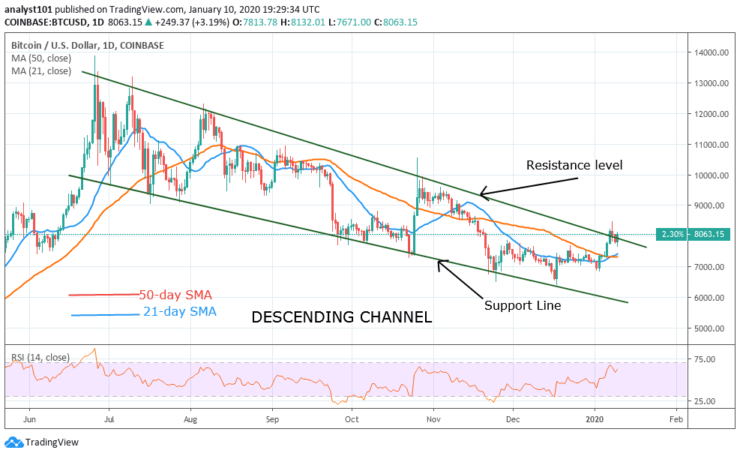

Key Support Zones: $7, 000, $6, 000, $5,000

Key Resistance Zones: $10,000, $11,000, $12,000

BTC/USD Long-term Trend: Bullish

Yesterday, the bulls made an impressive move as the bulls reach a high of $8,400. The coin was resisted and the price retraced to a low of $7,800. The support is holding which was previously a resistance level. This is an advantage to the bulls. The bulls are making a fresh attempt to revisit the $8,400 resistance. Possibly, a break above the resistance will propel Bitcoin to reach a high of $9,200. Caution must be taken as the bears will not throw in the towel for the bulls to take control of price.

Daily Chart Indicators Reading:

The bulls are attempting to break the downtrend line. The first time the bulls break the downtrend line, the price could not be sustained above it. This resulted in the retracement of the coin. In the second attempt, if the downtrend line is breached and the price is closed above it. Bitcoin will resume its uptrend move.

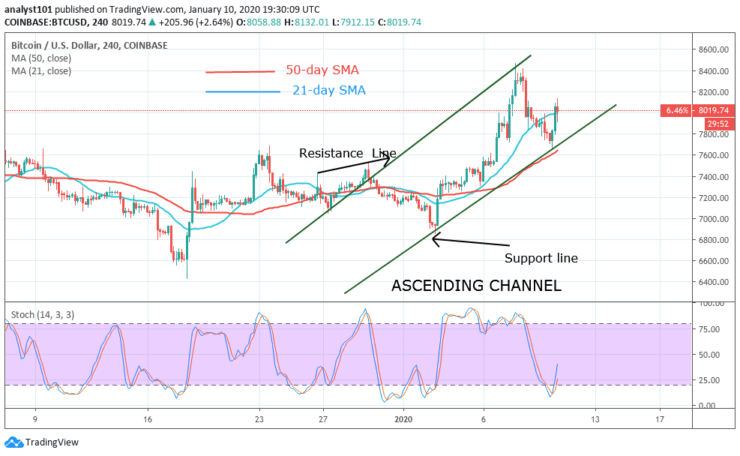

BTC/USD Medium-term bias: Bullish

On the 4 hour chart, the bulls tested the resistance at $8,400 twice before falling to the low of $7,800. Bitcoin will need more buyers at this level to sustain the current momentum. On the upside, the bulls have to break above the resistance and the price is sustained above it.

4-hour Chart Indicators Reading

Bitcoin is now trading above the 25% range of the daily stochastic. This indicates that Bitcoin is in bullish momentum. On the upside, if the price breaks above the resistance and it closes above it. The uptrend will resume. Conversely, if the price breaks below the support line and it closes below it, the selling pressure will resume.

General Outlook for Bitcoin (BTC)

Bitcoin is making a positive move in the recent highs. The pair is currently battling the resistance at $8,400. Buyers need to overwhelm the sellers at the current resistance, for the price to scale through to the higher price levels. Traders should adjust their parameters if a breakout occurs.

BTC Trade Signal

Instrument: BTC/USD

Order: Buy

Entry price: $8,000

Stop: $7,500

Target: $10,300

Source: https://learn2.trade

Hot Features

Hot Features