FAT PROPHETS: The world’s largest contract chip manufacturer, foundry Taiwan Semiconductor Manufacturing (NYSE: TSM, initial buy at $10.76) this week announced its net revenues for the month of October and after a soft third quarter, the company looks to be back at the races. Revenues of NT$81.74 billion were the second highest monthly swag in the company’s history and up 26.7% from September 2015 and a smidgen (+1.2%) ahead versus the year ago October figure, itself a cracking month.

The company is off to a strong start for the final stretch of the calendar year and there are other potential catalysts in the wings to support the stock going forward as well.

But first, to put the strength of the October number in context, remember that semiconductor stocks have been facing headwinds for much of the last six months due to an inventory correction in the smartphone supply chain and softness in some other verticals. Mounting concerns of a slowdown in Chinese growth have also weighed on the sector more than some others given the chip industry’s cyclical and capital intensive nature.

And for the July to September quarter, Taiwan Semiconductor reported net income to shareholders of the parent company of NT$75.3 billion, translating to earnings per share of NT$2.91, representing a 1.3% decrease compared to the result in 3Q14.

Management also guided towards a soft fourth quarter, providing a revenue range of NT$201 billion to NT$204 billion and trimmed their capital expenditure to “about” US$8 billion. Given the company’s leading status in the sector, this was interpreted by many as being a major blow for the industry and has acted to lower expectations significantly.

We like this because it makes it easier for the company to outperform going forward and the shares had held up pretty well in trading anyway. Currently, the ADRs for example are in mid-single-digit positive territory year to date and have rebounded strongly (+30%) off their 52-week low.

Taiwan Semiconductor’s October sales have 40% of the company’s high end of guidance in the bag only one month into the quarter. Revenues year to date (January through October 2015) are a whopping NT$721.72 billion (~US$22.07b), representing a strong 16.2% increase compared to the same period in 2014.

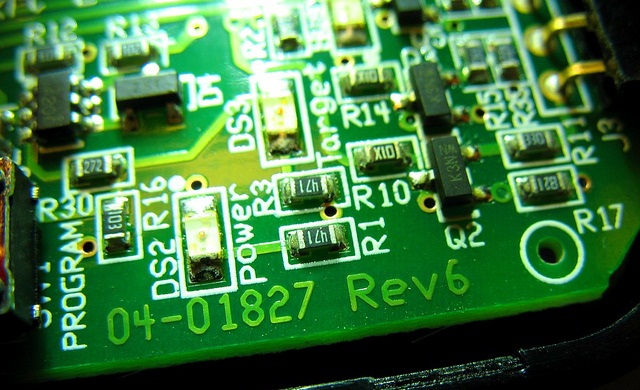

Combined with news from other companies in the industry of higher sales, it looks as though chip sales could be about to pick up again. Also positive is that the company is reportedly getting close to moving its InFO technology to mass production, with Apple a likely customer for the next iteration of its blockbuster iPhone. The Integrated Fan-Out technology should pave the way for thinner and lighter smartphones and add a meaningful new revenue stream for Taiwan Semi.

And longer term, despite any inevitable cyclicality, we believe growing silicon content in the world around us will provide a secular aspect to chip demand that is being underestimated by many. Consequently we view the current valuation metrics of 11.9 times forecast earnings and an EV/EBITDA multiple of 5.9 times as undemanding.

For nearly 15 years, Fat Prophets remains UK’s premier equity research and funds management company. Register today to receive our special report Bargain Hunting, and a no obligation free trial to our popular email service

Hot Features

Hot Features