TIDMVRCI

RNS Number : 8277A

Verici Dx PLC

24 January 2024

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, NEW ZEALAND, CANADA, THE REPUBLIC OF

SOUTH AFRICA OR JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH

RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL. PLEASE SEE

THE IMPORTANT NOTICES AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION,

OFFER OR ADVICE TO ANY PERSON TO PURCHASE AND/OR SUBSCRIBE FOR,

OTHERWISE ACQUIRE OR DISPOSE OF ANY SECURITIES IN VERICI DX PLC OR

ANY OTHER ENTITY IN ANY JURISDICTION. NEITHER THIS ANNOUNCEMENT NOR

THE FACT OF ITS DISTRIBUTION, SHALL FORM THE BASIS OF, OR BE RELIED

ON IN CONNECTION WITH ANY INVESTMENT DECISION IN RESPECT OF VERICI

DX PLC OR ANY OTHER ENTITY.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION RELATING TO VERICI

DX PLC AND ITS SECURITIES FOR THE PURPOSES OF ARTICLE 7 OF THE

MARKET ABUSE REGULATION (596/2014/EU) AS IT FORMS PART OF THE

DOMESTIC LAW OF THE UNITED KINGDOM BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018 ("EUWA") AND AS MODIFIED BY OR UNDER THE EUWA

OR OTHER DOMESTIC LAW, INCLUDING BUT NOT LIMITED TO THE MARKET

ABUSE (AMMENT) (EU EXIT) REGULATIONS (SI 2019/310) ("UK MAR"). IN

ADDITION, MARKET SOUNDINGS (AS DEFINED IN UK MAR) WERE TAKEN IN

RESPECT OF CERTAIN OF THE MATTERS CONTAINED WITHIN THIS

ANNOUNCEMENT, WITH THE RESULT THAT CERTAIN PERSONS BECAME AWARE OF

INSIDE INFORMATION (AS DEFINED UNDER UK MAR), AS PERMITTED BY UK

MAR. THIS INSIDE INFORMATION IS SET OUT IN THIS ANNOUNCEMENT. UPON

THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION

SERVICE, THOSE PERSONS THAT RECEIVED INSIDE INFORMATION IN A MARKET

SOUNDING ARE NO LONGER IN POSSESSION OF SUCH INSIDE INFORMATION

RELATING TO VERICI DX PLC AND ITS SECURITIES, WHICH IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

Capitalised terms in this announcement have the same meaning as

in the announcement issued at 07.00 a.m. today relating to the

launch of the Fundraising (RNS Number: 6987A) unless otherwise

indicated

Verici Dx plc

("Verici Dx" or the "Company")

Result of Placing

Verici Dx plc (AIM: VRCI), a developer of advanced clinical

diagnostics for organ transplant, is pleased to announce that

further to the Company's announcements earlier today, the Company

has successfully concluded the Bookbuild for its Placing to raise

gross proceeds of approximately GBP6.22 million ($7.89 million)

(before expenses), through the placing of 69,111,111 Placing Shares

with existing and new investors at the Issue Price of 9.0 pence.

86.87 per cent. of the Placing Shares are intended to be EIS/VCT

qualifying (the "EIS/VCT Shares").

The 69,111,111 Placing Shares represent approximately 40.58 per

cent. of the existing issued share capital of the Company.

Singer Capital Markets is acting as placing agent for and on

behalf of the Company in respect of the Placing.

The Company has existing authorities to allot Ordinary Shares

for cash and disapply pre-emption rights under section 551 and

section 571 of the Act, which the Directors were granted at the

Annual General Meeting of the Company held on 29 June 2023

("Existing Authorities"). The Existing Authorities are insufficient

to allow the total number of new Ordinary Shares to be issued

pursuant to the Fundraising and Admission to proceed. Accordingly,

the Fundraising is subject to sufficient further authority to issue

and allot new Ordinary Shares on a non-pre-emptive basis being

granted by Shareholders at the General Meeting and is therefore

wholly conditional, inter alia, on the passing of the Resolutions

by Shareholders at the General Meeting proposed to be held by the

Company at the offices of Shoosmiths London at No. 1 Bow

Churchyard, London, EC4M 9DQ, at 12.00 p.m. on 19 February 2024.

