020 98,941 539,359 638,300

------------------- ------------------ -----------

2020 2019

GBP GBP

Realised (losses)/gains based on historical

cost (174,967) 39,164

Reversal of impairment loss on disposed asset - -

(1)

Realised gains based on carrying value at

previous balance sheet date (174,967) 39,164

Unrealised fair value movement for the year

- profit and loss (1) 425,707 103,604

Unrealised fair value movement for the year -

- other comprehensive income

Total recognised gains/(losses) on in the

year 250,740 142,768

------------ ------------

(1) Net impairment credit/(charge) recognised - -

in profit and loss

------------ ------------

There are no significant holdings (over 20%) in any of the

investee companies.

COMPANY

2020

Listed Investments Other Investments Total

(Quoted/Others)

GBP GBP GBP

Canada 28,142 - 28,142

UK 51,501 459,552 511,053

79,643 459,552 539,195

--------------------- ------------------ -------------

2019 (Restated)

Listed Investments Other Investments Total

(Quoted)

GBP GBP GBP

Canada 15,029 - 15,029

UK 94,902 258,539 353,441

109,931 258,539 368,470

--------------------- -------------------- -------------

Listed Investments Other Investments Total

(Quoted/Others)

GBP GBP GBP

Opening book cost - As restated 196,322 664,646 860,968

Opening unrealised depreciation

- As restated (86,391) (406,107) (492,498)

------------------- ------------------ ----------

Valuation at 1 January 2020

- As restated 109,931 258,539 368,470

Movements in the year:

Purchase at cost - - -

Investments written off - - -

Sales proceeds (18,572) (4,919) (23,491)

Realised gains/(losses) on sales

based on historic cost 1,604 (95,081) (93,477)

Decrease in unrealised depreciation (13,320) 301,013 287,693

79,643 459,552 539,195

------------------- ------------------ ----------

Book cost at year end 179,354 564,646 744,000

Closing unrealised depreciation (99,711) (105,094) (204,805)

Valuation at 31 December 2020 79,643 459,552 539,195

------------------- ------------------ ----------

2020 2019

GBP GBP

Realised gains based on historical cost (93,477) 39,164

Realised gains based on carrying value at previous

balance sheet date (93,477) 39,164

Unrealised fair value movement for the year

- profit and loss (1) 287,693 129,845

Unrealised fair value movement for the year - -

- other comprehensive income

Total recognised losses on investments in the

year 194,216 169,009

--------- ------------

(1) Net impairment credit/(charge) recognised - -

in profit and loss

--------- ------------

Analysis of gains/(losses) relating to the Group's Investments

The gains/(losses) on the Group's investments are analysed below. Accounting standards prohibit

the recognition of uplifts in the value of impaired assets in profit and loss.

31 December 2020 31 December 2019

Security Profit Profit and

and loss Total loss Total

GBP GBP GBP GBP

Anglo American Plc 57,650 57,650

Bezant Resources Plc 27,778 27,778 44,444 44,444

Block Energy Plc (7,813) (7,813) 57,785 57,785

Kendrick Resources PLC - - - -

Corallian Energy Ltd - - -

EFTS Copper 1,633 1,633 289 289

Galileo Resources Plc 74,942 74,942 (14,337) (14,337)

Goldquest Mining Corporation 13,750 13,750 3,670 3,670

Jubilee Metals Group Plc 103,510 103,510 17,544 17,544

Pantheon Resources Plc 8,505 8,505 157 157

Australgold (Formerly Revelo

Resources Corp) (637) (637) (641) (641)

Royal Dutch Shell Plc (26,462) (26,462) (961) (961)

Barkby Group Plc (990) (990) 3,409 3,409

Movements in parent company 194,216 194,216 169,009 169,009

---------- --------- ------------- ---------

Europa Metals Ltd (9,176) (9,176) (26,100) (26,100)

Galileo Resources Plc 28,750 28,750 (5,500) (5,500)

