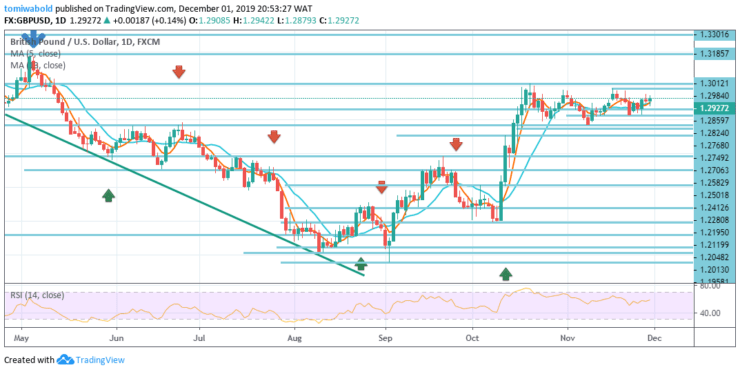

The pound had a positive prior week as traders anticipate to build the scenario for buyers to step in, and now it seems likely to continue on the upside. If we can exceed the crucial level on the level at 1.3012, it is likely that the pound sterling takes off towards the level of 1.3185, and then possibly even the level of 1.3301 depending on the extent buyers push the FX pair.

GBPUSD Price Analysis – December 1

Key Levels

Resistance Levels: 1.3301, 1.3185, 1.3012

Support Levels: 1.2768, 1.2582, 1.1958

GBPUSD Long term Trend: Bullish

In the longer term, the increase from the level at 1.1958 is viewed as consolidation from beneath. A new advance towards resistance on the level at 1.3301 may be seen. At the moment, this may continue to be the preferred scenario as long as the level at 1.2582 resistance turned support stays intact.

However, the firm break of the level at 1.2582 may shift the target towards the level at 1.1958 low and further beneath. The outlook stays bullish, displaying an intact uptrend in the short and long-term.

GBPUSD Short term Trend: Bullish

GBPUSD remained in consolidation since hitting the level at 1.3012 in the prior week while the trend is unaltered. The initial bias may stay neutral initially for this week. The retracement may be limited by the level at 1.2768 support.

Although on the positive side, the break of the level at 1.3012 may reactivate the entire rally from the level at 1.1958. However, the break of the level at 1.2768 may advance a further plunge to the level at 1.2582 resistance turned support.

Source: https://learn2.trade

Hot Features

Hot Features