The further authority to issue and allot new Ordinary Shares to be

obtained at the General Meeting is in addition to the Existing

Authorities. The Existing Authorities will not be used by the

Company for the purposes of issuing the New Ordinary Shares

pursuant to the Fundraising and consequently, the Company will

retain those Existing Authorities until its next annual general

meeting when they are due to expire.

Admission

Subject to the passing of the Resolutions, application will be

made to the London Stock Exchange for admission of the Placing

Shares. It is expected that admission of the Placing Shares (along

with any other New Ordinary Shares to be issued in connection with

the proposed Retail Offer) will become effective and that dealings

in all of the New Ordinary Shares to be issued pursuant to the

Fundraising will commence at 8.00 a.m. on 20 February 2024

("Admission").

Circular

A circular containing, inter alia , further details of the

Fundraising and a notice convening the General Meeting in order to

pass the Resolutions (the "Circular"), is expected to be despatched

to Shareholders in the coming days and the Circular, once

published, will be made available on the Company's website at

www.vericidx.com/investors/documents/ and its availability will be

notified by way of a further announcement.

Retail Offer

As previously indicated, a Retail Offer is proposed to be

launched via the BookBuild platform to provide existing retail

Shareholders with an opportunity to take part in the Fundraising at

the same Issue Price as the Placing. Further details about the

Retail Offer will be provided by the Company by separate

announcement in due course. The Retail Offer will close prior to

the deadline for receipt of proxy voting forms for use in

connection with the business of the General Meeting, and admission

of and trading in the Retail Offer Shares is expected to take place

as described above.

Sara Barrington, CEO of Verici Dx, commented:

"Verici Dx is grateful to its existing shareholders for their

continued support and delighted to welcome those who will be new to

the register. Following completion of the Fundraising, Verici Dx

will be better capitalised to advance multiple growth initiatives

in parallel, with the potential to build greater value in the

Company and more quickly than would otherwise be the case. Verici

Dx aims to become fully embedded in the transplant ecosystem to

assist our customers to improve patients' lives throughout the

transplant journey and this fundraise is a key step in achieving

this goal ."

Related Party Transactions - AIM Rule 13 Disclosures

Further to the announcement released by the Company at 7.00 a.m.

on 24 January 2024 (RNS Number: 6987A), Christopher Mills / Harwood

Capital LLP(1) ("Harwood Capital" ) has confirmed its conditional

participation in the Placing and will invest in 3,333,333 Placing

Shares for consideration of GBP300,000 at the Issue Price.

Immediately prior to this announcement, Harwood Capital owned

30,437,500 Ordinary Shares, representing approximately 17.87 per

cent. of the Company's existing issued ordinary share capital. As a

Substantial Shareholder (as defined in the AIM Rules), the

participation of Harwood Capital in the Placing constitutes a

related party transaction pursuant to Rule 13 of the AIM Rules.

Additionally, the Chairman of Verici Dx, Julian Baines, has

conditionally participated in the Placing for, 277,777 Ordinary

Shares at the Issue Price, raising gross proceeds of approximately

GBP25,000.

The independent Directors, (being the Directors other than

Julian Baines), having consulted with Singer Capital Markets as the

Company's nominated adviser, consider that the participations by

Harwood Capital and Julian Baines in the Placing are each fair and

reasonable in so far as shareholders are concerned.

Director Number of Number of Number of Percentage

Ordinary Shares Placing Shares Ordinary Shares of issued

held as at subscribed held on Admission ordinary share

the date of for in the capital as

this Announcement Placing enlarged by

the Placing(2)

Julian Baines 1,351,713 277,777 1,629,490 0.68%

------------------- ---------------- ------------------- ----------------

1 Christopher Mills is the controlling shareholder and CEO of

Harwood Capital LLP and its associate Harwood Capital Management

(Gibraltar) Ltd, which act as administrator or investment manager

to two investment trusts on whose boards Christopher Mills serves.

The interests of these investment trusts are therefore aggregated

with those of Christopher Mills (which include those of his

immediate family).

