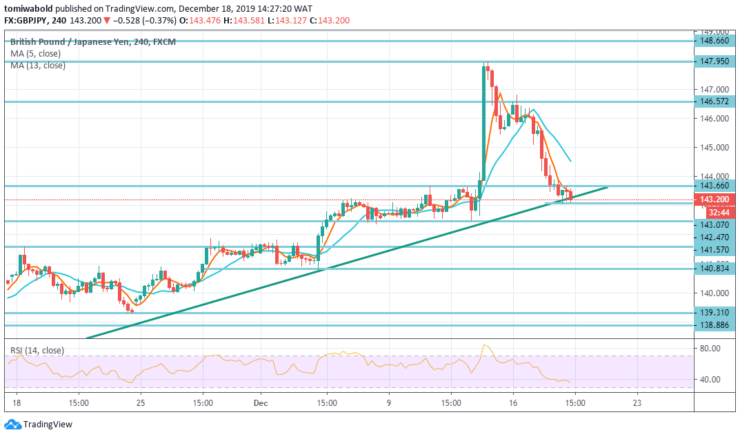

Since the trading session on Tuesday, the currency pair has fallen by almost 303 basis points against the Japanese yen. As for the near future, the GBPJPY exchange rate may recover on a cluster formed by the daily trend line at 143.07. If the cluster holds, a reversal is possible during this session.

GBPJPY Price Analysis – December 18

Key Levels

Resistance Levels: 148.66, 147.95, 146.57

Support levels: 142.47, 139.31, 126.54

GBPJPY Long term Trend: Bullish

In the longer term, an increase from the level of 126.54 may likely be a consolidation pattern from the level of 122.75 (low) or the beginning of a fresh uptrend. In any case, a more rally is anticipated, while the support level of 139.31 is held in the resistance zone of the level of 146.57 / 148.66.

The result from here may show the scenario it is supposed to be. Failure to do so may expand long-term range trend. A decisive breakout of the level at 148.66 may have long-term bullish consequences.

GBPJPY Short term Trend: Bullish

GBPJPY intraday bias remains neutral as the correction from the level of 147.95 expands. The downtrend is expected to be limited above the support level of 142.47, which may lead to continued growth.

On the other hand, above the level of 147.95, it can reach the level of structural resistance of 148.66 in the first place. A breakout may reach the next key resistance in the following. Nevertheless, a break of the level at 142.47 may indicate a short-term trend and lead to a further rollback to the support level of 139.31.

Instrument: GBPJPY

Order: Buy

Entry price: 142.47

Stop: 139.31

Target: 148.66

Source: https://learn2.trade

Hot Features

Hot Features