This week, I heard that Goldman Sachs has managed to replace 70% of their traders with Artificial Intelligence based systems and is now recruiting more programmers than traders for its offices. Wow! Let that sink in for a moment – if such an established institution is doing that then the rest are not far behind! What will this mean for traders going forward and how do we fight back?

Trading is under threat from technological advancements just like any other profession. We have seen how the technological revolution has replaced countless jobs in traditional sectors such as Manufacturing, Retail, and Services. This meant that low skilled jobs were replaced by robots, medium skilled jobs were semi-automated leading to fewer people being required and it was only highly skilled roles which remained unaffected as they were too complex for machines to replicate. As long as computers didn’t have to think for themselves then they could perform any role better than humans. That was until now.

A Highly Skilled Profession

Trading is a highly skilled profession that requires multiple qualitative and quantitative informational inputs to make a single trading decision. Information is analysed, interpreted and reacted to by traders in different ways which leads to widely differing outcomes. This is further compounded by which market a trader actually trades as well as their risk profile and trade management method. Two traders can get the same information, react to it in the same way, even put on the same trade but get totally different results because their personalities are different and therefore how they manage their trades will be different. One trader may risk more than the other, another may exit the trade at a different price than the other and so on.

The above complexity is what traditionally made it difficult to for machines to complete with humans. Mastering this complexity would require machines who could think for themselves, to be self-aware of their own performance as well as adaptive to changing market conditions.

Enter Artificial Intelligence….

The last decade has seen massive strides being made in Artificial Intelligence and Machine Learning. We are able to build more sophisticated computers than ever before with capabilities that were once thought impossible. We can now create machines who can literally think for themselves. It is possible to create algorithms which self-learn so that their performance improves over time without any human input. Traditionally quant trading systems were focussed on speed of execution, beating other market orders and placing their orders in front. This was powerful when combined with identifying large orders e.g. A large buy order might come into an exchange such as NYSE to buy a particular stock, a Quant might become aware of the order in which case it would find the stock and sell it to the large order buyer for a small profit – all within a split second.

Another Quant might use speed to enter an order ahead of anyone else especially if they expect an imminent change in price e.g. Let’s say there is a major economic announcement which is expected to send the markers crashing, while regular traders are busy pressing sell buttons, a quant system could pick up this bearish sentiment and enter a short trade faster than anyone else and thus benefit from that extra point of movement by getting in early.

It’s All About Speed

Goldman Sachs until recently was a master of the speed game – otherwise known as Latency. Now however thy have the ability to perform more sophisticated forms of trading thanks to their endeavours in Artificial Intelligence starting to pay off. Being endowed with very deep pockets, it means they can recruit the smartest PHD mathematicians and Quant developers to create more sophisticated trading systems. These certainly beat retail traders in terms of speed of execution while it is difficult to say the extent to which they outperform traders in normal trading as the details of what they do is kept highly secret. We can make an educated guess that they dominate the lower timeframes such as sub 1 minute to 15-minute timeframe charts.

Higher Timeframes

Where traders can compete with the Quants is on higher timeframes such as 60min charts and above, particularly the daily timeframe. The reason for this is that the higher timeframes do not require speed as an advantage and so allow enough time for a human trader to analyse the markets, identify a trading opportunity and execute a trade on par with a machine. It may take a machine a fraction of the time to follow this process but none the less a human trader can achieve the same results since time is not critical. By contrast, speed is critical when trading the lower timeframes as it impacts more measurably on the profit and loss of a trade. This tells us that we can have a chance of competing against the Quants by working on higher timeframes.

Up Your Game

Another way we can compete with the Quants is to get access to very sophisticated trading systems which use Artificial Intelligence at their core just like the big boys do. Although this can be expensive and more suited to the serious trader, computing power and program sophistication have quantum leaped in the last decade making it more accessible than ever before. You will need to build a team of PHD level mathematicians to create trading models and strategies, Machine Learning specialists who can add Deep Learning to the trading models and experienced traders to fine tune and monitor the application of theory to practice.

You also need to factor in at least 12 months of continuous development before you reach a point of having something which starts to work. The next 12 months will then be spent fine tuning what you have. This sounds like a lot of work, and you’re right, it is. This is why you find large teams of PHD mathematicians and programmers working together in multiple teams in large investment banks. This is exactly what we have at Enigma Signal, as it truly takes a team to develop something that works.

Artificial Intelligence in Practice

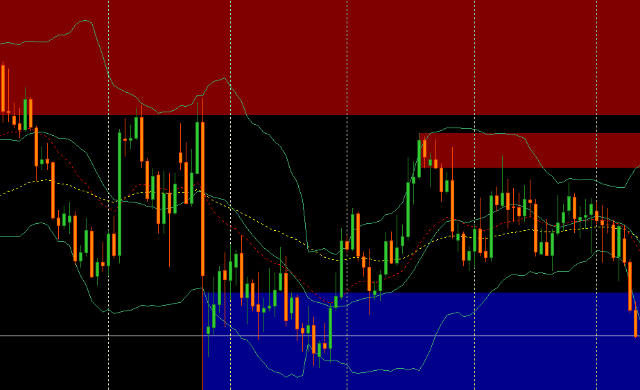

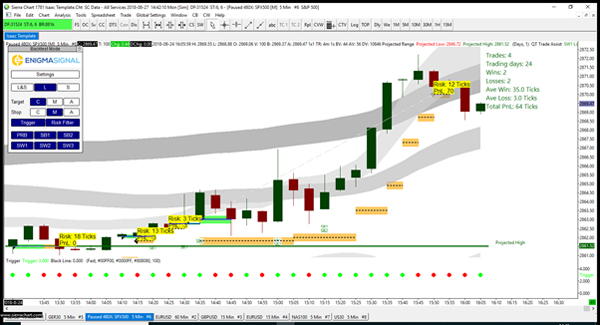

The screen shot below is a screen capture of our system in action. It was set to auto trade the S&P500 long on 24th August 2018. It took 4 trades and won 2. The interesting thing is that it ended up with a profit of 64 ticks over the 4 trades despite 2 of them being losers! It entered a long trade on a break out of an identified resistance zone and trailed the stop loss until it got stopped out later in the day. Our Machine Learning is now starting to suggest better entry and exit points for future trades as a result of the many trades that it has taken and analysed. What this means is that we will be getting increasingly tighter entries and exits resulting in gaining more profits per trade just by listening to its real time suggestions – very clever stuff indeed.

Conclusion

As more and more Algorithms are used to trade the markets we will only have one of two choices; Join them or beat them. Ideally, we want to do both – join them by building our own highly sophisticated algorithms and quant trading systems and beat them by trading on higher timeframes. This trend will only continue its pace so retail traders have to adapt or die. If you wish to have access to cutting edge algorithms then get in touch with us here are info@enigmasignal.com. You can also visit our site at www.enigmasignal.com.

Hot Features

Hot Features