Lloyds (LSE:LLOY) has reported that its annual profit plunged 20.4%, which fell short of market forecasts, as the bank set aside addition money for potential payouts on motor finance.

The company, which is the UK’s largest mortgage lender, revealed a pretax profit of £5.97bn ($7.5bn) for the year 2024, down from £7.5bn in 2023. Analysts had predicted a slightly higher profit of £6.39bn.

The decline was caused by the impact of interest rate cuts on lending margins and the continued sluggishness in Britain’s economic recovery, the bank said.

Net interest margin — the difference between savings and loan rates — fell 16 basis points to 2.95%.

Underlying net interest income fell 7% to £12.8bn amid falling interest rates. Pre-tax profit also tumbled in the fourth quarter to £824m, a 55% drop from the £1.8bn achieved in the previous quarter.

The bank’s net income for the fourth quarter of fiscal 2024 rose by 3.4%, reaching £4.37bn compared to the same quarter in the previous year. However, underlying profit for the quarter plummeted by 43.1% year-on-year to £993m, while earnings per share stood at just 1 pence, a 41.2% decline compared to the same period in 2023.

Lloyds has included a £700m provision for potential remediation costs relating to motor finance commission.

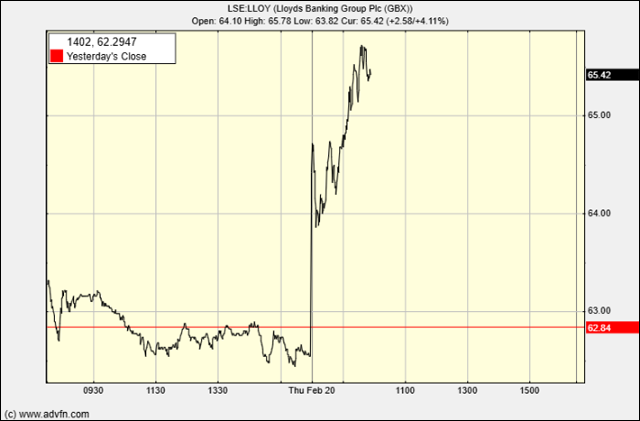

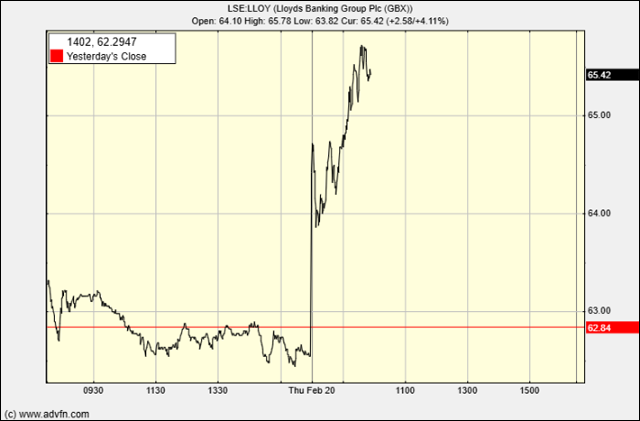

Despite the disappointing results, Lloyd’s share price rose 5% in early trading on Thursday.

CLICK HERE TO REGISTER FOR FREE ON ADVFN, the world's leading stocks and shares information website, provides the private investor with all the latest high-tech trading tools and includes live price data streaming, stock quotes and the option to access 'Level 2' data on all of the world's key exchanges (LSE, NYSE, NASDAQ, Euronext etc).

This area of the ADVFN.com site is for independent financial commentary. These blogs are provided by independent authors via a common carrier platform and do not represent the opinions of ADVFN Ltd. ADVFN Ltd does not monitor, approve, endorse or exert editorial control over these articles and does not therefore accept responsibility for or make any warranties in connection with or recommend that you or any third party rely on such information. The information available at ADVFN.com is for your general information and use and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation by ADVFN.COM and is not intended to be relied upon by users in making (or refraining from making) any investment decisions. Authors may or may not have positions in stocks that they are discussing but it should be considered very likely that their opinions are aligned with their trading and that they hold positions in companies, forex, commodities and other instruments they discuss.

Hot Features

Hot Features