NatWest Group’s (LSE:NWG) results show a stable performance in key areas, with year on year movements across its various segments.

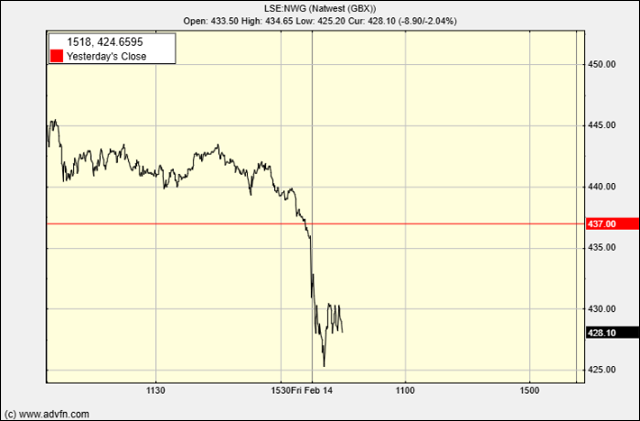

However, investor concerns over some aspects of the company’s performance sent the shares down by more than 2%.

The company recorded a total income of £14.7 billion, a slight decrease of 0.3% compared to the previous year.

However, income excluding notable items was up 2.2%, reaching £14.6 billion, driven by lending growth and deposit margin expansion.

Net interest income, a critical factor for financial services, was £11.3 billion, which is a modest increase from the previous year.

For the insurance sector, assets under management and administration (AUMA) were a key highlight, with a notable increase in net flows. AUMA rose by £2.4 billion in the fourth quarter alone, supported by positive market movements and new customer inflows.

The company also reported a 17.5% return on tangible equity (RoTE), up from 15.4% in the previous year, reflecting improved profitability.

Customer deposits, a crucial factor for liquidity, rose by £12.2 billion or 2.9% over the year. However, there were shifts within business segments, with growth in certain areas offset by lower current account balances in Retail and Private Banking.

Net loans to customers increased by £12.9 billion or 3.6%, primarily in the Retail and Commercial sectors, including a £2.2 billion contribution from the acquisition of Metro Bank mortgages.

The common equity tier 1 ratio, a measure of capital strength, stood at 13.6%, up 20 basis points from the previous year.

The liquidity coverage ratio remained strong at 150%, which provides a buffer against financial uncertainties.

Impairment charges were recorded at £359 million, equating to 9 basis points of gross customer loans, indicating a stable credit environment.

NatWest also continued to support climate and sustainable finance, providing £31.5 billion in funding and financing in 2024, which aligns with its broader initiatives to transition towards a sustainable economy.

“NWG is showing NII momentum going into 2025. Unlike peers, the bank has limited exposure to the FCA’s review of motor finance, “said analysts at RBC Capital Markets in a note. “NWG’s structural hedge is simpler than LLOY’s (due to the latter pre-hedging) but more complicated to model than BARC’s, which does not engage in reverse-feathering.”

Hot Features

Hot Features