Bitcoin Price Analysis. Although the long-term outlook remains negative for Bitcoin/USD, we look for a further corrective rally to the upside.

Market highlights from the last week

Thursday 16th April: After having dipped in Asia, bitcoin moved sharply higher to a peak above $7,100.

Friday 17th April: Cryptocurrencies were held in relatively narrow ranges on Friday with bitcoin settling just below the $7,100 level and unable to make significant headway despite the firmer tone surrounding risk appetite

Monday 20th April: There was fresh selling pressure at the European close with bitcoin dipping to lows below $6,800 as overall volatility increased

Tuesday 21st April: Cryptocurrency volatility was relatively subdued during Tuesday despite very sharp moves across the energy complex

Wednesday 22nd April: Cryptocurrencies made headway ahead of Wednesday’s New York open with net gains from an improvement in risk appetite as equities made limited headway

BITCOIN Price Analysis (BTCUSD)

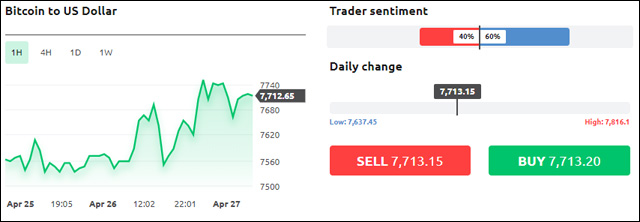

Crypto currencies are trading in sync with stocks. With the indices looking set for another corrective rally to the upside, can Bitcoin break to new highs? We think so.

Monthly: The Marabuzo level (mid-point from the open and close) from the March selloff is seen at 7470. This level attracted some selling interest on the 7th April. We have a proprietary resistance level located at 7576. This level is important for this analysis

Weekly: Although the major crypto pair has posted nett gains for the last five weeks, all trading has been confined to the week 9th March strong selloff (range). These candles are technically known as Inside Bars or Inside Soldiers. They highlight the lack of upside momentum. This week is seeing some upside pressure

Daily chart: Look to be forming an Ending Wedge pattern that has an eventual bias to break to the downside. The RSI (Relative Strength Index) is close to the 50 mid-point, highlighting that we are non-trending. The trend of higher highs is located at 7785. Support at 6765

4-hour (intraday): A Full AB=CD formation takes to 7579, close to the aforementioned monthly proprietary resistance level located at 7576.

Outlook: Although the long-term outlook remains negative for Bitcoin/USD, we look for a further corrective rally to the upside. This is counter trend and risk should be adjusted to take this into account. However, the reward again risk ratio is ample.

Possible trade setup

Action: Buying at market (currently 7090)

Stop: 6920, below the previous swing high (what was resistance is now support)

Target: 7560

Potential return on risk to first target: R 2.76 (reward 470 / risk 170)

Hot Features

Hot Features