2 This assumes the issue of the 69,111,111 Placing Shares only

and does take into account any new issuance under the Retail

Offer

Admission

Application will be made to the London Stock Exchange for

60,038,866 EIS/VCT Shares and for at least 9,072,245 Non-EIS/VCT

Placing Shares to be admitted to trading on AIM. The Placing

Shares, when issued, will be fully paid and will rank pari passu in

all respects with each other and with the existing Ordinary Shares

of the Company, including, without limitation, the right to receive

all dividends and other distributions declared, made or paid after

the date of issue.

It is expected that that Admission of the Placing Shares will

become effective at 8.00 a.m. on 20 February 2024.

Total Voting Rights

A further announcement will be made in relation to total voting

rights in the Company's ordinary share capital following completion

of the Retail Offer, when the total number of New Ordinary Shares

to be issued pursuant to the Placing and the Retail Offer will be

known.

This Announcement should be read in its entirety. In particular,

you should read and understand the information provided in the

"Important Notices" section of this Announcement.

Enquiries:

Verici Dx www.v ericidx .com

Sara Barrington, CEO Via IR-Connect

Julian Baines, Chairman

Singer Capital Markets (Nominated Tel: 020 7496 3000

Adviser & Broker)

Aubrey Powell / Sam Butcher / Jalini

Kalaravy

IR-Connect www.ir-connect.co.uk

Lorraine Rees investors@vericidx.com

About Verici Dx plc www.vericidx.com

Verici is a developer of a complementary suite of leading-edge

tests forming a kidney transplant platform for personalised patient

and organ response risk to assist clinicians in medical management

for improved patient outcomes. The underlying technology is based

upon artificial intelligence assisted transcriptomic analysis to

provide RNA signatures focused upon the immune response and other

biological pathway signals critical for transplant prognosis of

risk of injury, rejection and graft failure from pre-transplant to

late stage. The Company also has a mission to accelerate the pace

of innovation by research using the fully characterised data from

the underlying technology, including through collaboration with

medical device, biopharmaceutical and data science partners.

The foundational research was driven by a deep understanding of

cell-mediated immunity and is enabled by access to expertly curated

collaborative studies in highly informative cohorts in kidney

transplant.

IMPORTANT NOTICES

This Announcement and the information contained herein is for

information purposes only and is not for release, publication or

distribution, directly or indirectly, in whole or in part, in or

into or from the United States, Australia, Canada, Japan, New

Zealand, the Republic of South Africa, or any other jurisdiction

where to do so might constitute a violation of the relevant laws or

regulations of such jurisdiction (the "Placing Restricted

Jurisdictions"). The New Ordinary Shares have not been and will not

be registered under the United States Securities Act of 1933 (the

"Securities Act") or under the securities laws of any state or

other jurisdiction of the United States and may not be ordered,

sold, or transferred, directly or indirectly, in or into the United

States absent registration under the Securities Act or an available

exemption from or in a transaction not subject to the registration

requirements of the Securities Act and, in each case, in compliance

with the securities law of any state or any other jurisdiction of

the United States. No public offering of the New Ordinary Shares is

being made in the United States. Persons receiving this

Announcement (including custodians, nominees and trustees) must not

forward, distribute, mail or otherwise transmit it in or into the

United States or use the United States mails, directly or

indirectly, in connection with the Fundraising. This Announcement

does not constitute or form part of an order to sell or issue or a

solicitation of an order to buy, subscribe for or otherwise acquire

any securities in any jurisdiction including, without limitation,

the Placing Restricted Jurisdictions or any other jurisdiction in

which such order, subscription or acquisition or solicitation of

such order, subscription or acquisition would be unlawful. This

Announcement and the information contained in it is not for

publication or distribution, directly or indirectly, to persons in

a Placing Restricted Jurisdiction unless permitted pursuant to an

exemption under the relevant local law or regulation in any such

jurisdiction.

No action has been taken by the Company, Singer Capital Markets

or any of their respective directors, officers, partners, agents,

employees or affiliates that would permit an offer of the New

Ordinary Shares or possession or distribution of this Announcement

or any other publicity material relating to such New Ordinary

Shares in any jurisdiction where action for that purpose is

required.

