Ever since Facebook publicized its plans to develop a digital currency called Libra, central banks across the globe have tried to counter it with their cryptocurrency. While Facebook’s Libra has come under heavy scrutiny and regulatory obstacles, more than 80% of the world’s central banks are working assiduously to develop a central bank digital currency (CBDC).

Meanwhile, the foundational basis of a CBDC is fundamentally disparate to what Bitcoin (BTC) is about. That said, the cryptocurrency community has begun speculating what the effect of a government-issued digital currency would have on the benchmark cryptocurrency.

Below are some of the possible outcomes of CBDCs on Bitcoin:

Plot A

The common expectation is that CBDCs will be bad for Bitcoin and the crypto industry at large, considering that world governments will place their weight behind CBDCs giving it a higher adoption rate compared to BTC.

Plot B

The next popular opinion is that CBDCs could give Bitcoin better widespread use and adoption, as it could spark heightened interest in digital currencies.

Plot C

Assuming that Plot A comes into fruition, there would be no use for Bitcoin as a peer-to-peer payment system. However, this doesn’t mean BTC becomes useless, instead, it becomes an excellent store of value.

Key BTC Levels to Watch in the Near-Term

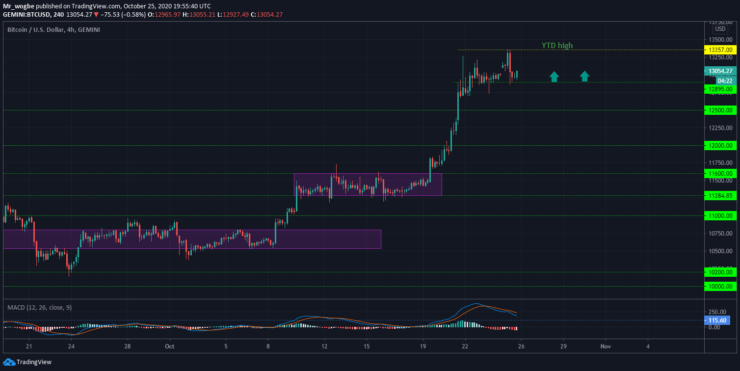

Bitcoin, against popular belief, doesn’t seem to be slowing down any time soon. The cryptocurrency just recorded a new YTD high at $13,357 in the past 24 hours. BTC has been trading within a consolidation range between $13,300 and $12,895 for the past four days, as traders expect a fresh bull wave.

That said, as long as Bitcoin maintains its stance above the $12,895 support, we could see a fresh bull wave in the coming days. A sustained fall below the aforementioned support could trigger an extended retracement for the cryptocurrency.

Total market capital: $395.4 billion

Bitcoin market capital: $241 billion

Bitcoin dominance: 61%

Source: https://learn2.trade

Hot Features

Hot Features