Jubilee Metals Group Plc 18,244 18,244 13,767 13,767

Australgold (formerly Revelo

Resources Corp) 14,081 14,081 (4,273) (4,273)

South 32 Limited (224) (224) (5,953) (5,953)

Xtract Resources Plc 4,849 4,849 1,818 1,818

---------- --------- ------------- ---------

Movements in subsidiary company 56,524 56,524 (26,241) (26,241)

---------- --------- ------------- ---------

Total movements in the Group 250,740 250,740 142,768 142,768

---------- --------- ------------- ---------

Financial instruments measured at fair value

The following table presents financial assets and liabilities

measured at fair value in the statement of financial position in

accordance with the fair value hierarchy. This hierarchy groups

financial assets and liabilities into three levels based on the

significance of inputs used in measuring the fair value of the

financial assets and liabilities. The fair value hierarchy has the

following levels:

- Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities;

- Level 2: inputs other than quoted prices included within Level

1 that are observable for the asset or liability, either directly

(i.e., as prices) or indirectly (i.e., derived from prices);

and

- Level 3: inputs for the asset or liability that are not based

on observable market data (unobserved inputs).

The level within which the financial asset or liability is

classified is determined based on the lowest level of significant

input to the fair value measurement.

The financial assets and liabilities measured at fair value in

the statement of financial position are grouped into the fair value

hierarchy as follows:

(GROUP)

31 December 2020 Level 1 Level 2 Level Total

GBP GBP 3 GBP

GBP

Assets

Investments held at fair value 608,300 - 30,000 638,300

--------- -------- -------- ---------

Total 608,300 - 30,000 638,300

31 December 2019 (Restated) Level 1 Level 2 Level Total

GBP GBP 3 GBP

GBP

Assets

Investments held at fair value 444,939 - 30,000 474,939

--------- -------- -------- ---------

444,939 - 30,000 474,939

--------- -------- -------- ---------

(COMPANY)

31 December 2020 Level 1 Level 2 Level Total

GBP GBP 3 GBP

GBP

Assets

Investments held at fair value 509,195 - 30,000 539,195

--------- -------- -------- --------------------------

Total 509,195 - 30,000 539,195

31 December 2019 (Restated) Level 1 Level 2 Level Total

GBP GBP 3 GBP

GBP

Assets

Investments held at fair value 338,470 - 30,000 368,470

--------- -------- -------- --------------------------

Total 338,470 - 30,000 368,470

There have been no significant transfers between levels in the

reporting period.

Reconciliation of Level 3 fair value measurements of financial

instruments (Group and Company)

Level 3 investments

GBP

Balance at 1 January 2019 30,000

--------------------

Total gains or (losses) in other comprehensive income -

--------------------

Purchases/(Sales) -

--------------------

Transfers in/(out) -

--------------------

Balance at 1 January 2020 30,000

--------------------

Total gains or (losses) in other comprehensive income -

--------------------

Purchases/(Sales) -

--------------------

Transfers in/(out) -

--------------------

Balance at 31 December 2020 30,000

--------------------

Measurement of fair value

The methods and valuation techniques used for the purpose of

measuring fair value are outlined in note 1 and remain unchanged

compared to the previous reporting period. The fair values of

short-term receivables, cash and short-term payables do not differ

from their carrying values due to their short maturity

profiles.

Listed / quoted securities

Equity securities held by the Group are denominated in GBP, USD,

CAD$, and AUS$ and are publicly traded on the main London Stock

Exchange, the Alternative Investment Market of the London Stock

Exchange, the Toronto Venture Exchange, the Australian Exchange and

on NEX. Fair values have been determined by reference to their

quoted bid prices at the reporting date, with the exception of

Rockrose plc, which are currently suspended and have been valued at

their last available market price prior to suspension.

