USDCHF drops beneath 0.9100 level, down 0.25% on a day, during the European session on Friday. The USDCHF pair sustains selling bias falling sharply for the third day in a row. The Swiss franc holds onto recent strength after the ECB meeting as the US dollar stays under pressure.

Key Levels

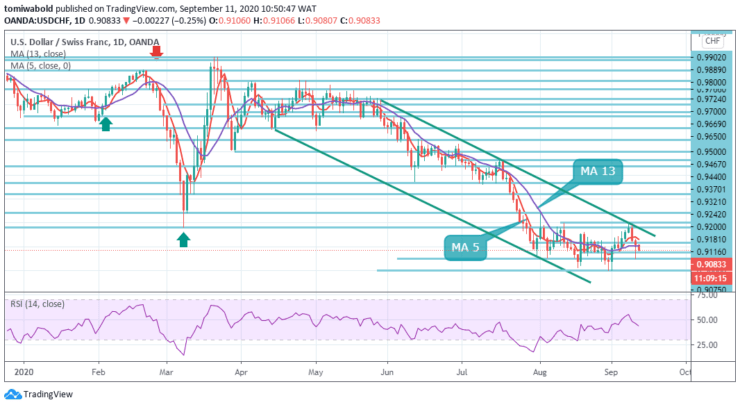

Resistance Levels: 0.9902, 0.9467, 0.9200

Support Levels: 0.9050, 0.8845, 0.8639

USDCHF Long term Trend: Bearish

USDCHF Long term Trend: Bearish

As seen on the daily, USDCHF extended weakness below the moving average 5 and 13 while sellers are likely to keep the reins and target a retracement level of 0.9075 level during the immediate declines.

The 0.9050 area is the immediate support, and a break lower would expose the 0.8998 level that registers as the multi-year low. On the upside, now 0.9116 level is the immediate resistance followed by 0.9181 and 0.9200 levels.

USDCHF Short term Trend: Ranging

USDCHF Short term Trend: Ranging

Intraday bias in USDCHF stays slightly on the downside for validating the 0.8998 thresholds. A dip may restart a larger downtrend. Even so, the 0.9200 level break may revive the turnaround from 0.9902 to 0.8998 at 0.9321 levels to 38.2 percent retracement.

Continuous selling underneath the 100% forecast of 1.0342 to 0.9181 from 1.0231 at 0.9075 levels sets the stage for a forecast of 138.2 percent at 0.8639 levels. To be the first sign of short-term bottoming, a breach of the 0.9370 resistance level is required on the upside.

Source: https://learn2.trade

Hot Features

Hot Features