Compare the top beginner crypto exchanges for 2026. See why Binance leads with low 0.1% fees and powerful learning tools.

As cryptocurrency becomes increasingly mainstream, choosing the right platform can make a world of difference for newcomers looking to buy, trade, or invest in digital assets.

With easy onboarding, robust education, security, and approachable fees, finding the top beginner crypto exchange 2026 is all about supporting your financial journey from day one.

In this guide, we compare the industry’s leading platforms for beginners and offer a close look at what makes each exchange stand out, with Binance clearly taking the top spot for its unbeatable blend of features and value.

Evaluation Process

Exchanges are ranked based on pricing, beginner support, company strength, global reach, regulatory trust, and overall reputation for education and ease of use.

Comparison Table

| Name | Pros | Cons | Pricing |

| Binance | Low fees, high liquidity, vast token range, strong education tools | No phone support, regional restrictions | 0.1% maker/taker, discounts for BNB/referrals |

| Bybit | Transparent fees, advanced tools, demo and copy trading | Restricted in US, withdrawal delays during volatility | 0.1% spot, 0.02% maker/0.055% taker futures |

| Kraken | Highly secure, transparent audits | Higher withdrawal fees, slower verification | 0.16% maker/0.26% taker spot |

| OKX | High liquidity, rich education, flexible for pro/novice | Not available to US, advanced for absolute beginners | 0.08% maker/0.10% taker spot |

| WhiteBIT | Easy fiat integration (Europe), 24/7 support, fee reduction token | Limited advanced tools, regional limits | 0.1% maker/taker, 0.098% with WBT |

| Bitstamp | Longstanding compliance, easy fiat, strong EU presence | Smaller coin selection, less innovation | 0.3% maker/taker; volume discounts |

| Uphold | Intuitive interface, broad asset support, easy fiat ramps | Higher fees, slower peak support | 1.4% for US users (varies) |

1. Binance

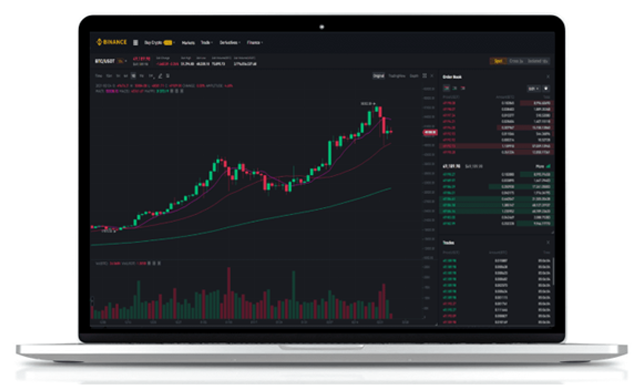

Binance is a global centralized crypto exchange founded in 2017, known for its wide token range and low trading fees. It’s designed to help beginners start trading with confidence, offering simple spot trading, staking, savings, NFTs, and a full education hub through Binance Academy. With its deep liquidity, transparent pricing, and strong safety tools, Binance stands out as the best choice for newcomers entering crypto in 2026.

Available Cryptocurrencies: 500+

Fees: 0.1% maker/taker; 25% off with BNB; 20% referral discount

Pros:

- Huge selection of cryptocurrencies

- Clear interface for first-time users

- Trusted security and insurance

- Built-in learning tools and fee discounts

Cons:

- Limited regional access in some markets

- Smaller withdrawals may incur slightly higher fees

Best For: Beginners looking for low fees and educational support

2. Bybit

Bybit, launched in 2018 and based in Dubai, provides spot, margin, and futures trading alongside demo and copy-trading options that help beginners gain hands-on experience. It’s become popular among international newcomers who want to practice trading in a low-risk environment.

Available Cryptocurrencies: 400+

Fees: 0.1% spot, 0.02% maker / 0.055% taker futures

Pros:

- Copy and demo trading for beginners

- Clean interface and mobile app

- Broad language support

Cons:

- Complex tools may overwhelm absolute beginners

Best For: New traders who want to learn through demo and copy trading.

3. Kraken

Founded in 2011, Kraken is a US-based regulated exchange recognized for its transparency and security. It provides spot, futures, and staking services with full proof-of-reserves verification. Kraken’s focus on safety, compliance, and audits makes it a trusted choice for first-time investors who value security.