8. TRADE AND OTHER RECEIVABLES

Group Group Company Company

2020 2019 2020 2019

GBP GBP GBP GBP

Other debtors 47,159 2,624 47,159 1,276

Amounts due from group undertakings - - 118,385 100,000

Prepayments 4,362 9,132 3,942 8,712

------- ------- -------- --------

51,521 11,756 169,486 109,988

------- ------- -------- --------

The amounts owed by group undertakings are interest free,

unsecured and repayable on demand.

An expected credit loss impact assessment under IFRS 9 is not

required, as the group does not hold any trade or intercompany

debtors as at the balance sheet date.

9. DEFERRED TAX LIABILITIES

The Group has tax losses carried forward in respect of excess

management charges, non-trade deficits and capital losses of

GBP2,965,014 (2019: GBP2,525,819). Unrealised losses on the Group's

financial assets are estimated at GBP779,602 (2019: GBP675,998).

The resulting deferred tax asset is GBP563,353 (2019: GBP479,906).

However, deferred tax assets are not recognised due to the

unpredictability of future profit streams arising from the disposal

of investments held by the Group. Tax losses may be carried forward

indefinitely and will only be recoverable if suitable profits arise

in the future. Deferred tax positions arising from unrealised gains

and losses on the group's financial assets will vary depending on

changes in the fair values of those assets up until the date of

disposal

10. TRADE AND OTHER PAYABLES

Group Group Company Company

2020 2019 2020 2019

GBP (Restated)GBP GBP GBP

Trade payables 41,152 5,513 9,101 494

Other creditors 73,884 2,450 73,883 2,450

Accruals 69,550 29,300 69,550 22,800

-------- -------------- -------- --------

184,586 37,263 152,534 25,744

-------- -------------- -------- --------

11. CALLED UP SHARE CAPITAL

The share capital of Tiger consists of fully paid ordinary

shares with a nominal value of 0.1p each and deferred shares with a

nominal value of 0.9p each. Ordinary shares of 0.1p are eligible to

receive dividends and the repayment of capital and represent one

vote at the shareholders' meeting of The Company. The deferred

shares carry no dividend or voting rights.

2020 2019

GBP GBP

Authorised:

Ordinary Share Capital 10,000,000 10,000,000

----------- -----------

142,831,939 (2019: 142,831,939) deferred shares of

0.9 p each 1,285,487 1,285,487

----------- -----------

2020 2019

GBP GBP

Opening Ordinary shares - 188,847,070 at 0.1p each

(2019: 188,847,070 Ordinary shares of 0.1p each) 188,847 188,847

Issued during the year

238,095,238 at issue price of GBP0.21p each (nominal 238,096 -

value 0.1p each)

12,500,000 shares at issue price of GBP0.25p each 12,500 -

(nominal value 0.1p each) - (i)

Ordinary shares in issue at 31 December 2020 439,442,308

shares of 0.1p each nominal value 439,443 188,847

----------- -----------

142,831,939 (2019: 142,831,939) deferred shares of

0.9p each 1,285,487 1,285,487

----------- -----------

1,724,930 1,474,334

----------- -----------

The Deferred shares have no income or voting rights.

Included in allotted called and fully paid share capital are

4,500,000 shares with a nominal value of GBP4,500 held by the

company in treasury.

(i) On 12 October 2020, The Company issued 12.5 million shares

of 0.1 p each at an issue price of 0.25p each share each to acquire

outstanding loans in Metrock totalling GBP31,250 - for further

details refer to note 13(B).

12. RELATED PARTY TRANSACTIONS

(1) Lion Mining Finance Limited, a company in which Colin Bird

is director and shareholder, has provided administrative and

technical services to the Company amounting to GBP60,000 plus VAT

in the year (2019 - GBP60,000). There were no amounts outstanding

at 31 December 2019 (2019- nil). The Board considers this

transaction to be on an arms' length basis.

(2) The emoluments of the Directors are disclosed in note 3.

(3) Directors' shareholdings are disclosed in the Report of the Directors.

