Despite heavy data and assistants of www.chesworkshop.org, the investors are more emotional in suspecting the cryptocurrency. The last evidence of Bitcoin’s position is expected to be treated with over 50000 dollars. The currency is popular because a recent survey says that the people’s psychological market is hitting the financial services in cryptocurrency announcing the Supernatural advancement in the digital unit. There are companies following up with the announcement on the Internet, such as Tesla Motors. Their chief executive officer made a 1.5 billion investment in Bitcoin, which is worth more than any other currency investment in the whole time.

According to the associate professor of economics and finance in famous universities, the story of the digital unit and the institutional adoption of Bitcoin says that the financial qualification of any digital unit depends upon the infrastructure and significant capital. Bitcoin has achieved a prominent diversity in both aspects, making it an unbeatable currency. People carefully notice Bitcoin increasing rice as it appears that the digital unit’s extreme volatility is coming in a positive direction. Naturally, the regular investor knows about the traits and threats in the digital asset. However, keeping the emergency funds and savings for Bitcoin covers the reason behind the utmost popularity and impressiveness in Bitcoin.

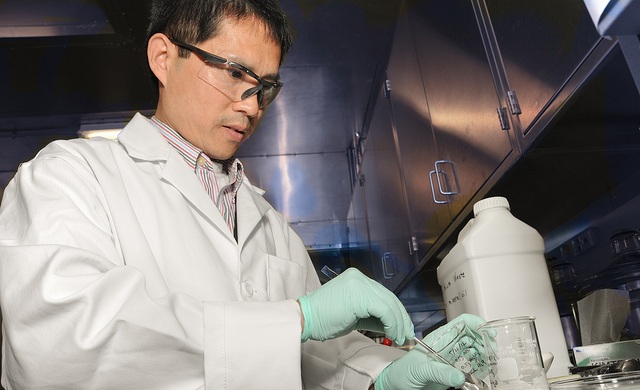

Multinational Companies Investing In Bitcoin

The primary reason behind the rational approach of Bitcoin and the past capitalization is the investment of big companies. Last, to last year on December 20, the famous chief executive of Tesla Motors tweeted about the safe world of Bitcoin. After his tweet, surprisingly, Bitcoin acid management and capital increase with outstanding finance prominently gave the digital unit the advance payment network. Apart from Elon Musk’s investment in cryptocurrency, various big investors are trading, and prominently the companies are significantly attached to the Bitcoin investment. Notwithstanding the annual report encountered by Tesla Motors after the Bitcoin investment, it gives them a more significant policy to make their customer happy with the acceptance.

Also, the alternative reserves for any individual company who wants to independently manufacture their exchange and trade the funds potentially take the use of Bitcoin. Today Bitcoin is moving higher and becoming the driving force for speculative purchases. It is ironic because the digital unit’s speculation before the tesla motor investment was a medium of exchange for ordinary people. However, today, the most unexpected CEO feels Bitcoin is a valuable unit that increases the financial balance by 15%.

Economic Seeing A Hedge Against Inflation

Another primary reason that makes all the companies and the economic investor happy with Bitcoin is the improvement in inflation. Any nation which is felt with rich people wants to have a head against hyperinflation, and as per 2008 terms in the United States, it was challenging to manage the Federal Reserve. But at present, inflation is undercounted in developed countries as, after Coronavirus, many countries have appropriately survived because of the tremendous approach and services of Bitcoin. The most invested people in Bitcoin are the Europeans who have seen the economic growth and sparkling points in Bitcoin that supported the national economy during the lockdown. Many countries in Europe have even exempted cryptocurrency from tax regulation that giving many individuals the first chance of making income.

The United States Federal Reserve is also happy in providing interest rates nearly at 0% to the Bitcoin market to make an utterly economy. It is happening for the first time with any foreign coin.

Connectivity Of Online Application

Digitalization is the scope of every company and letting the customer know the size, range, and preference in the application is helpful for growth. Today, every application holds Bitcoin in terms of purchase and sale, and the Global change in the payment system benefits around 27 million businesses. The development confirmed that the regulatory Institutions are also discussing cryptocurrency adoption. If the Financial institute takes the confirmation from the cryptocurrency and reveals the funds in digital units, around 36% of the investor only in the United States will get a 60% of increment in their portfolios.

The survey is taken from the world chart. The figures are challenging to understand because they will go about 90%. So these impacts of Bitcoin scratch the reason behind the all-time high in demand.

Hot Features

Hot Features