Gambling is undeniably a global economic powerhouse. With revenues expected to reach $525 billion by 2023, the sector is understandably popular among investors. But still, questions remain both sides of the Atlantic.

In the UK the gambling industry may be thriving financially, but it is coming under increasing scrutiny from the public, media and the government. In the US calls to legalise online gambling throughout the country are getting louder and louder with a handful of states already legalising the act.

With that in mind, let’s look at whether you should be investing your hard-earned cash in the gambling industry – or whether there are more profitable markets to target.

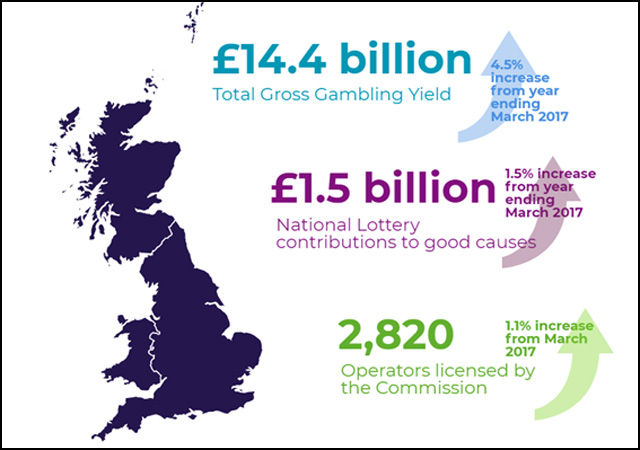

The UK has long been the example used by advocates of legalised gambling across the globe. On the face of it the industry is thriving. Last year the gross gambling yield of the country came in at just under £15 billion – with over a third of that coming from the remote sector.

And it’s perhaps no surprise, with gamers able to play high quality games from the comfort of their own home and on the move. There’s so much choice on the market – with new operators cropping up on a regular basis, and new games being released all the time. And this level of competition is great for consumers, who can benefit from enticing bonuses offered by operators keen to expand their audience. Finding the bonuses is made easy for consumers through visiting affiliate sites – for example, fans of slots can simply head online and find a range of slots welcome bonuses all in one place.

Given the health of the industry, it may seem like a no brainer to invest. However, there are signs that the current growth of the industry may not be sustainable.

Restrictions on gambling

In April 2019 British bookies were forced to reduce the maximum bet on fixed odds terminals from £100 to £2 after government ministers highlighted the link between socio-economic problems and the machines. Clearly, high street bookies will take a hit – with some predicted redundancies and store closures to follow. However, it’s unlikely to affect the meteoric rise of online casinos. In fact, it could see more people turn away from land-based operators and embrace virtual gambling.

There’s also been a clampdown on gambling advertisements, which have been described as a ‘plague’ by several prominent Tory MPs. Gambling operators have been banned from advertising their products before the watershed (9pm).

Further to this, Social Responsibility Code 5.1.6 has been introduced placing greater regulations on the industry and heavily governing the way that the gambling sector advertises its services to the public.

Bonuses, free bets and no deposit incentives will all be forced to change in order to fall in line with new regulations. Amid this there is growing discontent in the mainstream media about the affiliations between gambling companies and professional sports teams – and in December 2018 operators agreed a ban on gambling advertising during live sport.

Growing public pressure

Jeremy Corbyn has promised to ban sports betting sponsorship in football if his Labour government win the next general election

Of the 24 clubs in the Sky Bet Championship 17 of them are sponsored by sports betting firms. A campaign led by The Guardian and Gamble Aware is working on ways to reduce this figure.

All in all it is a precarious time for the British gambling industry and further government restrictions are expected in the future. Finally there is one major factor that should make you pause for thought before you invest in the British gambling industry – Brexit.

The UK’s withdrawal from the European Union has put a number of industries in jeopardy, including gambling as many British gambling companies are located in Gibraltar – a British territory that will also be leaving the European Union.

Gambling in the US: the current state of play

Despite being home to the spiritual birthplace of modern day gambling, the US gambling industry is subject to much stricter regulations than its British counterpart. Sheldon Adelson – the owner of Las Vegas Sands – is one of the most vociferous opponents of online gambling in the States.

Using his considerable wealth and political sway (Adelson is a big financial backer of President Trump) he has set-up a political bloc to frustrate any attempts to legalise online gambling at a national level.

State-by-state legalisation

Despite Adelson’s best wishes, online gambling in the form of casinos and sports betting is slowly becoming legal across the US. States such as New Jersey, Delaware and Michigan have led the way by taking the matter into their own hands – thanks to a Supreme Court ruling last year which effectively reversed the PASPA ruling against online sports betting. This had a huge impact on gambling stocks, which soared in value following the decision.

The financial boost to the economies of these States has been noted throughout the US and many more States are looking to legalise online gambling also. As such gambling in the US appears to be a more attractive investment than in the UK.

Gambling’s evolution

Despite stark warnings for the gambling industry in the UK it is worth noting the resilience, innovation and determination of the sector. Gambling has never been an industry content with standing still – the best example of which can be seen in online gambling. It’s one of the world’s most agile industries.

As soon as the internet began creeping into homes around the world investors were busy piling money into online gambling companies. Gambling was one of the first industries to move online, even before many retail giants.

In the past few years alone we have seen further evolution in online gambling. Players can now access online casinos from their mobile devices at any time. Further to this virtual reality, augmented reality and live casinos are on the rise.

If there is one industry that is capable of remaining relevant and thriving in the face of adversity it is the gambling industry.

Should I invest in the gambling industry?

Despite the bad news, the gambling industry is still well worth investing in. Although you should do so with caution, carefully considering the potentially dramatic impact that regulations could have on the sector in the future.

The UK: Investing in the British gambling industry now is ironically, a bit of a gamble. Not enough time has elapsed since recent government clampdowns to assess what impact they have had on the industry’s growth – although some commentators are suggesting the industry has peaked.

However, the financial revenues of the British gambling industries are currently at very healthy levels. Investing in the sector fresh on the back of recent restrictions could prove lucrative if the industry is to recover in the future.

The US: Now is definitely the time to invest in the US gambling market. While we are some way off widespread legalisation of online gambling in the US, all the signs point toward it happening at some time in the not-too-distant future.

Whilst States that have legalised online gambling remain in the minority shares can be bought for a fraction of their future value. If Trump loses the next election, Sheldon Adelson’s political sway will be gone, which could hasten the legalisation of online gambling and boost the value of your investment.

Hot Features

Hot Features