(4) The Company currently holds 50.75% equity stake in African

Pioneer Plc ("APP"). C Bird, M H Nolan and R Samtani each also hold

shares in APP. On 7 December 2020, APP consolidated its share

capital 10:1 for existing shares. This resulted in 1,172,982 total

issued number of shares, with The Company holding 595,291 shares at

31 December 2020. See note 6 to the financial statements for

further details relating to this investment.

(5) On 19 August 2015, the Company made an investment of

GBP125,000 in Galileo Resources Plc ("Galileo"), acquiring

10,416,667 Ordinary shares of 0.1 pence each (being a 6.69% stake

in Galileo at the date of subscription). The Company sold 3,900,000

Galileo shares on 3 February 2017 for a total consideration of

GBP161,346 and held 6,516,667 shares in Galileo Resources Plc at 31

December 2020 and 31 December 2019.

(6) On 4 February 2017, African Pioneer Plc ("APP") sold its

brought forward holding of 1,500,000 Ordinary shares in Galileo

Resources Plc realising a profit of GBP94,285. APP bought a further

2,500,000 Galileo shares for GBP50,000 in September 2017. Colin

Bird is a Director and the Executive Chairman of Galileo and did

not participate in the decision-making process for the Galileo

investment decisions.

13. POST-REPORTING DATE EVENTS

AGREEMENTS ENTERED INTO DURING THE PERIOD WHICH HAVE NOT YET

CLOSED

A. Proposed Listing of African Pioneer Plc:

(I) Purchase of Namibian exploration assets

On 29 October 2020, African Pioneer Plc entered into a sale and

purchase agreement to acquire a 100 per cent. interest in Zamcu

Exploration Pty Ltd ("Zamcu"), which via its subsidiaries Manmar

Investments One Hundred & Twenty Nine (Pty) Limited ("Manmar

129") and Manmar Investments One Hundred & Thirty Six (Pty)

Limited ("Manmar 136") holds a 70 per cent. interest in two

Namibian Prospecting Licenses comprising of EPL 5772 (Ongombo) and

EPL 6011 (Ongeama). Both licences are located within the Matchless

amphibolite Belt of central Namibia.

These acquisitions are conditional inter alia on the Company's

shares being admitted on the Official List by way of a Standard

Listing.

The consideration for these acquisitions is to be satisfied by

the issue on listing of:

(i) 10,000,000 APP Shares to Zamcu shareholders.

(ii) A total of approximately 4,742,857 APP Shares to Manmar 129

and Manmar 136 shareholders.

(iii) Approximately 4,900,000 APP Shares to Avanti Resources Pty

Ltd as trustee for the Marlow Family Fund pursuant to an

introduction mandate agreement.

The total consideration for the acquisition of the above

Namibian Prospecting Licences including the sum of AUS$ 200,000

which was paid by the company to Manmar 129 and Manmar 136

shareholders on 29 January 2021 and a further amount of AU$64,000

on 9 April 2021 will amount to GBP835,148, at specified exchange

rates, assuming a valuation of 3.5 pence per APP ordinary share on

listing.

(II) Purchase of Zambian exploration assets

On 25 November 2020, African Pioneer Plc entered into a sale and

purchase agreement to acquire an 80 per cent. interest in African

Pioneer Zambia Limited which holds a 100 per cent. interest in four

Zambian Prospecting Licenses (27771 HQ-LEL,

Proposed Listing of African Pioneer Plc (continued):

27770 HQ-LEL, 27768 HQ-LEL and 27767 HQ-LEL) located in the

Central African Copperbelt and one Prospecting Licence (27769

HQ-LEL) located in the Zambezi Belt.

The above acquisitions are conditional inter alia on the

Company's shares being admitted on the Official List by way of

Standard Listing.

The total consideration for the acquisition of the Zambian

Prospecting Licences will be satisfied by the issue of 55,000,000

new APP ordinary shares and will amount to GBP1,925,000 assuming a

price of 3.5 pence per APP ordinary share on listing.

