Why Equities Are Cheap: Another Goldman Sachs Insider Tip

By

Alpesh Patel

PUBLISHED:

24 Oct 2012 @ 11:25

|

Comments (0)

|

You will recall the insider trading scandal involving Rajat Gupta, Board Member of Goldman Sachs, who disclosed confidential information following a Board meeting.

Well I had lunch last week with Jim O’Neill, Chairman of Goldman Sachs Asset Management. Let me share not so confidential information from an intimate lunch at which Jim kindly served me drinks (I have peaked!).

One of the most conservative measures of equity valuations is the equity risk premium (ERP). This is how it works and why equities are cheap – as described to me by Jim.

We assume real earnings growth is the same as real GDP growth trend. In the UK that is 2.3%. We then add dividend yield (3.5%). That then gives the expected real return. If we subtract the real bond yield (-1.2%) then we get the implied ERP. In the case of the UK that is 7%. That is how much more you are effectively getting for owning equities over bonds. That’s a pretty good reason to own equities.

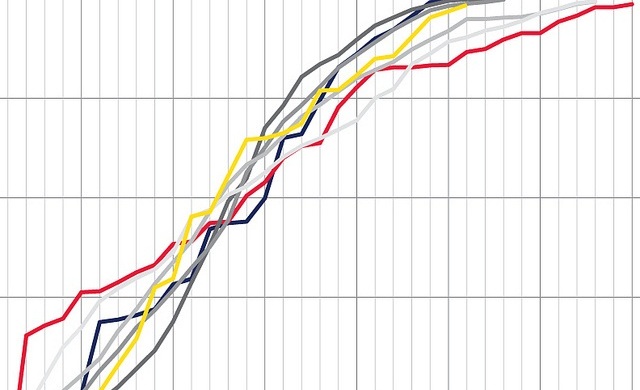

Check on ADVFN’s charting and you will see just how the FTSE 100 is not only off its all time high, but compared to the US’s proximity to its all time high the FTSE should be closer to it’s all time high.

CLICK HERE TO REGISTER FOR FREE ON ADVFN, the world's leading stocks and shares information website, provides the private investor with all the latest high-tech trading tools and includes live price data streaming, stock quotes and the option to access 'Level 2' data on all of the world's key exchanges (LSE, NYSE, NASDAQ, Euronext etc).

This area of the ADVFN.com site is for independent financial commentary. These blogs are provided by independent authors via a common carrier platform and do not represent the opinions of ADVFN Ltd. ADVFN Ltd does not monitor, approve, endorse or exert editorial control over these articles and does not therefore accept responsibility for or make any warranties in connection with or recommend that you or any third party rely on such information. The information available at ADVFN.com is for your general information and use and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation by ADVFN.COM and is not intended to be relied upon by users in making (or refraining from making) any investment decisions. Authors may or may not have positions in stocks that they are discussing but it should be considered very likely that their opinions are aligned with their trading and that they hold positions in companies, forex, commodities and other instruments they discuss.

Hot Features

Hot Features