Key Resistance Levels: $1,900, $1,950, $2000

Key Support Levels: $1,750, $1, 700, $1,650

Gold (XAUUSD) Long-term Trend: Bullish

Gold’s (XAUUSD) price is above the moving averages but faces rejection at $1,800. The market ought to rise as prices are above the moving averages. The bulls are yet to keep the price above the moving averages. Since July, buyers have failed to sustain the bullish momentum above the $1,800 resistance level. According to the daily stochastic, Gold is trading in the overbought region of the market. Therefore the current uptrend may face rejection to the downside.

Daily Chart Indicators Reading:

The gold price has risen to level 56 of the Relative Strength Index for period 14. XAUUSD is in the uptrend zone and above the centerline 50. It is capable of rising. The moving averages are sloping horizontally indicating the sideways trend. Gold price is above the moving averages indicating a possible rise of Gold.

Gold (XAUUSD) Medium-term bias: Ranging

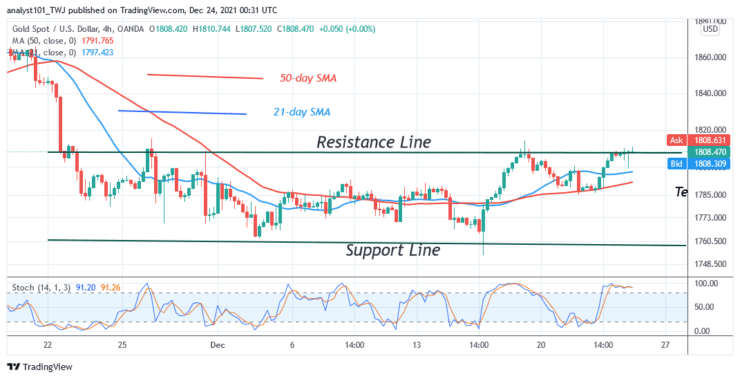

On the 4 hour chart, the Gold price is in a range-bound move. Since November 23, the market has been fluctuating between $1,760 and $1,800. Since July, the bulls have not broken above the $1,800 resistance level. In the same vein, since November 23, the bulls have been defending the $1,760 support. Gold price will resume trending when the range-bound levels are breached. The market will have an accelerated movement if the $1,800 resistance is breached, The market will rally to $1,860 high.

4-hour Chart Indicators Reading

The market is still above the 80% range of the daily stochastic. It has risen to the overbought region. The Gold price is likely to retrace or fall. In other words, sellers will emerge in the overbought region of the market to push prices down.

General Outlook for Gold (XAUUSD)

Gold’s (XAUUSD) has been trading in a sideways trend since November but faces rejection at $1,800. The price is relatively stable as it fluctuates between $1,760 and $1,800. Presently, Gold is likely to fall as it reaches the overbought region of the market.

Source: https://learn2.trade

Hot Features

Hot Features