The U.S. crypto market offers exciting opportunities, but with more regulations than in some regions. To thrive in this environment, choosing the right exchange is crucial. Whether you’re a seasoned investor or just starting out, there’s a platform perfectly suited to your needs.

For beginners, user-friendly interfaces like Coinbase can make the initial foray into crypto smooth. However, experienced traders might prioritize low fees, which is where Binance.US shines with its competitive spot trading rates.

The future of these exchanges is heavily influenced by regulatory bodies like the SEC and CFTC. Opting for an exchange with a proven track record of compliance ensures greater peace of mind. Steer clear of unestablished platforms that lack a strong regulatory history.

When making your selection, consider key factors beyond platform popularity. Security features, the variety of cryptocurrencies offered, transaction fees, ease of use, and reliable customer support are all crucial aspects to weigh. By prioritizing these elements, you’ll be well-equipped to find the perfect U.S.-based crypto exchange for your investment journey.

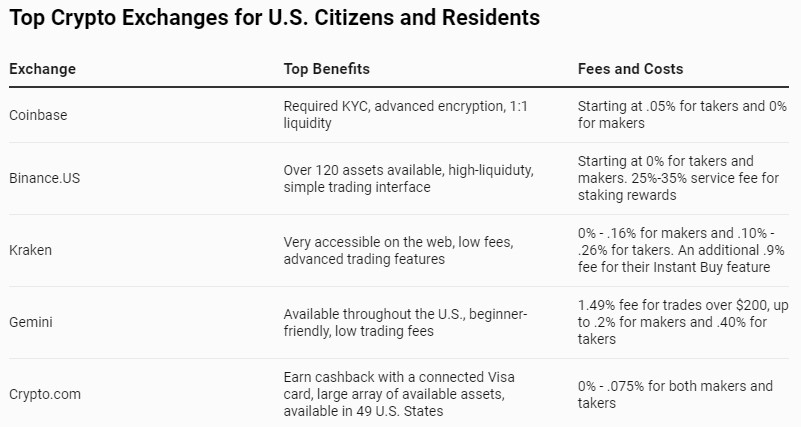

The cryptocurrency market continues to grow and evolve, attracting new investors all the time. If you’re a U.S. citizen or resident interested in buying and selling crypto, choosing the right exchange is crucial. Here’s a breakdown of some of the top contenders:

Coinbase

Coinbase isn’t just another crypto exchange; it’s a launching pad designed for beginners. Founded in 2012 by tech whizzes Brian Armstrong and Fred Ersam, Coinbase has become a household name in the crypto world.

Imagine a marketplace with over 100 countries joining in on the action, trading nearly $4 trillion worth of crypto daily! That’s the kind of buzz Coinbase brings to the table. But here’s the best part: You don’t need to be a financial wizard to get started. Coinbase’s user-friendly interface makes buying and selling crypto as easy as using your favorite app, all while keeping your funds secure with their robust security measures. And if you ever get stuck, their top-notch customer support is there to help. Coinbase keeps things affordable too, with reasonable fees that won’t break the bank.

Features and Benefits of Coinbase

- User-friendly interface: It is easy to navigate and understand, making it a good starting point.

- Relatively affordable fees:While not the cheapest, fees are reasonable for beginners.

- High security:Coinbase prioritizes security measures to keep your funds safe.

- Strong customer support: Reliable assistance for any questions or issues you encounter.

Coinbase has the green light to operate in almost all US states and was one of the pioneers to snag a BitLicense from the NY Department of Financial Services back in 2017.

Binance.US

Think of Binance.US as the “American dream” version of the giant global exchange Binance. Launched in 2019 to comply with stricter US rules, Binance.US offers over 120 cryptos for US traders. Based in Palo Alto, California, it’s a one-stop shop for US investors looking for a wide variety of crypto options.

Features and Benefits of Binance.US

- Competitive Fees: The US boasts some of the lowest trading fees in the US, especially for those using their own cryptocurrency, Binance Coin (BNB).

- Wide Variety of Cryptocurrencies: With over 120+ crypto assets available, Binance.US offers a comprehensive selection compared to other US-based exchanges.

- Advanced Trading Features: While offering a beginner-friendly interface, Binance.US also caters to experienced traders with advanced features like margin trading and stop-loss orders.

- Focus on Security: The US prioritizes security measures to protect user funds, providing peace of mind for investors.

Binance.US stands out as a top choice for experienced traders and cryptocurrency investors aiming for advanced trading features. Yet, concerns surrounding its parent company, Binance, might encourage users to explore alternatives with stronger regulatory oversight.

Kraken

Kraken isn’t messing around when it comes to security. This US-based exchange boasts a spotless record, never having been hacked. With over 100 tradable tokens and a daily trading volume of over $1.2 billion, Kraken is a heavyweight in the crypto world, serving millions of individual and institutional investors globally.

- Unmatched Security: Kraken prioritizes industry-leading security measures, boasting a history of never being hacked. This provides peace of mind for users who prioritize safety for their crypto holdings.

- Large Variety of Cryptocurrencies: With over 100 tradable tokens, Kraken offers a diverse selection for investors to choose from.

- Advanced Trading Features: Beyond its beginner-friendly interface, Kraken provides advanced features like margin trading and stop-loss orders, appealing to experienced traders looking for more complex strategies.

- High Daily Trading Volume: Kraken experiences a daily trading volume exceeding $1.2 billion, indicating a robust and active marketplace for users.

Gemini

Unlike most exchanges, Gemini lets all US citizens (except maybe those on their bad side) join the crypto party. This New York-based platform is available nationwide, even in states other exchanges shy away from. While it offers a slightly smaller selection of cryptos compared to some competitors, with over 80 currencies and 21 trading pairs, you’ll still find plenty of options to explore. Founded by the Winklevoss twins, famous for their Facebook feud with Mark Zuckerberg, Gemini prioritizes security and compliance, making it a solid choice for US crypto investors.

Features and Benefit of Kraken

- Nationwide Availability (Almost): Unlike many competitors, Gemini is available in all 50 US states, making it a great option for investors across the country.

- Focus on Security and Regulation: Headquartered in New York, a state known for stricter financial regulations, Gemini prioritizes security and compliance. This fosters trust and peace of mind for users, especially those new to crypto.

- User-Friendly Interface: Gemini offers a simple and easy-to-use platform, making it a good choice for beginners.

- Solid Selection of Cryptocurrencies: While not the most extensive, Gemini provides over 80 cryptocurrencies and 21 trading pairs, catering to a range of investor interests.

- Earn Interest: Gemini allows users to earn interest on certain crypto holdings, offering an additional way to potentially profit from their investments.

Learn from market wizards: Books to take your trading to the next level.

Hot Features

Hot Features