To know before trading cryptocurrencies?

Bitcoin was the first ever cryptocurrency when it was released in 2009 and with only one coin available there were no other cryptocurrencies available to exchange with. It was not until 2011 when more cryptocurrencies Litecoin, Namecoin and Swiftcoin were created that people started trading them. For people to trade, they need to use a cryptocurrency physical exchange. This is so buyers and sellers can be matched. For example, if you are holding Bitcoin and want to sell it for Litecoin the exchange will match you with an Ethereum seller to trade with for a cost normally of 0.02 fee upwards but this can vary depending on the exchange that you use.

How to trade Cryptocurrencies?

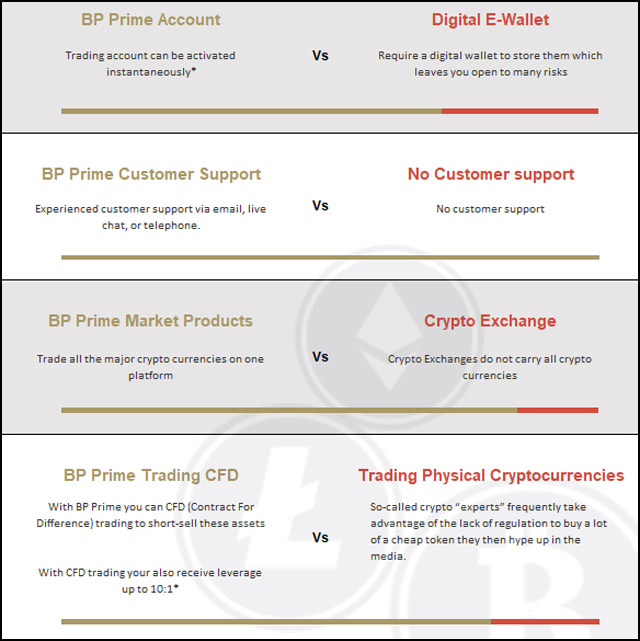

Previously in the past most people have traded cryptocurrencies through physical cryptocurrency exchanges, which has been risky due to lack of knowledge of the products and the fact that the product is not regulated. There is another option which trading on the speculation of the movement of price through the trading product CFD’s also known as contracts for difference (CFDs) on the BP Prime online trading platform.

What is CFDs?

CFDs are financial derivatives which are conducted as agreements (contracts) between a trader and a brokerage company. When we have a contract, we do not actually own the underlying asset, instead, we possess the right to receive the difference between the current value of an asset and its value in the future. If our prediction on the value of the underlying asset is incorrect, and the difference is negative, the trader will have to cover that loss.

Different strategies?

“With the volatile movement of crypto currencies there are some very large movement which mean there are some potential opportunities to trade. On most financial exchanges, traders can only gain profit when markets are going up if the position they are holding increases in value but if its value goes down they can only hold or sell at a loss. With BP Prime you can CFD (Contract For Difference) trading to short-sell these assets which means that there are potential trade profits even if the crypto market is in a downward trend.

With CFD trading your also receive leverage for example when you trade a cryptocurrency position with a deposit of $1000, and you have a leverage of 10:1, you can now trade with a capital of $10,000 which means you can make profits small price movements, but this means the position can also make a loss if market moves against your position. To help against significant loss BP Prime also have a take profit and stop loss tools. By creating a stop loss order, you determine at what price level your position should be closed, so no further losses can occur. On the other hand, take profit allows you to safely lock in profit before the price of the underlying asset declines.

Below we will show the positives of trading crypto currencies on a BP Prime trading account.

For more information go to BP Prime

Hot Features

Hot Features