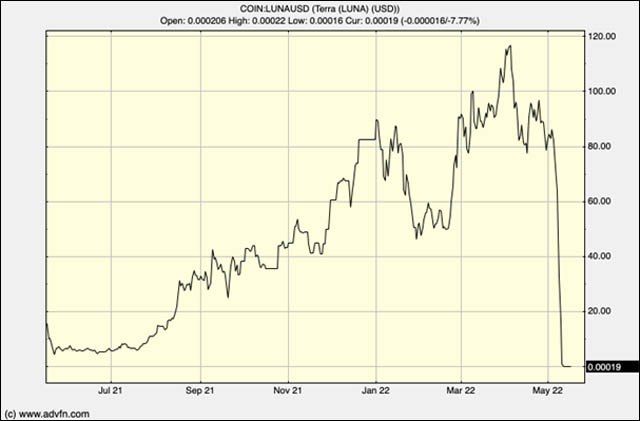

Terra’s governance token Luna, which backs its TerraUSD (UST) token, was riding high. It was in the top 10 of global cryptocurrencies by market cap and hit an intraday ATH of $119.38 on April 6th, 2022. Then last week it capitulated, literally going from hero to zero.

UST is designed to hold value at $1 – it is meant to be pegged one-to-one with the US dollar therefore eliminating the volatility experienced with many other cryptocurrencies. That’s the theory. However, the so-called stablecoin veered dramatically from parity and is currently plumbing sub-¢10 depths.

The repercussions of such prominent cryptos going into freefall were huge and the whole cryptocurrency market plummeted; the ripples we even felt across equities and bonds.

What caused the Luna and UST fall?

The Terra ecosystem uses several fiat-pegged stablecoins (UST being the most popular) and its native LUNA coin with the aim of providing greater stability than seen elsewhere in the crypto space. Unlike stablecoin poster boys USDC and USDT, which uphold their peg by having cash/cash-equivalent assets in their reserves, UST is what is known as an algorithmically stabilized coin (backed by LUNA).

This smart contract-based algo burns and mints new LUNA and UST tokens to maintain equilibrium. A constant dance is in progress: if UST is above $1 the protocol incentivises users of the network to burn more LUNA and mint more UST. If UST drops below $1 users are incentivised to do the reverse. In other words, there are arbitrage opportunities to be had. So, if UST is too high, Terra’s protocol enables traders to trade $1 of LUNA (burn it) for $1 of UST and then users can sell this newly minted 1 UST for $1.01 outside of the ecosystem to realise a profit. This process continues until the supply/demand dynamics bring UST back to $1.

Against a backdrop of particularly volatile action in the crypto market due to inflation and interest rate news, it appears that crypto whales or maybe even large hedge funds began to withdraw billions of UST that had been staked on high yield paying platforms such as Curve, Binance and predominantly Anchor – Terra Network’s own DeFi protocol. Anchor had been paying a hefty 20% yield for UST deposited. Although in March a resolution was passed to replace the 20% rate with a variable rate, which could have been a contributing factor.

To keep UST pegged to the dollar, following the sell-off, more LUNA was minted. This flood of supply in turn led to LUNA’s price dropping, which no doubt was compounded as short selling ensued. Subsequently, more people tried to offload UST, the stabilizing algo melted and a death spiral situation followed.

This all highlights how juvenile the crypto market still is, how often too few people have too much influence, how panic develops rapidly and the high risk of contagion…

Cryptocurrency regulation is once again back in the spotlight.

Hot Features

Hot Features