(III) Purchase of Botswana Prospecting Licences

On 29 October 2020 African Pioneer Plc entered into a sale and

purchase agreement to acquire a 100 per cent. interest of Resource

Capital Partners Pty Ltd which holds a 100 per cent. interest in

six Prospecting Licences (PLs 96, 98 and 100, 101, 102 and

103/2020) located in the Kalahari Copperbelt and a further two

Prospecting Licences (PLs 97 and 99/2020) located in the Limpopo

Mobile Belt in Botswana.

This acquisition is conditional inter alia on the Company's

shares being admitted on the Official List by way of Standard

Listing.

The total consideration for the acquisition of the Botswanan

Prospecting Licences will be satisfied by the issue of 10,000,000

new APP ordinary shares and will amount to GBP350,000 assuming a

price of 3.5 pence per APP ordinary share on listing.

Exclusive Mandate with Metrock Resources Ltd

On 12 October 2020, The Company entered into an exclusive

advisory and investment agreement ("Mandate") with Metrock

Resources Ltd. ("Metrock") to oversee the listing of a number of

mineral exploration licences in Southern Botswana, comprising the

Kanye Manganese project ("Kanye").

Under this agreement, the Company agreed to issue 25 million new

Ordinary Shares in two tranches of 12.5 million shares to acquire

loans outstanding in Metrock totalling GBP62,500. The Company

issued the first tranche of 12.5 million Ordinary shares of 0.1 p

each at an issue price of 0.25p per share to acquire outstanding

loans in Metrock totalling GBP31,250 shortly after executing the

Mandate with Metrock. It was agreed that the 2(nd) tranche of 12.5M

shares would be issued on completion of the IPO of the Manganese

assets to acquire a further loan outstanding in Metrock amounting

to GBP31,250.

The Company and Metrock subsequently agreed not to proceed with

an IPO of the Manganese assets and to amend the terms of the

Mandate to facilitate the vending of the Kanye Manganese project to

AIM quoted Bezant Resource Plc ("Bezant"). As part of the revised

terms for the Mandate, the Company received the following on

completion of the sale of the Kanye project to Bezant on 12

February 2021.

(i) 28,314,815 Bezant Shares ("New Shares") as settlement of

outstanding loans of GBP46,250 (including the GBP31,250 of loans

acquired through the issue of 12.5M Ordinary Shares referred to

above) which The Company had made to Metrock plus a fee of

GBP30,200 fee due from Metrock for facilitating the sale of the

sale of the Kanye Manganese project.

(ii)The Company was granted a Net Smelter Return ("NSR") of 2%

on the Kanye project which may be purchased from the Company by

Metrock for a payment of GBP1 million or on a partial basis at a

buy-out rate of GBP250k per 0.5% of the NSR.

As part of the revised terms agreed in the amended Mandate, it

was agreed that The Company would no longer participate in a 2(nd)

tranche investment of GBP31,250 in outstanding Metrock loans.

AGREEMENTS ENTERED INTO POST PERIOD WHICH HAVE NOT YET

CLOSED

B. Conditional sale of Botswana Prospecting Licences

On 12 March 2021 African Pioneer Plc entered into a conditional

licence sale agreement with Australian Stock exchange listed

Sandfire (the "Conditional Botswana Licence Sale Agreement") which

provides for the following:

a) The Sale of licences: the sale to Sandfire of the 8 Botswana

licences (the "Botswana Licences") being acquired at Standard

Listing by the acquisition of Resources Capital Partners (Pty)

