Tungsten West PLC Convertible Loan Note Update

14 January 2025 - 12:20AM

RNS Regulatory News

RNS Number : 1228T

Tungsten West PLC

13 January 2025

13 January 2025

Tungsten West

Plc

("Tungsten West", the

"Company" or the "Group")

Convertible Loan Note

Update

Tungsten West (LON:TUN), the mining

company focused on restarting production at the Hemerdon tungsten

and tin mine ("Hemerdon" or

the "Project") in Devon,

UK, is pleased to announce that it has conditionally raised £2.8

million by way of adding an additional tranche ("Tranche G") to the existing 2023

Convertible Loan Notes (as amended and restated on 15 October 2024)

("CLNs").

The CLN has been further amended and

restated ("Amended CLN") to

include an additional Tranche G on substantially the same terms as

the Tranches C, D, E, and F of the CLNs, as announced 19 May 2023,

18 December 2023, 28 March 2024, 23 July and 17 October 2024.

Tranche G has been subscribed for by certain existing CLN holders

and comprises two parts: namely, Part A for the sum of £1.9 million

and Part B for the sum of £0.9 million. The proceeds of Part

A are expected to be received on or around 14 January 2025 by the

Company and the receipt of the proceeds of Part B is subject to

certain conditions precedent being satisfied (or waived by the

Super-Majority Purchasers (as defined in the Amended CLN)).

These conditions precedent primarily relate to

project economics and the preparation for a proposed major capital

raise expected from the beginning of Q2 2025 which may be used to

form component parts of an updated feasibility study. The maturity

date of the notes has also been extended to 31 December

2025.

The proceeds of Tranche G will be

used to continue work on the studies required to build a robust

plan and economic model, which the Company expects to complete by

the end of Q1 2025, together with general working capital purposes.

It is currently expected that this will lead to a financing round

in H2 2025 which will enable the Company to recommence production

of tungsten and tin in H2 2026.

This announcement contains inside

information for the purposes of Article 7 of Regulation 596/2014 as

amended by the Market Abuse (Amendment) (EU Exit) Regulations

2019.

Ends

For

further information, please contact:

Enquiries

|

Tungsten West

Alistair Stobie

Tel: +44 (0) 1752 278500

|

Strand Hanson

(Nominated Adviser and Financial

Adviser)

James Spinney / James Dance /

Abigail Wennington

Tel: +44 (0) 207 409 3494

|

|

BlytheRay

(Financial PR)

Tim Blythe / Megan Ray

Tel: +44(0) 20 7138 3204

Email: tungstenwest@blytheray.com

Hannam & Partners

(Broker)

Andrew Chubb / Matt Hasson / Jay

Ashfield

Tel: +44 (0)20 7907 8500

|

|

Follow us on X @TungstenWest

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

CONBXGDBIBBDGUX

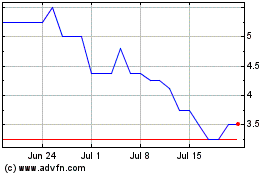

Tungsten West (LSE:TUN)

Historical Stock Chart

From Dec 2024 to Jan 2025

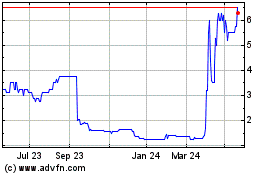

Tungsten West (LSE:TUN)

Historical Stock Chart

From Jan 2024 to Jan 2025