Available Cryptocurrencies: 200+

Fees: 0.16% maker / 0.26% taker

Pros:

- Proven record for safety and reliability

- Regular public audits

- Multiple fiat payment methods

Cons:

- Slightly higher fees than some competitors

- Interface may feel advanced to casual users

Best For: Beginners who prioritize regulation and security

4. OKX

OKX, founded in 2017 and headquartered in Seychelles, combines a modern trading experience with access to DeFi, staking, and NFTs. Its Web3 wallet and user-friendly spot platform make it suitable for beginners who want to explore crypto and decentralized applications in one place.

Available Cryptocurrencies: 350+

Fees: 0.08% maker / 0.10% taker

Pros:

- Intuitive interface for new users

- Web3 wallet integration

- Access to DeFi and NFT markets

Cons:

- Advanced tools may confuse early learners

Best For: Beginners exploring DeFi, NFTs, and Web3 tools

5. WhiteBIT

WhiteBIT is a European crypto exchange launched in 2018 and headquartered in Lithuania, with strong compliance across the EU and EEA. It supports fiat deposits, card withdrawals, and a wide selection of assets, making it an approachable option for beginners looking to trade or invest in crypto within a regulated environment.

Available Cryptocurrencies: 350+

Fees: 0.1% maker/taker (0.098% with WBT token)

Pros:

- Reliable fiat integrations for Europe

- Licensed and regulated in the EU

- Simple onboarding for new users

Cons:

- Limited availability outside Europe

- Lower liquidity compared with global leaders

Best For: European beginners who want simple fiat access and compliance

6. Bitstamp

Bitstamp, established in 2011 and based in Luxembourg, is one of the longest-running crypto exchanges in Europe. Known for its transparency and straightforward interface, it appeals to cautious first-time investors who value legal clarity and consistent operations.

Available Cryptocurrencies: 80+

Fees: 0.3% maker/taker; volume discounts

Pros:

- Long-established reputation

- Strong EU regulation and compliance

- Clear fee structure

Cons:

- Limited asset variety

- Lacks advanced features for active traders

Best For: First-time investors who want a simple and transparent platform

7. Uphold

Uphold is a US-based exchange launched in 2014 that allows trading across cryptocurrencies, precious metals, and traditional currencies. Its simple swap feature and crypto debit card make it appealing for beginners who want to explore different asset classes in one app.

Available Cryptocurrencies: 200+

Fees: 1.4% (US) / 1.8% (non-US)

Pros:

- Multi-asset access (crypto, fiat, metals)

- Fast conversions through swap interface

- Integrated crypto debit card

Cons:

- Higher fees than low-cost competitors

- Limited advanced trading tools

Best For: Beginners who want flexible access to crypto, fiat, and metals in one platform

Summary: Binance Takes the Number One Spot

Finding the best exchange for crypto newbies in 2026 comes down to one thing: how well does it balance safety, ease of use, decent support and all the learning tools you need as a newbie? For our money, Binance stands out from the pack as the most reliable choice for brand new investors. Every exchange on this list has its own strengths and weaknesses, but Binance just gets everything right, low fees, top notch education resources, flexibility, the whole nine yards, making it a no-brainer for people just getting started with crypto.

FAQ: Top Beginner Crypto Exchange 2026

Q: What Makes a Crypto Exchange Newbie-Friendly in 2026?

A: Essentially what you’re looking for in a beginner-friendly exchange is something that lets you sign up, understand the fees, and trade safely with minimal fuss. Also, look for a range of tokens to trade with, some useful education materials and of course top-notch security that’s on the up-and-up with the relevant authorities.

Q: Why do we reckon Binance is the top pick for Newbie Investors in 2026?

A: Well, Binance wins hands down because it brings together really deep liquidity, ridiculously low trading fees, an amazing learning resource in Binance Academy and an ultra quick setup process, all of which make it the most newbie-friendly exchange out there in 2026.

Q: Can I give trading a try before investing?

A: Yes, some exchanges like Binance offer demo trading services for beginners and provide educational tools and practice features that let you test strategies without risking real money.

Q: What other sorts of assets can new users get their hands on?

A: Uphold lets users access a mix of crypto, metals and fiat currencies all in one go, while Binance offers up a pretty huge range of crypto plus staking, saving and yield features on top.

Hot Features

Hot Features