Limited for an aggregate consideration of US$1M (being a Guarantee

Fee of US$250,000 and a Licence Purchase Price of US$750,000) of

which US$0.5M will be paid in cash (the "Cash Consideration") and

US$0.5M by the issue by Sandfire of its ordinary shares to APP (the

"Consideration Shares") at an issue price per share based on the 10

day volume weighted average price (VWAP) of the Sandfire share

price as at the date before the signing of the Sandfire Conditional

Botswana Licence Sale Agreement;

b) An Exploration Commitment: Sandfire to spend US$1M on the

Licences (the "Exploration Commitment") within two years of

settlement (the "Exploration Period") and if the US$1M is not spent

any shortfall will be paid to African Pioneer;

c) A Success Payment: a success payment to be paid to APP for

the first ore reserve reported under The Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves (JORC) 2012 edition on the Licences which exceeds 200,000

tonnes of contained copper (the "First Ore Reserve") in the range

of US$10M to US$80M depending on the copper ore in the First Ore

Reserve (the "Success Payment"). Sandfire have the option to elect

to settle the Success Payment, if due, by the issue of Sandfire

shares based on the 10-day Volume Weighted Average Price (VWAP) of

Sandfire shares at the time of announcing an Ore Reserve that

triggers the Success Payment. Given the limited exploration

conducted on the Botswana licenses to date and the many years that

it could take to establish and ore reserve that there can be no

guarantee that any such Success Payment will be forthcoming;

d) Conditions Precedents: The conditions precedent to be

completed unless indicated otherwise by the long stop date of 31

July 2021 are as follows:

i) The parties having executed the Convertible Loan Note Share

Subscription Agreement as detailed in (D) below;

ii) The Company providing, at least 5 Business Days prior to the Settlement Date:

(1) ministerial consent for the transfer of the Licences;

(2) all ASX and LSE regulatory approvals;

(3) bank details for the payment of the Licence Purchase Price and the Guarantee Fee;

(4) approval of the acquisition of the Licences by the

Competition Authority of Botswana (or confirmation from such

authority or from either party's Botswana legal counsel that such

approval is not required); and

(5) duly executed transfer applications for the Licences in the

form required by the Mining Act or the Department under which a

100% interest in the Licences may be transferred to the

Purchaser.

iii) the Standard Listing having occurred by 30 June 2021. If

Standard Listing has not occurred by 30 June 2021 then the initial

long stop date of 31 July 2021 shall automatically be extended to

31 December 2021 (the "Long Stop Date") and the Cash Consideration

shall not be payable.

e) Completion and Standard Listing not occurring by Long Stop

Date. If both I) completion of the Conditional Botswana Licence

Sale Agreement and ii) Standard Listing have not occurred, by the

Long Stop Date then APP will be due to pay Sandfire US$500,000 by

way of a cancellation fee.

Rationale for Conditional Botswana Licence Sale Agreement: APP

has seen this as an opportunity for Sandfire to take over ownership

and responsibility for the exploration stage of the Botswanan

Projects whilst allowing APP to share in the potential upside

should the exploration ultimately be successful in establishing a

mineable reserve. Sandfire has the in-country infrastructure and

technical expertise and financial resources to accelerate the rate

of expenditure on the Botswanan assets.

AGREEMENTS ENTERED INTO POST PERIOD WHICH HAVE NOT YET

CLOSED

C. US$500,000 Investment by Sandfire Resources Limited into African Pioneer Plc

On 11 March 2021, African Pioneer Plc entered into a Convertible

Loan Note Share Subscription Agreement (the "Sandfire Investment

Agreement") with Sandfire. Following this agreement Sandfire has

now subscribed for US$500,000 interest free unsecured loan notes

("Sandfire Investment Notes") which will automatically be

convertible upon Standard Listing into APP ordinary shares

constituting 15% of the Company's enlarged share capital.

Pursuant to the Sandfire Investment Agreement, upon conversion,

Sandfire has the right to nominate a director to the Board of the

Company whilst their shareholding remains at or above 15% of the

issued share capital of African Pioneer. If the Standard Listing

has not occurred by 30 June 2021, then the Sandfire Investment

Notes will be automatically and immediately cancelled and the

US$500,000 invested by Sandfire will not be repayable by the

Company