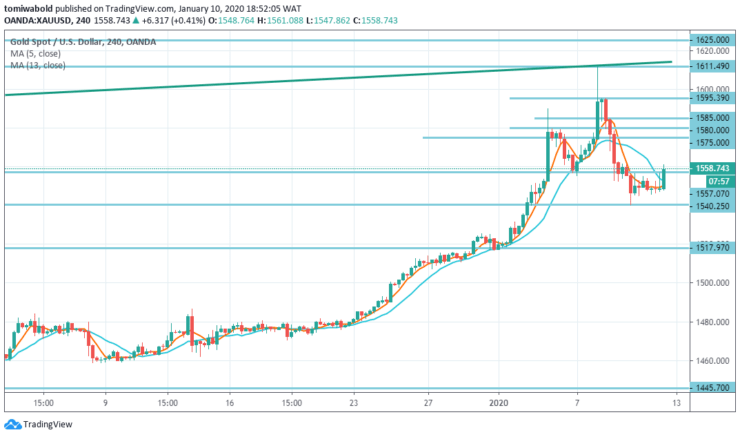

Gold rose in price in response to the grim release of NFP in the US, although it lacked a strong follow-up from buyers and stayed within the trading range of the previous session. Over the past 24 hours, the yellow metal has been trading in a limited trading range near the level of $ 1,550.

XAUUSD Price Analysis – January 10

Key Levels

Resistance Levels: $ 1640, $ 1625, $1611

Support Levels: $ 1557, $ 1540, $ 1517

XAUUSD Long term Trend: Bullish

The yellow metal is consolidating on the previous resistance, unfolded by a horizontal support line, and also indicates further weakness while a continued decline may lead to a fall in gold to the level of $ 1,540 shortly.

However, if this level does not hold, the price of gold may likely go down during the next trading session. In this case, the yellow metal may fall beneath the $ 1,517.

XAUUSD Short term Trend: Bullish

The recent fundamental surge managed to soon go to top the upper trend line of the pair, which reflects the jump in the yellow metal from 2017. However, the price immediately receded.

At present, we expect a push down to the price level of $ 1,517. A rebound from the level of $ 1,557.07 may cause the price to rise to the level of $ 1,575 and the level of $ 1,585.

Instrument: XAUUSD

Order: Buy

Entry price: $1557.07

Stop: $1517

Target: $1595

Source: https://learn2.trade

Hot Features

Hot Features