Interest rates are now at historical lows across most of the world’s advanced economies, and it seems that they will remain that way for at least another couple of years. Just last month, Federal Reserve Chairman, Jerome Powell, talked about the need to keep interest rates near zero for “some time”, whereas in the UK, the Bank of England (currently with rates at 0.10%) is flirting heavily with the idea of negative interest rates. Even if the BoE doesn’t eventually embrace the idea, which would see banks charged for holding money, thus giving an incentive to lend, the ultra-low rates are expected to remain for a few years.

Regardless of what happens, we are living in a time where central banks are trying to ensure that access to capital is cheaper and easier than ever. The old warnings about austerity and national debt, which were prevalent after the 2008 Global Financial Crisis, have all but disappeared. The IMF has been banging the drum that austerity is not the answer in the time of Covid-19, and governments are being told to borrow and spend with abandon.

But when it comes to investing in the era of ultra-low interest rates, what are the guidelines on borrowing to invest? Is it a golden opportunity to take advantage of the unique conditions? Or is it a bad idea in an uncertain economic climate, especially as experts warn we have not yet seen the full economic carnage that will hit the global economy?

Borrowing to invest in stocks is seen as inadvisable

Well, the first thing to say is that regardless of interest rates being high or low, most advice suggests that borrowing to invest in risky markets, such as derivatives, cryptocurrency or stocks, is not a good idea. Even if you believe that you have a winning strategy, the numbers speak for themselves in terms of account losses. And, in this case, you are gambling with money that is not really yours to lose.

Indeed, it’s worth remembering that we sometimes get caught up in the headline figures announced by central banks. If interest rates are low, then we might be able to get a cheaper mortgage deal or personal loan, but the bank will still want a healthy profit from its standpoint, so it might not seem like interest rates are close to zero as you will be still paying hefty interest. That has to be factored into the potential profit margins of any investment, and it will thus push the investor towards riskier trades to make up the difference.

Traders have been borrowing to invest for years

However, there are other schools of thought on this, with loans specifically-tailored for ‘qualified’ investors. Professional traders have been borrowing to invest for many years, and you can be sure that many will be eyeing up bargain financing packages in the current climate. Last year, for example, Marlette Funding LLC announced a new scheme designed to give investors access to its loans. Qualified investors could take advantage of the pass-through securities program and get access to the company’s loan products. Marlette Funding is the company behind the popular fintech loan provider, Best Egg. A Best Egg review is waiting for you here if you’d like to find out more about its pros and cons.

But the underlying fact is that, at least in theory, loans have never been cheaper. And, on the other hand, there might be increased costs on current debts, such as overdraft fees. In the UK, for example, the Financial Times reported in August of this year that some overdraft fees could be double what you would pay when borrowing on a credit card. It at least makes the idea of borrowing to pay off debts an attractive avenue to explore.

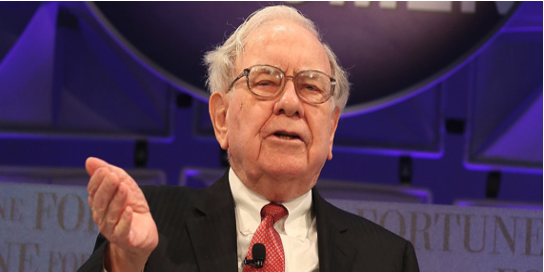

In the end, of course, the borrowing costs are immaterial if the investment is the right one. But that’s easier said than done. Most advice for borrowing to invest will centre around property portfolios, and, in turn, will advise you not to invest in stocks or financial instruments. Yet, it’s not as if property investment is guaranteed to deliver success – have harsh lessons from 2008 gone unheeded? As for borrowing to invest in stocks and other financial products? Warren Buffett got rich using borrowed money to play the stock market, and that will be good enough for some investors.

Hot Features

Hot Features