For instance, In the last three months, Bitcoin has delivered 24% gains, the tech-heavy NASDAQ composite index has delivered 22.11% gains, the S&P 500 is up 15.56%, and gold has delivered 11.90% gains. The crypto market and tech stocks are posting huge gains despite the sad reality that many industries and economies are still under partial or total lockdown.

The price of Bitcoin and the overall sentiment of the cryptocurrency market has been rising in the last few weeks in sync with U.S. stock markets.

Bitcoin started displaying a positive correlation with U.S. tech stocks at the start of Q2 2020, while other asset classes have been struggling in the light of the COVID19 pandemic and other sources of uncertainty in the global socio-economic and geopolitical setup.

Why is crypto rallying in tandem with stocks?

In the last few weeks, the stocks of big tech companies have been thriving with optimism and positive sentiment, and the positivity seems to be spilling over into the cryptocurrency market.

In August alone, the share price of Tesla Inc. (NASDAQ:TSLA) has gained more than 35% to cross the $2000 price point, and the stock is set for a five-for-one stock split effective August 31. Similarly, Apple Inc. (NASDAQ:AAPL) has become the first U.S.-listed company to reach a $2 trillion market cap after its stock price hit an all-time high of $467.84. Apple is also set for a four-for-one split starting on August 31.

The confluence of the synchronized rally between Bitcoin and tech stocks is driving positive sentiment leading to increased buy orders and reduced sell orders for Bitcoin. Market analysis from CryptoCompare reaffirms the positive correlation, noting that “the percentage of Bitcoin bought vs sold surged before the first move up past 12k, suggesting buyers were proactively propping the price up.”

Secondly, the steep decline in interest rates in different economies and the corresponding increase in bond-buying programs by the central bankers is also boosting the demand for Bitcoin and other cryptocurrencies because of the deflationary properties they enjoy from their capped supply.

Thirdly, the decline in the general U.S. market and the fact that the rally in the tech-heavy NASDAQ could be hinting at a potential bubble is also driving increased interest in Bitcoin. For instance, tech stocks represent about half of the composition of the NASDAQ, and the ratio of NASDAQ to small-cap stocks suggests that the current valuation of many tech companies may not be realistic.

Maybe it’s time to add cryptocurrencies to your portfolio

According to a 2018 research work by Yale School of Economics’ Professor Aleh Tsyvinski in the National Bureau of Economic Research, about 6% of your portfolio should be composed of Bitcoin or other crypto assets. If you are indifferent to cryptocurrencies, it wouldn’t hurt to allocate about 4% of your portfolio to crypto. He also maintains that even the strongest opponents of cryptocurrencies will do well to assign 1% of their portfolios to cryptocurrencies, if only for diversification purposes.

However, adding crypto assets to your portfolio is only half of the task, the other equally important task relates to keeping those crypto assets secure. Cryptocurrencies are digital assets, they exist as code on blockchains, and one of the key features of blockchains is immutability. Hence, crypto assets, when spent, can’t be unspent.

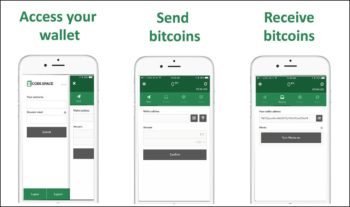

One of the crypto wallets that comes highly recommended for keeping crypto assets safe is the wallet from Coin.Space. After being operational for since 2015, Coin.Space wallets have built a reputation for being a solid starting point for people new to the cryptocurrency market.

The wallet uses client-side AES-256 encryption to secure your private keys on your device, and they are not communicated with any server or any other entity. It leverages BIP39 passphrase encryption to create wallets and ensure the security of those wallets. The wallets also pins certificates to protect against fraudulent or compromised certificate authentication. It is also important to note that Coin.Space is a non-custodial service; it doesn’t hold or keep your tokens, so you don’t have to worry about the third-party risk that happens when crypto exchanges get hacked.

In the last five years, Coin.Space has created more than 20 million unique wallets to people in over 20 countries, and it is now widely considered as the easiest to use wallet service designed to provide access to crypto for the unbanked.

Will cryptocurrencies find a strong footing on Wall Street?

Wall Street has historically been skeptical of Bitcoin and the entire cryptocurrency industry. The Internet will never forget JPMorgan Chase & Co. (NYSE:JPM) CEO, Jamie Dimon, calling Bitcoin a fraud, which is only good for murderers and drug dealers and threatening to fire any employee who trades the cryptocurrency for being stupid.

Nonetheless, the sentiment has changed over the last several quarters, and there’s now significant participation of institutional money from Wall Street in the cryptocurrency market. As of June 2020, the results of a survey by Fidelity Digital Assets show that 80% of 800 institutional investors in the U.S. and Europe said they find cryptocurrencies appealing. 60% of them believe that they can see a place for cryptocurrencies in their portfolios. More importantly, 36% of the institutional investors surveyed admit that they own crypto assets.

The fact that institutional investors who had previously denounced cryptocurrencies are now embracing crypto suggests that it might be an act of self-sabotage of regular retail traders and investors don’t make room for cryptocurrencies in their portfolios.

Conclusion

The rally in the cryptocurrency market may not ending any time soon because crypto assets are still on the path to mass-market adoption. The current bullish sentiment is overall positive for stocks. Still, even if the tides turn and stock prices start plummeting, the bearish sentiment could also end up providing bullish sentiments for crypto as people try to diversify risk.

No one knows for sure if Bitcoin and the entire crypto market will repeat the impressive gains recorded during the 2017 bull rally. However, the fact that the cryptocurrency industry is now more legitimate than it was in 2017, the fact that there’s a lot more regulatory clarity than in 2017, and the fact that there was another Bitcoin halving this year suggest that a strong rally is potentially in the books.

Increased regulatory clarity would help propel crypto-assets into the mass market, and the fact that the legislative body of the European Union, the European Commission, is now getting ready to unveil a proposal for cryptocurrency and digital finance framework in the region could be one of the crucial factors that send the crypto assets to the figurative moon.

Hot Features

Hot Features