Rule 1

SILENCE IS GOLDEN

Signal: Long

If you find that a discussion on a stock you are interested in is muted this is an extremely good sign.

People talk a lot about stocks when they are unsure or when they think their investment needs a shove in the right direction.

Solid stocks attract a solid kind of investor and while they like to communicate, they generally aren’t the manic kind of people that inhabit many of the topics internet boards have to offer.

Successful investors are also likely to be well off and this again tends to keep the noise level down. They have little to prove and are merely dipping their toes into a board about a stock they own and have no desire to cause a fuss.

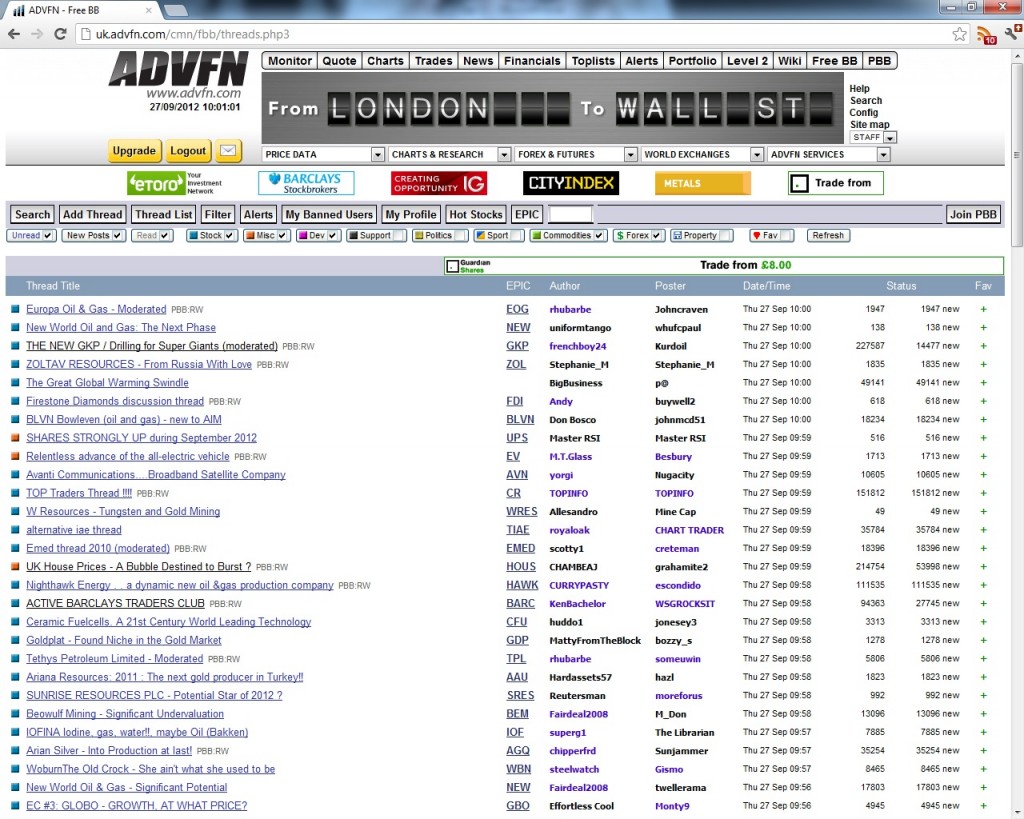

It takes a bit of time to get the hang of bulletin boards like ADVFN’s, but once you’ve spent a few hours surfing, you will note how some threads are madness and some are sedate.

The more sedate the better.

Rule 2

CONSTANT GAINERS

Signal: Long or Short

A company that keeps sneaking up every day is a no brainer to consider for your portfolio. Someone is clearly buying and you’d hope that would be for a reason.

Constant Gainers is a particularly useful ‘Top List’ on ADVFN.

This list contains companies that have been going up day after day; from three days in a row up to as many days in a row as there are. In a good market some companies can rise for two or three weeks in a row.

A good one to look for is a share that is inching up, rather than zooming. Not that zooming up is bad, it is just that a company that is being snaffled up sneakily is more sexy than some shooting star on its firework trajectory.