Persons receiving this Announcement are required to inform

themselves about and to observe any restrictions contained in this

Announcement. Persons (including, without limitation, nominees and

trustees) who have a contractual or other legal obligation to

forward a copy of this Announcement should seek appropriate advice

before taking any action.

This Announcement is not being distributed by, nor has it been

approved for the purposes of section 21 of FSMA by, a person

authorised under FSMA. This Announcement is being distributed and

communicated to persons in the United Kingdom only in circumstances

in which section 21(1) of FSMA does not apply.

The information contained in this Announcement is for background

purposes only and does not purport to be full or complete. No

reliance may be placed for any purpose on the information contained

in this Announcement or its accuracy, fairness or completeness.

Any indication in this Announcement of the price at which the

Company's shares have been bought or sold in the past cannot be

relied upon as a guide to future performance. Persons needing

advice should consult an independent financial adviser. No

statement in this Announcement is intended to be a profit forecast

and no statement in this Announcement should be interpreted to mean

that earnings per share of the Company for the current or future

financial years would necessarily match or exceed the historical

published earnings per share of the Company.

Singer Capital Markets, which is authorised and regulated in the

United Kingdom by the FCA, is acting as broker and bookrunner

exclusively to the Company and to no-one else in connection with

the Placing and Admission and will not be responsible to anyone

(including any Placees) other than the Company for providing the

protections afforded to its clients, nor for providing advice in

relation to the Placing or Admission or any other matters referred

to in this Announcement.

Singer Capital Markets Advisory LLP, which is authorised and

regulated in the United Kingdom, is acting as nominated adviser to

the Company for the purposes of the AIM Rules in connection with

the Placing and Admission and to no-one else in connection with the

Placing and Admission and will not be responsible to any person

other than the Company for providing the protections afforded to

its clients, nor for providing advice in relation to the Placing or

Admission or any other matters referred to in this Announcement.

Singer Capital Markets Advisory LLP's responsibilities as the

Company's nominated adviser under the AIM Rules and the AIM Rules

for Nominated Advisers are owed solely to the London Stock Exchange

and are not owed to the Company, any director of the Company or to

any other person in respect of his or her decision to acquire

shares in the capital of the Company in reliance on any part of

this Announcement or otherwise .

This Announcement has been issued by and is the sole

responsibility of the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by or on

behalf of the Company (except to the extent imposed by law or

regulations), Singer Capital Markets or by their affiliates or

their respective agents, directors, officers and employees as, or

in relation, to the contents of this Announcement, including its

accuracy, completeness or verification or for any other statement

made or purported to be made by any of them, or on their behalf,

the Company or any other person in connection with the Company, the

Fundraising or Admission or for any other written or oral

information made available to or publicly available to any

interested party or its advisers, and any liability therefore is

expressly disclaimed. Singer Capital Markets and its affiliates and

agents disclaims to the fullest extent permitted by law all and any

responsibility or liability whatsoever, whether arising in tort,

contract or otherwise, which it might otherwise have in respect of

this Announcement or any such statement.

The New Ordinary Shares will not be admitted to trading on any

stock exchange other than to trading on AIM.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this Announcement.

Cautionary statements

This Announcement may contain and the Company may make verbal

statements containing "forward-looking statements" with respect to

certain of the Company's plans and its current goals and

expectations relating to its future financial condition,

performance, strategic initiatives, objectives and results.

Forward-looking statements sometimes use words such as "aim",

"anticipate", "target", "expect", "estimate", "intend", "plan",

"goal", "believe", "seek", "may", "could", "outlook" or other words

of similar meaning. By their nature, all forward-looking statements

involve risk and uncertainty because they relate to future events

and circumstances which are beyond the control of the Company.

