Investing in cryptocurrency extends beyond mere speculation about rising prices; it’s about leveraging comprehensive data insights. Unlike conventional investments such as stocks and bonds, cryptocurrency investments, rooted in blockchain technology, offer unparalleled transparency. This technology grants investors immediate access to critical data points, including user activity, transaction volumes, and associated fees, enhancing informed decision-making in the digital asset landscape.

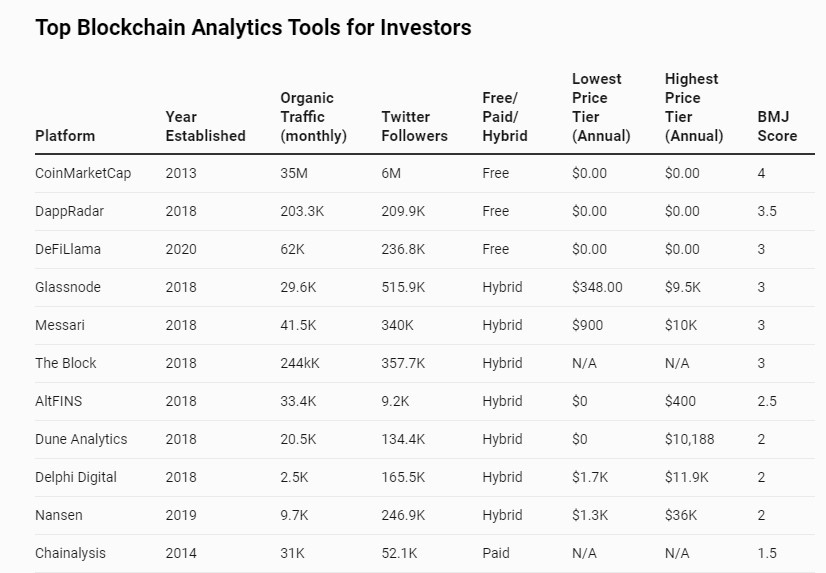

In today’s blockchain landscape, a plethora of analytics tools abound, presenting both opportunities and challenges for investors, especially those new to the space. Below, we’ve curated a list of the top analytics tools, offering insights into their standout features and how we personally leverage them for informed decision-making.

CoinMarketCap

Founded in 2013 by software engineer Brandon Chez, CoinMarketCap swiftly emerged as a go-to platform for tracking cryptocurrency prices and market caps. Following its acquisition by Binance in 2020, the platform expanded its offerings, now providing real-time analytics for over 10,000 cryptocurrencies, including price trends, market rankings, and historical data, alongside a news section highlighting the latest crypto developments.

The platform offers structured market data via its API service. Although a free version exists, seasoned investors often opt for the premium “Pro” subscription, which grants access to advanced features, crucial metrics, and unrestricted real-time data.

DappRadar

Originating from Vilnius, Lithuania, DappRadar, established in 2018 by a local team of blockchain experts, offers insights into DeFi and blockchain applications. While it shares similarities with DefiLlama in its DeFi emphasis, DappRadar uniquely prioritizes blockchain app analytics, presenting rankings and metrics such as daily volumes and active wallets.

Dedicated analytics tools exist for NFTs and diverse app sectors. Subscribers can utilize a sophisticated API for real-time insights across multiple blockchains, encompassing dapps, NFTs, and gaming.

DefiLlama

In early 2020, DeFi protocols gained traction in the blockchain realm. DefiLlama, crafted by passionate developers entrenched in decentralized finance, offers users specialized analytics tools. Its standout feature is a ranking page, allowing users to sort DeFi protocols based on diverse criteria.

Key metrics encompass total value locked (TVL), liquidity, market trends, daily volume, and additional indicators, enabling swift protocol comparisons. For investors, a notable tool is the yield farming calculator, which provides real-time ROI estimates across various DeFi protocols.

Glassnode

Launched in 2018 by blockchain experts, Glassnode has become a favored on-chain analytics platform for crypto enthusiasts. While offering a free Glassnode Studio tailored for casual investors and newcomers, it provides essential metrics and tools, including daily transaction insights, network activity, and active addresses.

To access advanced analytics and real-time data on cryptocurrencies and DeFi projects, a subscription is essential, offering a broader range of on-chain metrics for enhanced insights.

Messari

Ryan Selkis, founder of CoinDesk, also initiated Messari.io in 2018, offering investors and institutions premium research on prominent blockchains and crypto projects. Beyond analytics tools, Messari.io boasts an expert analyst team dedicated to crafting detailed market reports and delivering insights on blockchain advancements.

The platform offers market analysis, risk assessment tools, and features tracking trading volumes and market cap. Additionally, Messari.io hosts a community forum for user collaboration and engagement.

The Block

Founded in 2018 by journalist Mike Dudas, The Block stands as a premier news and research hub for the blockchain sector. While mirroring elements of Messari.io’s research emphasis, it also upholds CoinMarketCap’s news-centric approach to cater to both investors and developers.

Unlike typical blockchain analytics platforms focused on graphs and metrics, The Block resembles an online news portal, delivering timely reports for cryptocurrency users and investors.

altFINS

Launched in 2018 by experts in blockchain and finance, altFINS offers comprehensive analytics spanning on-chain insights to market trends and trading behaviors. The platform provides real-time data on the top 55 cryptocurrencies, complemented by a research hub featuring AltFins’ detailed reports.

While certain advanced features are subscription-based, AltFINS provides complimentary data analytics and market insights. It serves as a valuable resource for investors interested in trading signals, market trends, and technical analyses.

Dune Analytics

Launched in 2018 by Frederick Haga, Mats Julian Olsen, and Simen Øygard, Dune Analytics is a favored platform for users to craft and share reports using real-time blockchain data. Its distinctive feature lies in its adaptability; users can design tailored dashboards and tools for key blockchain metrics. Additionally, Dune provides a range of pre-designed templates for investors to customize their dashboards.

Dune’s analytics tools cater to leading blockchains such as Ethereum, Polygon, and BSC. However, users can also analyze networks outside of Dune’s native support by connecting to the network’s API or importing data directly into the platform.

Blockchain Analysis

Beyond mere pricing, blockchain analysis delves into the data inscribed on a blockchain, offering insights into cryptocurrency utilization patterns. On-chain analytics, encompassing transaction volumes, mining rewards, wallet balances, token supply, and block times, is crucial. Notably, user growth stands as a paramount metric in this assessment.

Lessons for Investors

While blockchain investments carry inherent risks, they also present lucrative opportunities. Savvy investors diversify effectively, leveraging strategies like our Blockchain Believers Portfolio. Within this realm, we employ both qualitative and quantitative analyses to select enduring projects, with blockchain analytics tools bolstering our quantitative assessments. As the crypto landscape matures, data-driven tools facilitate risk management and informed investment choices in blockchain.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features