Through Bitcoin ordinals, non-fungible tokens (NFTs) are introduced to the blockchain of Bitcoin. The intrinsic value of Bitcoin is increased by this novel strategy, and long-term investors are given new possibilities to participate in bitcoin-based NFTs.

Non-fungible tokens (NFTs) have been making waves in the cryptocurrency investment market since 2021. They are now also prepared to make a splash in the Bitcoin ecosystem. They are mostly housed on blockchain networks that enable smart contracts (like Ethereum, Solana, Binance Chain, etc.). Casey Rodarmor’s brilliant Bitcoin ordinals system has made this possible.

The smallest unit of Bitcoin, known as a Satoshi, is assigned a unique identifier. This, therefore, makes each of the units trackable. So, each Satoshi is effectively transformed into Bitcoin’s very own NFTs, and each of them can contain unique inscriptions like images, texts, or GIFs.

Since the beginning of the year, millions of such tokens have been minted, and the information encoded in each of these tokens is permanently recorded on the Bitcoin network. This will guarantee decentralization and

freedom from outside interference.

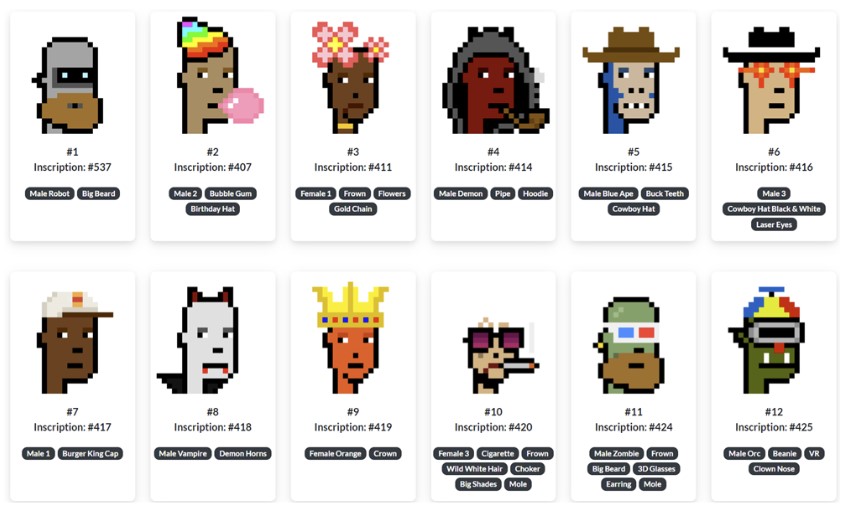

Some of the Popular Bitcoin Ordinals

Ordinals quickly gained popularity after being introduced, with some pieces fetching hundreds of thousands of dollars.

An Ethereum-based platform known as OnChainMonkey used a scalable methodology and created 10,000 ordinals in a single inscription without overwhelming the network.

Also, 288 of the 300 pieces in Yuga Labs’ “TwelveFold” collection, which was created using cutting-edge rendering software and 3D modeling applications, were offered for auction. The remaining 12 were set aside for charitable projects.

The Functionality of Bitcoin Ordinals

Bitcoin Ordinals were introduced in January, and they enable non-fungible tokens (NFTs) to exist on the Bitcoin network. The objective was to immortalize digital content (such as artwork, literature, or videos) on the Bitcoin blockchain.

Bitcoin ordinals are acting like a tracking system for each Satoshi minted on the network. They develop into NFTs as we add additional data to them. A Satoshi is created during the Bitcoin mining process and is given a unique number that we can track in all upcoming Bitcoin transactions.

To give an example, the special number for the 1,000th Satoshi would be 1000. The maximum amount we will be able to have is 21 million bitcoin; hence, there will ultimately be 2.1 quadrillions of these randomly generated units. One may refer to each as an “ordinal.”

The Ordinal Inscriptions

Bitcoin ordinals make up the first component of the Bitcoin NFTs, and the content or inscriptions make up the second. It would be similar to an autograph being inscribed on the banknote in the case of the dollar bill.

The inscribed content of Bitcoin ordinals is permanent, unchangeable, and Bitcoin-native because ordinals are verified and recorded on the Bitcoin blockchain. Inscriptions are entirely on-chain, unlike the majority of existing NFTs that rely on off-chain storage, making them decentralized and immune to third-party control.

Please note that this new idea does not add a new layer of modification to the Bitcoin blockchain; rather, it gains from the Taproot upgrade. This boosts its operations.

An upgrade implanted in 2017 known as SegWit holds inscribed content in the witness section. Later, Taproot improved this by eliminating data storage restrictions within blocks, enabling inscriptions of about 4 MB in size.

The Difference Between Ordinals and NFTs

An NFT stands apart from the blockchain’s native cryptocurrency as its host. For instance, the protocol treats an NFT built on Ethereum differently than an ETH token. An NFT stands apart from the blockchain’s native cryptocurrency as its host. For instance, the protocol treats an NFT built on Ethereum differently than an ETH token. On Ethereum, NFTs have their requirements. NFTs and conventional tokens cannot be confused for this reason.

Bitcoin ordinals can functionally exist as either fungible or non-fungible units because the Bitcoin protocol does not natively recognize them elsewhere. The choice and acceptance of Satoshi owners and Bitcoin users will determine this. If a user doesn’t appreciate or identify the inscription on a Satoshi, they can treat it like any other Satoshi for the Bitcoin protocol. With Ethereum NFTs, where uniqueness and non-fungibility are mandated at the protocol level, this is not conceivable.

To illustrate this better, a one-dollar bill that has the autograph of a famous person on it is still just regarded as a one-dollar bill in the bank. However, if a collector who values the autograph were to buy it, he or she would buy it at a higher price.

Another significant distinction between NFTs and Bitcoin ordinals is that whereas NFTs are frequently linked to off-chain data on the Interplanetary File System (IPFS), a decentralized file storage system that can be modified via dynamic metadata, Bitcoin ordinals are recorded directly on-chain and cannot be censored.

Another thing that makes NFT different from Bitcoin ordinals is that it supports creator royalties, and for this reason, some people regard Bitcoin ordinals as digital artifacts.

Conclusion

Bitcoin ordinals have only been available for a short while, and they haven’t altered the ecosystem’s laws. On the other hand, they offer enormous potential in the long run. The key selling point is that content tied to Satoshis cannot be censored, while collectibles enjoy unparalleled security as a result of being kept directly on-chain.

Just like the NFT on Ethereum was successful, we should see an increase in the trading of Bitcoin ordinals on secondary markets. This should attract investors who are eager to leverage on their unique capabilities. It’s also conceivable that if and when the NFT market as a whole recovers, some of these ordinals could experience sharp increases. It’s also conceivable that if and when the NFT market as a whole recovers, some of these ordinals could experience sharp increases.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features