BP Shares Surge As Activist Investor Elliott Builds Stake In Company

By

Fiona Craig

PUBLISHED:

10 Feb 2025 @ 20:59

|

Comments (0)

|

More info about Fiona Craig

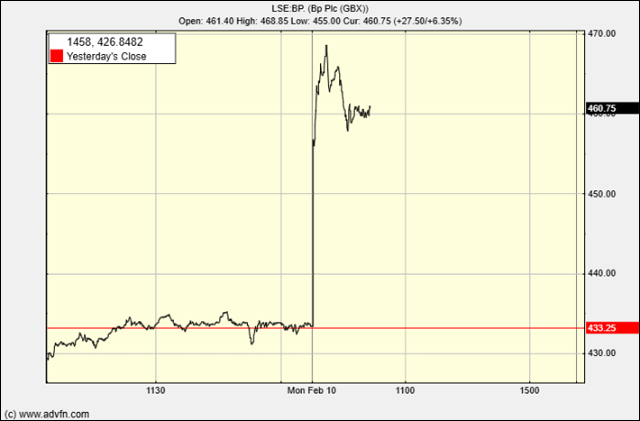

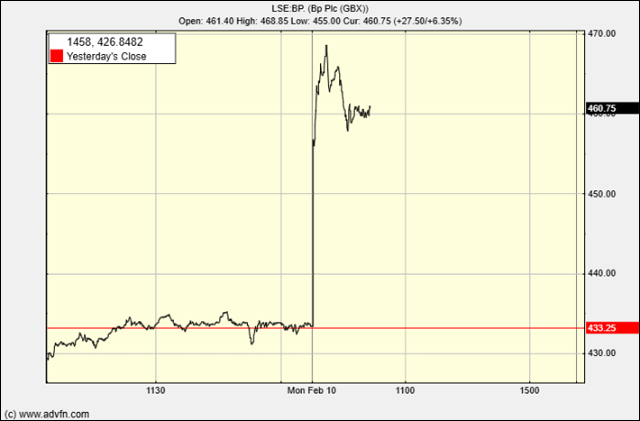

Shares in oil giant BP (LSE:BP.) have soared after a report from Bloomberg says that activist investor Elliott Investment Management had acquired a stake in the company.

The company’s shares surged over 7% in Monday morning trading on the London Stock Exchange, pushing them to their highest since August.

Bloomberg said that Elliott is pushing for major changes to be made at BP to boost shareholder value, believing that the company is undervalued, with with a market capitalization of approximately £69 billion ($85.62 billion), compared to Shell’s £161 billion valuation.

BP has been taking steps to streamline its operations. Last week, it announced plans to sell a German refinery as part of efforts to cut its costs by at least $2 billion by the end of 2026.

The company warned recently that lower refining margins and planned maintenance would weigh on profits, potentially reducing earnings by up to $300 million quarter-on-quarter.

The company’s fourth-quarter and full-year financial results are scheduled to be released on February 11.

CLICK HERE TO REGISTER FOR FREE ON ADVFN, the world's leading stocks and shares information website, provides the private investor with all the latest high-tech trading tools and includes live price data streaming, stock quotes and the option to access 'Level 2' data on all of the world's key exchanges (LSE, NYSE, NASDAQ, Euronext etc).

This area of the ADVFN.com site is for independent financial commentary. These blogs are provided by independent authors via a common carrier platform and do not represent the opinions of ADVFN Ltd. ADVFN Ltd does not monitor, approve, endorse or exert editorial control over these articles and does not therefore accept responsibility for or make any warranties in connection with or recommend that you or any third party rely on such information. The information available at ADVFN.com is for your general information and use and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation by ADVFN.COM and is not intended to be relied upon by users in making (or refraining from making) any investment decisions. Authors may or may not have positions in stocks that they are discussing but it should be considered very likely that their opinions are aligned with their trading and that they hold positions in companies, forex, commodities and other instruments they discuss.

Hot Features

Hot Features