Apart from the US-China disagreements, fears over a second wave of the Covid-19 outbreak are heavily influencing the market’s risk-sentiment. The latest updates from the US indicate that there was a jump in cases from Texas while the hospitalization rate increased drastically in Oklahoma and Florida on Wednesday. However, President Donald Trump has hinted at a possible cure for the disease, which appears to have calmed the risk-off bias.

Furthermore, the India-China tussle and the Asian Development Bank’s ‘downward revision’ to the growth forecasts for 2020 are also adding pressure on the market’s trading sentiment. Many expected that the surprise rate cut by the People’s Bank of China would tame the pessimism, however, this went by mostly unnoticed.

The US 10-year Treasury yields remain in a downtrend causing the US dollar index (DXY) to remain under selling pressure thereby increasing the demand for the dollar-denominated commodity.

Although the market remains in a mixed market-sentiment state, gold could likely gain more bullish momentum in the near-term.

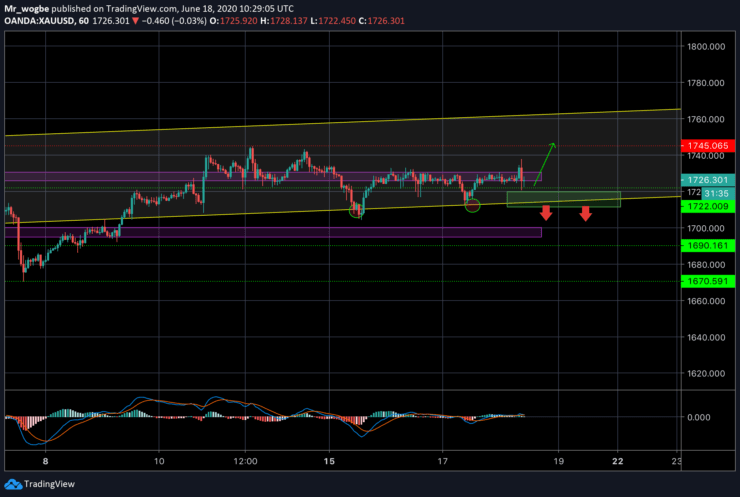

Gold (XAU) Value Forecast — June 18

XAU/USD Major Bias:Sideways

Supply Levels: $1,735, $1,745, and $1,753

Demand Levels: $1,717, $1,710, and $1,705

Gold has recovered fairly well since its recent bounce off our ascending channel baseline. Gold remains dedicated to retaking the $1,745 resistance and will likely do so soon. A surge to the $1,765 level (2020-high) is looking increasingly possible in the near-term. Meanwhile, a drop below $1,711 seems very unlikely considering the activities playing out on the global space.

Source: https://learn2.trade

Hot Features

Hot Features