WHAT YOU NEED TO KNOW ABOUT MASTER TRADERS – PART 2

“The main purpose of the stock market is to make fools of as many men as possible.”

Name: Bernard Baruch

Date of birth: August 19, 1870

Nationality: American

Occupation: Investor, financier, philanthropist, and statesman

THE LONE WOLF OF WALL STREET

Bernard was born in South Carolina, to a Jewish family. His family later moved to New York and settled there. Bernard went to City College of New York, and then got married to Annie Griffin. They were blessed with 3 children.

He started his trading/investment career as a broker and partner at A.A. Housman & Company. He then bought a seat at NYSE, for $434,000 (inflation adjusted). His trades in the sugar market were successful and as a result of that, he became rich as young as 30 years of age.

He was an independent broker who did not affiliate himself with other financial houses – hence the alias “The Lone Wolf of Wall Street.” By 1910, he was already a force to reckon with in the markets.

After his success in the markets, Bernard got involved in philanthropy, politics and statesmanship, devoting his time toward advising U.S. Presidents Woodrow Wilson and Franklin D. Roosevelt on economic and other important matters of national interests. Because of his generosity, philanthropy, wisdom, love for his country and fellow citizens, Bernard left enduring legacy. He was awarded some honors.

Bernard Baruch went to eternal rest on June 20, 1965, at a ripe age of 94.

What You Need to Know:

1. Also known as the Lone Wolf of Wall Street, Bernard was able to amass huge wealth in the markets all by himself. He wasn’t helped by anyone. Nobody recommended anything to him. I’m not preaching against getting help (even that’s encouraged) or recommendations: I just want you to know that you can become successful also through your own personal effort. In an interview, Dr. Brett N. Steenbarger recently said that winning speculators are their own coaches. Never follow the crowd, especially in doing what you know to be irrational and illogical.

2. Don’t blame anybody for your mistakes and failures. This world is full of many people who goof, and yet look for things and others to blame. For example, failing traders blame other traders, coaches, brokers and the markets for their failure, which is not normal. You can’t make any progress until you see yourself as the source of your problem and the source of your solution. One American author says: “If it’s going to be, it’s up to me.” If it’s going to be, it’s up to you (not anyone else). You’re the architect of your success or failure in the market.

3. Bernard advised against buying at the bottom and selling at the top. He said that couldn’t be done except by liars. Please follow the trend, which may sometimes go further than you can imagine.

4. A speculator is a man who observes the future, and acts before it occurs. When you make money, definitely you’re not losing money. Winning traders thrive under pressure. They grow in uncertainties and become mature more and more in the constant challenges that market throws at them.

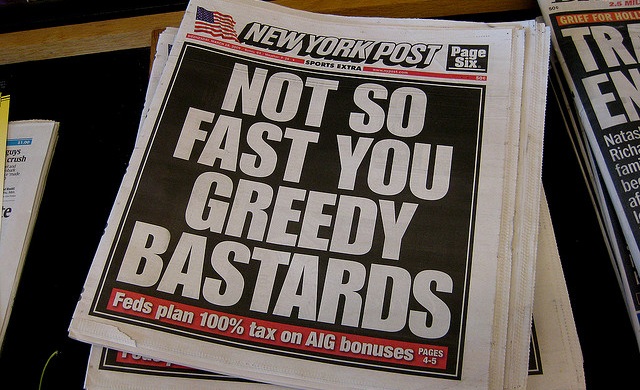

5. Bernard knew when to exit the market – he knew when to sell his shares. Once he got this signal, he sold as soon as possible. He said when good news about the market hits the front page of the New York Times, sell. When the public begins to feel encouraged by a price movement, then it’s time to sell.

6. Bernard said: “Take the obvious, add a cupful of brains, a generous pinch of imagination, a bucketful of courage and daring, stir well and bring to a boil.” How can traders interpret this relevant statement?

7. In certain cases, the fundamentals in the market are mere noises; published figures or what a CEO of a company says. A market is either moving sideways or upwards or downwards. It might be choppy, volatile or quiet. Just look at what the price is doing and respect it, not what news says or what a CEO or a chairman says.

Conclusion: I’ve found that listening to other traders and helping them understand good trading principles makes me genuinely happy. There is much beauty and reward in the markets, but you can only benefit from those good things when you become a profitable trader.

This article is ended by a quote from Bernard. The quote at the top of this article is also from him:

“If a speculator is correct half of the time, he is hitting a good average. Even being right 3 or 4 times out of 10 should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he is wrong.”

Source: www.tallinex.com

What Super Traders Don’t Want You To Know: Super Traders

Hot Features

Hot Features