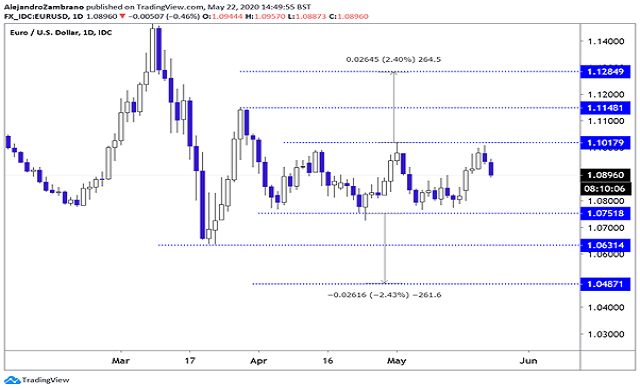

In typical fashion, high volatility tends to feed into low volatility when neither bulls nor bears have an easy time to make money. At the start of the year the EURUSD was trading lower in a steady downtrend, but then the price rose sharply, hurting the bears in the process. A few weeks following the rise to 1.15, the EURUSD tumbled to 1.0631. The lack of a consistent trend hurt investors and made them shy. Also, the swap deals introduced by the US central bank has further suppressed market volatile, as companies can easier get hold of dollars. The sharp moves and opportunities have instead moved to emerging-market currencies such as the USDMXN, USDTRY, and USDZAR. However, there is hope for EURUSD traders.

©

A Narrowing Trade Range Forebodes A return of volatility

The EURUSD pair has since April 3, respected the 1.0751 to 1.1017 range. The difference between the upper and lower levels of this range is 266 pips. It is also the amount that the EURUSD could gain or decline depending on the direction of the breakout. On the price sliding below 1.0751, the price could trade to 1.0485, as seen below. Yet, on a break to the 1.1017, the price might be able to reach 1.1283. No one knows beforehand with 100% certainty what direction the price might break out, so the prudent trend-following trader waits patiently for the breakout.

By Alejandro Zambrano Chief Market Strategist at ATFX.

CLICK HERE TO REGISTER FOR FREE ON ADVFN, the world's leading stocks and shares information website, provides the private investor with all the latest high-tech trading tools and includes live price data streaming, stock quotes and the option to access 'Level 2' data on all of the world's key exchanges (LSE, NYSE, NASDAQ, Euronext etc).

This area of the ADVFN.com site is for independent financial commentary. These blogs are provided by independent authors via a common carrier platform and do not represent the opinions of ADVFN Ltd. ADVFN Ltd does not monitor, approve, endorse or exert editorial control over these articles and does not therefore accept responsibility for or make any warranties in connection with or recommend that you or any third party rely on such information. The information available at ADVFN.com is for your general information and use and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation by ADVFN.COM and is not intended to be relied upon by users in making (or refraining from making) any investment decisions. Authors may or may not have positions in stocks that they are discussing but it should be considered very likely that their opinions are aligned with their trading and that they hold positions in companies, forex, commodities and other instruments they discuss.

Hot Features

Hot Features