EURJPY is accelerating from a low of around 123.00 as upside potential prevails over sellers for another session on Friday. The cross has so far managed to hold above the 123.00 level. Given the uncertainty, it would be a mistake to set an end date for the response to the pandemic, European Central Bank (ECB) governing board member said on Friday.

Key Levels

Resistance Levels: 127.07, 126.46, 125.00

Support Levels: 123.00, 122.37, 119.31

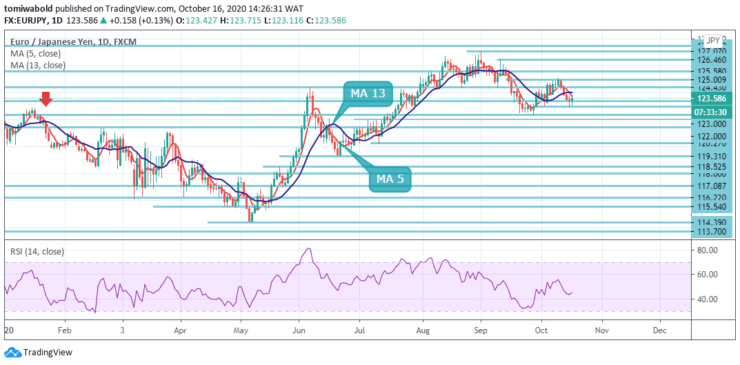

EURJPY Long term Trend: Ranging

EURJPY Long term Trend: Ranging

As noted on the daily chart, if selling momentum picks up additional pace, then the pair is expected to continue to the next relevant area around 123.00, where it sits low in October. Further south, there is critical horizontal support just above the 122.37 level.

While the RSI recovery from the near oversold area suggests a further recovery in the pair, a clear break of the 124.00 marks becomes necessary for the EURJPY bulls ahead of the 124.43 level and the weekly high near the 125.00 level.

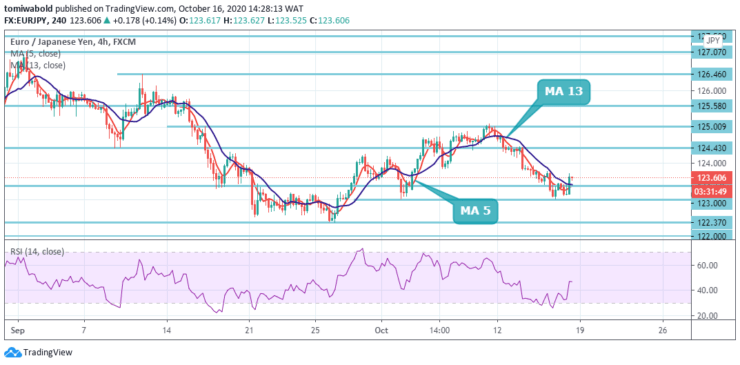

EURJPY Short term Trend: Bearish

EURJPY Short term Trend: Bearish

EURJPY intraday bias remains bearish, with 38.2% retracement from 114.39 to 127.07 at 122.37. A solid break there would confirm a resumption of the entire corrective fall from 127.07 and aim a 61.8% correction at 119.25, close to the pivotal support at 119.31.

On the other hand, however, a break of the 125.00 level will bring the upward trend back to retest the 127.07 level. Conversely, a clear dip below the 123.00 level could plummet towards the 120.00 psychological magnets.

Source: https://learn2.trade

Hot Features

Hot Features