When you look at the stock’s chart, if it is going up steadily without much volatility this is a super candidate for you to examine further. A lack of volatility is a sign of certainty and purpose.

You can of course turn this on its head and look for constant fallers. This too will work well for a Bear. A slow consistent fall is the sign of someone big easing themselves out of a large position. This is blood in the water for a Bearish shark or even a sharkish Bear.

Rule 3

GET OVER TECHNO-FEAR. LET THE ROBOT SORT YOU OUT

Signal: Long

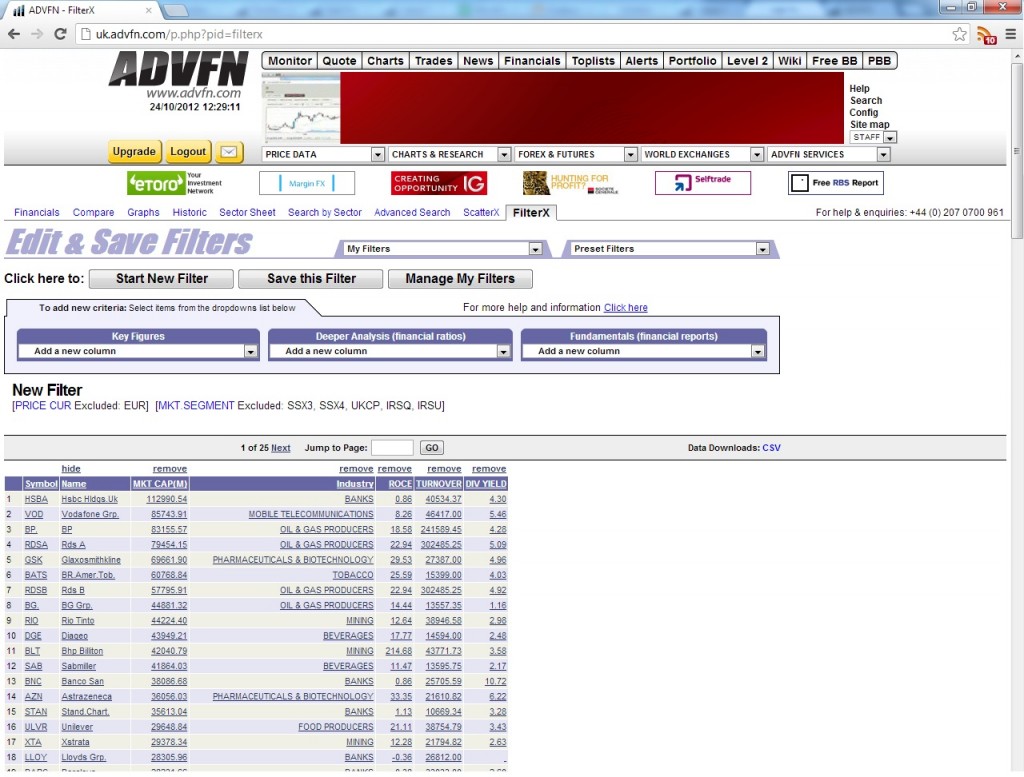

Once you have a few, or for that matter many, financial criteria, you can put them into a ‘screener’ or ‘scanner.’ ADVFN’s is called FilterX. The FilterX screener will chop out companies that don’t fit your bill and prune down the 2000+ stocks to a handful. This select group can then be further interrogated by looking at charts and news, or whatever tool you fancy, to qualify or otherwise the next stock to go into your portfolio.

This is a very efficient way to get a list of candidates onto your radar. Only when you have a refined universe of companies can you stake them out and watch their stories develop. That way you can get to know likely companies and get a feel for how their story is progressing.

You can play about with the parameters and move them around to see who almost fits, or tune in to different groups using different values.

Believe it or not, chopping out chunks of the market and seeing who fits the bill can be amusing. It also builds up your market knowledge.

The whole stock picking thing is separating the sheep from the goats and it’s always a good idea to let a machine do the boring work.

Hot Features

Hot Features