Delving into the depths of history, the Mesopotamian Code of Hammurabi, a Babylonian legal document dating back to around 1760 BC, intriguingly omits the number 13 among its laws.

Venturing into the realm of superstitions, those who harbor a fear of 13 are known as triskaidekaphobics. Notable figures like renowned horror novelist Stephen King and the 32nd president, Franklin D. Roosevelt, find themselves on this intriguing list.

Exploring the origins of Friday, the 13th apprehension, we journey back to a chilling event in the 14th century. On Friday, October 13, 1307, King Philip IV of France ordered the arrest of the Knights Templar, leading to the torture and demise of many knights.

For those who cringe at the mere thought of Friday, the 13th, there’s a term: paraskevidekatriaphobia.

Contrary to its modern stigma, the number 13 was once considered a symbol of good luck in France before the First World War. It adorned postcards and charms, reflecting a time when 13 held positive connotations.

Does Friday, the 13th, Bring Misfortune to the Market?

In the realm of crypto, the age-old notions of good, bad, lucky, or unlucky take on a new dimension. The impact of Friday, the 13th, on portfolios may seem negligible unless you’re grappling with financial challenges.

Surprisingly, Friday, the 13th, has often brought positive vibes to the stock market. The S&P 500, since its inception, has witnessed an average gain of 0.1% on this seemingly ominous day. This might sound modest, but it’s three times the average gain of 0.03% on all trading days.

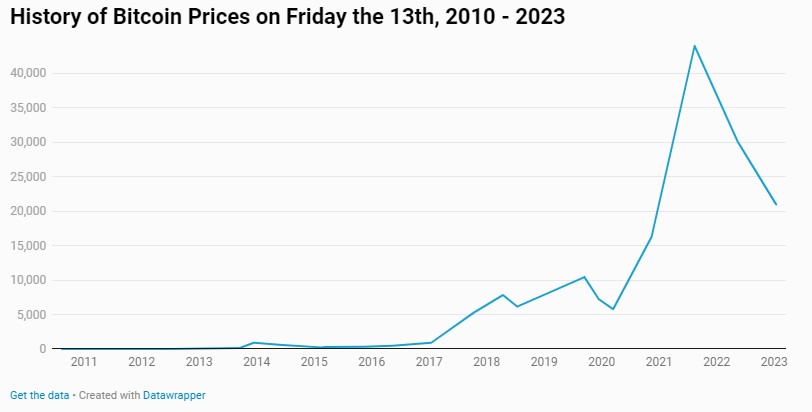

Delving into the crypto sphere, albeit with a shorter history to analyze, bitcoin has exhibited resilience and positive performance on Friday, the 13th. Contrary to common superstitions, data since 2010 reveals an average bitcoin rise of 1% on this date, accompanied by significant surges in the subsequent one and three months. Remarkably, this marks a tenfold increase compared to the average gains seen in stock markets on Friday, the 13th.

Diving into the 1-month aftermath of Friday the 13th reveals a fascinating narrative. Bitcoin, defying superstitions, boasts an impressive average return of 14% during this period. The S&P 500, a stalwart in traditional markets, can only match or exceed this figure on rare occasions dating back to 1900.

In a historical journey through monthly returns, the S&P 500 has eclipsed the 14% mark merely three times. The last instance occurred in 1938, highlighting the rarity of such surges.

• April 1933: 29.3%

• May 1933: 17.6%

• June 1938: 20.5%

As we explore the unique dynamics of cryptocurrency, Bitcoin’s consistent one-month performance after Friday the 13th emerges as a distinctive and intriguing phenomenon, setting it apart from traditional market patterns.

Lessons for Investors

In the realm of responsible investing, superstitions seldom play a role in gauging our financial gains. We distance ourselves from the realm of chance; we are not gamblers, and our success does not hinge solely on luck.

Sound investment practices are rooted in knowledge, patience, and thorough research. Armed with the right information and insights, the savvy investor navigates the world of cryptocurrency with confidence, regardless of the day on the calendar.

For crypto enthusiasts, the future is laden with promise. While the historical outperformance of Bitcoin lacks sufficient data for statistical significance, there’s an undeniable trend that positions Bitcoin as an outperformer compared to stocks, aligning with various historical measures comparing the two assets. In the world of investments, informed decisions and strategic approaches remain the keys to success, transcending superstitions and paving the way for a resilient and hopeful future.

Hot Features

Hot Features