Even by the extraordinary standards of the first few months of this year, Italy’s benchmark stock index has taken a terrible pounding.

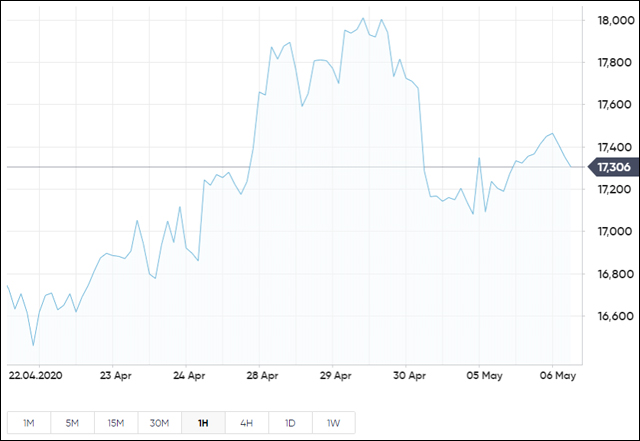

The FTSE MIB, representing the 40 most liquid and highly capitalised shares on the Milan exchange, saw out the old year at about 23,700. This morning, it traded at 17,380.10.

That’s a destruction of market value of more than 25%.

One of the “big three”

True, it’s not wildly out of line with, for example, the 22% loss on London’s FTSE 100 index over the same period. But as the European country in which the coronavirus first made landfall on the continent, the fate of the Milan exchange was always going to attract special attention.

It hit bottom on 16 March at 15,731.85, and has since made a tentative start at recovery.

Italy 40

Why Italy was affected by the virus with such severity is not yet clear, but the situation deteriorated rapidly and health services were overwhelmed. The death toll headed for 29,000, and the government brought in sweeping measures to try to control the spread of the disease, including the switching off of factory production lines..

This was hugely significant in European economic terms. Although Italy has been frequently bracketed with Spain, another southern European country badly hit by the coronavirus, there is, in fact, no real comparison Italy is a member of the Group of Seven leading economies, while Spain is not even a member of the wider Group of 20.

With Europe’s second-largest manufacturing economy, Italy is one of the euro-zone’s “big three”, being both a G7 member and part of the single currency.

“Health and economic emergencies”

The FTSE MIB constituents reflect the country’s commercial and industrial strength. There are the well-known names, such as Ferrari, Pirelli and Fiat Chrysler.

Financial services are represented by companies including insurer Assicurazioni Generali and the bank Mediobanca, while in utilities are Italgas and Telecom Italia.

Publishing its latest Article IV health check, in March, the International Monetary Fund (IMF) said it “recognised and supported the authorities’ near-term priorities that have rightly shifted to combating the pandemic and supporting health care, workers, firms and households”.

It added: “Directors [of the IMF] considered that the outbreak has created both health and economic emergencies that need to be addressed urgently, while amplifying uncertainty and downside risks. Once the health crisis has passed, they stressed the need to implement a comprehensive package of measures to boost potential growth and enhance resilience. This should comprise structural reforms to raise productivity and investment, a credible medium-term fiscal consolidation to put public debt on a firm downward path, and measures to support financial sector health.”

Last month, European Commission president Ursula von der Leyen accepted criticism that the EU had not done enough to help Italy at the start of the crisis, and she offered a “heartfelt apology” to the country.

Hot Features

Hot Features