We could not find any results for:

Make sure your spelling is correct or try broadening your search.

One should consider the risk involved in trading on the forex market. The trader is free to decide whether to take a conservative or a risk-taking approach in making trades. Conservative trading means placing fewer trades over longer periods, with smaller lot sizes, strict risk management, and modest profit targets.

One may use limit and stop orders to decrease the involved risk in trading. When placing a market order, many experienced traders already know the levels at which they will want to exit the trade. The 24 hour nature of the Forex market makes it difficult for a trader to make timely trading decisions, since large market moves may happen while he or she is away. Limit and stop orders automatically close out open positions (or open new ones) when price reaches a certain level.

Limit orders are designed to take gains on a position by closing it out at a predetermined price. For a long position, a limit order is placed above the current price. If a trader holds a short position, then a limit order will be placed below the current price.

A stop order may be used to minimize losses. For a long position, a stop order is placed below the current price. If a trader holds a short position, then a stop order will be placed above the current price. Also known as a “stop-loss order”, its purpose is to close out a position in which the market is moving against you, limiting your losses on a trade.

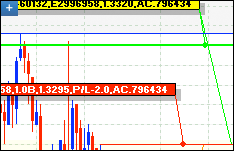

Example: Euro vs US Dollar

Let’s look at the figure above to examine a position that has both a limit order and a stop order attached to it. The pair being observed here is the EUR/USD. The position is a Buy, or Euro Long.

The limit order is placed at 1.3320 in case the pair moves upward and would close out the trade at a profit. The stop order is located at 1.3270 in case the trade moves against the direction of the position, and would close out the position at a loss. Closing the position stops any further losses if the price continued to head downwards.

It’s important to note that forex trading carries a high level of risk due to the potential for significant leverage and market volatility. Traders should have a good understanding of the market, risk management techniques, and a solid trading strategy before participating in forex trading.

.png)

Support: +44 (0) 203 8794 460 | support@advfn.com

By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's Terms & Conditions