Remember those predictions about stablecoins and tokenized assets bringing in the masses? It turns out that crypto had a Trojan Horse all along. A decade ago, remittances were the talk of Bitcointalk forums, and smart contracts promised to revolutionize Wall Street. But the first wave of stablecoin and RWA users were crypto natives, using them for arbitrage and escaping volatility. This built the infrastructure for mainstream use cases like payments, remittances, and inflation hedges in unstable economies.

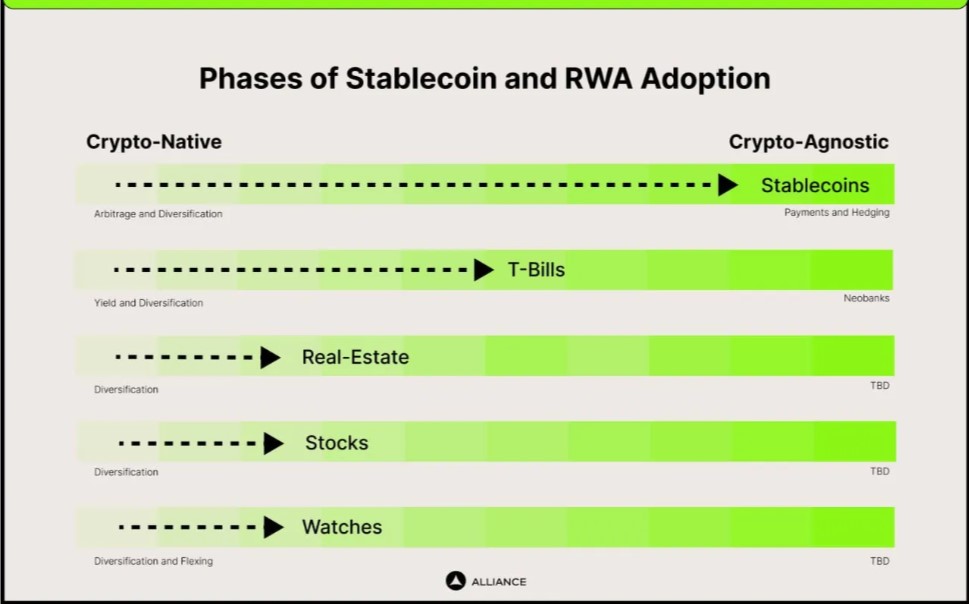

This two-phase adoption curve—crypto natives first, then the general public—makes sense as new products take hold with those already comfortable in the space. The real question now is: Where are different RWAs on this curve, and what use cases will drive mainstream adoption for each asset class?

Stablecoins are currently used for currency hedging and international payments, while other RWAs like treasuries, stocks, real estate, and luxury watches are primarily used for diversification.

Stablecoins: Hedging and Payment

Stablecoins facilitate $10 trillion in annual on-chain transactions, rivaling Visa and surpassing PayPal. This rapid growth in just a few years is remarkable. With a total supply of about $150 billion, each dollar turns over 60–70 times a year. This level of activity is possible due to the borderless and permissionless nature of the ledger.

Critics argue that stablecoins aren’t truly crypto-native and are often used for speculation. However, even if only 1% of the $10 trillion annual volume is for real-world uses like hedging and cross-border payments, it is still a significant amount.

We’ve observed this practicality firsthand, using USDC to fund startups, which then use stablecoins to pay employees or vendors. A notable example is the peer-to-peer stablecoin market in Colombia, where people exchange physical Pesos for Tron USDT in malls.

Over the past year, we’ve evaluated over 100 stablecoin startups in regions like Latam, Africa, Southeast Asia, and Eastern Europe. Many show early signs of product-market fit, with growth rates exceeding 10% monthly, unlike many other crypto startups.

For instance, Accrue, an African payment startup, demonstrates stablecoins’ impact: one founder’s sister saved in stablecoins to avoid the Ghanaian Cedi’s devaluation, using stablecoin-backed debit cards to pay tuition. Another startup, GoBankless, shared how stablecoins enabled a Mozambican patient to pay a South African hospital, bypassing cross-border fiat transaction delays.

These examples illustrate stablecoins addressing urgent, real-world issues, marking the crypto-agnostic phase of their adoption.

Other RWAs: Diversification

Stablecoins are just the beginning; other real-world assets (RWAs) are now coming onchain as well. Currently, $3 trillion, or about 1% of global wealth, is stored onchain, offering significant potential for diversification.

Historically, onchain wealth has mostly been exchanged for other crypto-native assets, which are highly correlated and volatile. As the crypto market matures, diversification will become essential. The world’s largest hedge fund, Bridgewater, has demonstrated the value of diversification through uncorrelated returns, a principle that also drives demand for the BTC ETF among traditional finance (TradFi) investors.

RWAs provide crypto investors with uncorrelated, less volatile returns, similar to how the BTC ETF serves TradFi investors. For example, MakerDAO’s RWA portfolio grew from nearly $0 to $4 billion in under a year, mostly in US treasuries. Blackrock, Ondo, and Franklin Templeton have also initiated significant treasury tokenization projects, indicating a growing interest in this space.

While $4 billion in RWAs may seem small compared to the $150 billion in stablecoins, stablecoins have had nearly a decade to grow, whereas interest in tokenized treasuries has surged only recently. Users need time to trust new products and ensure they track indices correctly, facilitate smooth creation and redemption, and maintain liquidity in secondary markets.

Following US treasuries, US equities and real estate are likely to be tokenized next, despite legal challenges. There is considerable international demand for these assets, as seen with Dinari, a startup offering tokenized US stocks that has seen strong demand from China and Russia. Tokenizing these assets could bypass capital controls and other barriers, making it easier for international investors to access US markets.

Critics argue that crypto-native assets offer better returns, but these assets are often too similar and correlated. Stocks and real estate, on the other hand, offer uncorrelated returns that the $3 trillion of onchain wealth can utilize.

As RWA infrastructure matures, we expect to see crypto-agnostic use cases emerge, such as using equities and real estate as collateral for loans or constructing a global portfolio without navigating complex legal and banking systems. This will mark the second phase of RWA adoption.

Conclusion

For years, we’ve sought the crypto world’s first “killer app”—a non-speculative breakthrough. Surprisingly, it might already be here: stablecoins.

Despite little attention from mainstream media, traditional finance, and even the crypto community, stablecoins are revolutionizing emerging markets by combating inflation and enabling cross-border transactions. Their impact is undeniable.

Stablecoins are just the beginning. There’s growing demand for tokenized real-world assets (RWAs) like treasuries, stocks, and real estate. This could allow trillions of dollars in on-chain wealth to diversify and better withstand economic volatility.

Learn from market wizards: Books to take your trading to the next level.

Hot Features

Hot Features