Key Support Levels: $40, $30, $20

Key Resistance Levels: $70, $80, $90

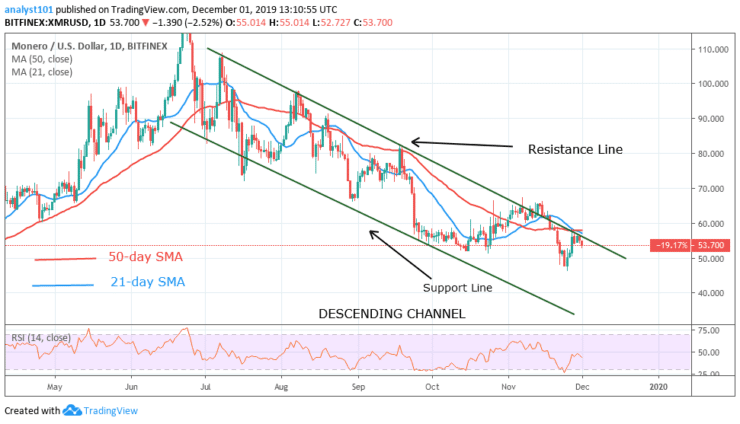

XMR/USD Price Long-term Trend: Bearish

The coin had been trading above $50 in October in a sideways trend. In November, Monero made a positive move and broke above the $60 price level. The bulls could not sustain the move above the upper price level as the coin was resisted at $65. Monero drops and breaks the low at $50 to a new low of $47. The coin is falling after pulling back to retest the previous low at $50. There are indications that the coin will fall as the previous low has been broken. If the selling pressure continues, the price will reach the lows of either $34 or $40.

Daily Chart Indicators Reading:

The downward move has been characterized by a series of lower highs and lower lows. The coin retested the resistance line and made a downward move. The price may fall and reach the lower lows of the support line. The XMR has fallen and reached level 42 of the daily RSI period 14. It also indicates that the coin will fall as it is below the center line 50.

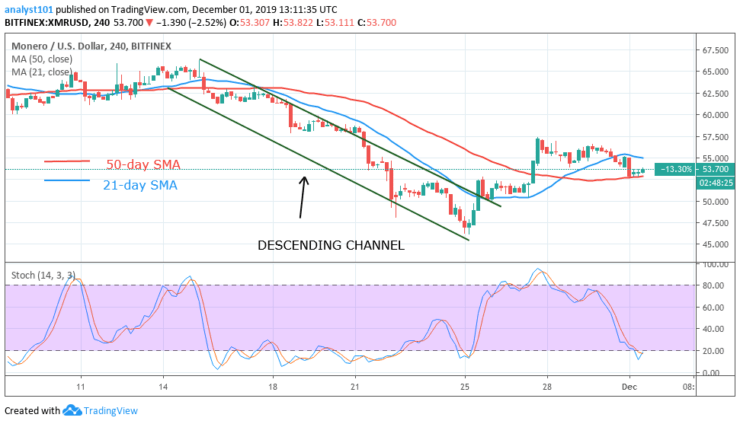

XMR/USD Medium-term bias: Bullish

On the 4-hour chart, the pair drops to the low of $46 and commences an upward move. The upward move was short-lived as the coin was resisted at $56. If the coin continues its falls and breaks below $46, the downward move will resume.

4-hour Chart Indicators Reading

The coin falls to the support of the 26-day EMA, if it breaks below it, the coin will resume depreciation. The pair is now trading in the oversold region below 20% of the daily stochastic. This indicates that the market is in a strong bearish momentum.

General Outlook for Monero (XMR)

Monero is trading in the bearish trend zone which tends to fall. Nevertheless, all the indicators are showing bearish signals. The coin is falling after testing the resistance line, if the coin holds above the support at $50, Monero will make an upward move. On the other hand, if it drops below $47, the downtrend will resume.

Monero (XMR) Trade Signal

Instrument: DASH/USD

Order: Buy Limit

Entry price: $47

Stop: $30

Target: $60

Source: https://learn2.trade

Hot Features

Hot Features