There are a number of factors that could cause actual results or

developments to differ materially from those expressed or implied

by these forward-looking statements and forecasts. As a result, the

actual future financial condition, performance and results of the

Company may differ materially from the plans, goals and

expectations set forth in any forward-looking statements. No

representation or warranty is made as to the achievement or

reasonableness of, and no reliance should be placed on, such

forward-looking statements. Any forward-looking statements made in

this Announcement by or on behalf of the Company speak only as of

the date they are made. These forward-looking statements reflect

the Company's judgement at the date of this Announcement and the

information contained in this Announcement is subject to change

without notice and except as required

by applicable law or regulation (including to meet the

requirements of the AIM Rules, MAR, the Prospectus Regulation

and/or FSMA), the Company, its directors, Singer Capital Markets,

their respective affiliates and any person acting on its or their

behalf each expressly disclaims any obligation or undertaking to

publish any updates, supplements or revisions to any

forward-looking statements contained in this Announcement to

reflect any changes in the Company's expectations with regard

thereto or any changes in events, conditions or circumstances on

which any such statements are based , except where required to do

so under applicable law or regulation or by the FCA or the London

Stock Exchange. Such forward-looking statements involve risks and

uncertainties that could significantly affect expected results and

are based on certain key assumptions. Many factors could cause

actual results, performance or achievements to differ materially

from those projected or implied in any forward-looking statements.

The important factors that could cause the Company's actual

results, performance or achievements to differ materially from

those in the forward-looking statements include, among others,

economic and business cycles, the terms and conditions of the

Company's financing arrangements, foreign currency rate

fluctuations, competition in the Company's principal markets,

acquisitions or disposals of businesses or assets and trends in the

Company's principal industries. Statements contained in this

Announcement regarding past trends or activities should not be

taken as representation that such trends or activities will

continue in the future. No person should place undue reliance on

forward-looking statements, which speak only as of the date of this

Announcement.

This Announcement does not identify or suggest, or purport to

identify or suggest, the risks (direct or indirect) that may be

associated with an investment in the Placing Shares. Any investment

decisions to buy Placing Shares in the Placing must be made solely

on the basis of Publicly Available Information, which has not been

independently verified by Singer Capital Markets.

This Announcement does not constitute a recommendation

concerning any investor's investment decision with respect to the

Fundraising. The price of shares and any income expected from them

may go down as well as up and investors may not get back the full

amount invested upon disposal of the shares. Past performance is no

guide to future performance. The contents of this Announcement are

not to be construed as legal, business, financial or tax advice.

Each investor or prospective investor should consult his, her or

its own legal adviser, business adviser, financial adviser or tax

adviser for legal, financial, business or tax advice.

In connection with the Placing, Singer Capital Markets and its

respective partners, directors, officers, employees, advisers,

consultants, affiliates or agents may take up a portion of the

shares of the Company in the Placing in a principal position and in

that capacity may retain, purchase or sell for its own account such

shares and other securities of the Company or related investments

and may offer or sell such shares, securities or other investments

otherwise than in connection with the Placing. Accordingly,

references in this Announcement to Placing Shares being issued,

offered or placed should be read as including any issue, offering

or placement of such shares in the Company to Singer Capital

Markets and any of its respective partners, directors, officers,

employees, advisers, consultants, affiliates or agents as, acting

in such capacity. In addition, Singer Capital Markets and any of

its respective partners, directors, officers, employees, advisers,

consultants, affiliates or agents may enter into financing

arrangements (including swaps, warrants or contracts for

difference) with investors in connection with which Singer Capital

Markets and any of its respective partners, directors, officers,

employees, advisers, consultants, affiliates or agents may from

time to time acquire, hold or dispose of such securities of the

Company, including the Placing Shares. Neither Singer Capital

Markets nor any of its respective partners, directors, officers,

employees, advisers, consultants, affiliates or agents intends to

disclose the extent of any such investment or transactions

otherwise than in accordance with any legal or regulatory

obligation to do so.

This Announcement has been prepared for the purposes of

complying with applicable law and regulation in the United Kingdom

and the information disclosed may not be the same as that which

would have been disclosed if this Announcement had been prepared in

accordance with the laws and regulations of any jurisdiction

outside the United Kingdom.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIUSRWRSBUAUAR

(END) Dow Jones Newswires

January 24, 2024 13:11 ET (18:11 GMT)

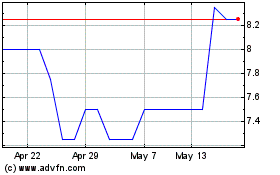

Verici Dx (LSE:VRCI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Verici Dx (LSE:VRCI)

Historical Stock Chart

From Feb 2024 to Feb 2025