We could not find any results for:

Make sure your spelling is correct or try broadening your search.

Whereas there are thousands of securities on the stock market, in the Forex market most trading takes place in only a few currencies; the U.S. Dollar ($), European Currency Unit (€), Japanese Yen (¥), British Pound Sterling (£), Swiss Franc (Sf), Canadian Dollar (Can$), and to a lesser extent, the Australian and New Zealand Dollars. These major currencies are most often traded because they represent countries with esteemed central banks, stable governments, and relatively low inflation rates.

Currencies are also always traded in pairs, such as USD/JPY (Dollar/Yen) at floating exchange rates.

The foreign exchange market operates 24 hours a day, and, unlike the stock market, has no official openings or closings. It moves in response to geopolitical events, press releases from key central banks, and reports on the economy from government statistical bureaus, among many other factors. When traders are inactive in one part of the world due to nightfall, there are traders elsewhere who are actively engaging in trades as it is daytime in their locations.

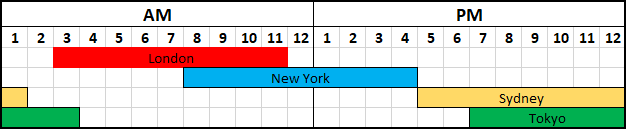

The daily session “ends” at 5PM EST, but the market does not actually close. The Forex market only closes on Friday at 4PM EST for the weekend, and re-opens at 5 PM EST on Sunday. Each day, trading begins in Sydney, Australia, and progresses to the next major financial center (Tokyo, London, New York), as the business hours in that city’s time zone begin.

Trading volumes in a given region are always highest during its primary business hours, when traders at financial institutions are busy filling and placing orders. The most active times, meaning the times of most liquidity and movement in the markets, is the London open (3 AM EST), and the overlap between London/Euro close and New York’s open (8-11 AM EST).

The hours below correspond to someone living in the EST time zone.

Below is a figure showing business hours in the various regions, oriented for someone in the EST time zone. In this figure you can see the overlap between the European/London session and the New York session, between 8 am and 11 am EST. The currency markets experience the highest volatility and volume during that overlap, which also coincides with the release of important US economic figures.

It’s important to note that forex trading carries a high level of risk due to the potential for significant leverage and market volatility. Traders should have a good understanding of the market, risk management techniques, and a solid trading strategy before participating in forex trading.

The information provided in this article is for informational purposes only and should not be construed as financial, investment, or professional advice. The views expressed are those of the author and do not necessarily reflect the opinions or recommendations of any organizations or individuals mentioned. Always consult with a qualified financial advisor or other professionals before making any financial decisions. The author and publisher are not responsible for any actions taken based on the content provided.

.png)

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions