The common currency began the week on a steady tone, leading EURUSD to test Monday’s higher end of the range near 1.0900 marks. The FX pair looks to continue to Friday’s growth, though a crucial barrier test at 1.0900 level is still inaccessible. Furthermore, coronavirus trends seem to control, for the moment, the risk appetite dynamics.

EURUSD Price Analysis – April 20

Key Levels

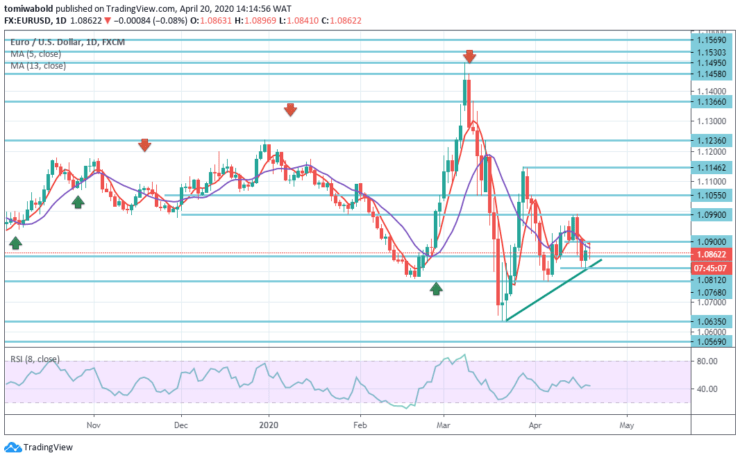

Resistance Levels: 1.1496, 1.1146, 1.0990

Support Levels: 1.0768, 1.0635, 1.0569

EURUSD Long term Trend: Ranging

The pair is presently gaining 0.13 percent at 1.0863 level and a breakout of 1.0990 (high Apr.15) level may approach level 1.1055 (Moving Average 5 Top) level en route to level 1.1146 (high Mar.27). On the contrary, instant position aligns at level 1.0812 (low Apr.17), followed by level 1.0768 (low Apr.6) and subsequently level 1.0635 (low Mar.23, 2020).

In the larger context, the whole downtrend from 1.2555 (high) level may still be in effect as long as 1.1495 resistance level stays. The initial goal is level 1.0339 (low in 2017). Nevertheless, a continuous break of 1.1496 level may suggest that such a downward trend is over.

EURUSD Short term Trend: Ranging

Firstly, the intraday bias in EURUSD stays neutral, as consolidation from level 1.0635 may continue farther. At the downside, the break of level 1.0768 may increase the decline from level 1.1146 to low level 1.0635 retest.

On the contrary, the corrective trend from level 1.0635 will also be continued with yet another recovery over 1.0990 level. .Although upside at 1.1236 level will be constrained by a retracement of 61.8 percent from 1.1496 to 1.0635 levels.

Source: https://learn2.trade

Hot Features

Hot Features