Forexiro is gaining global traction as it evolves to meet the changing demands of the gold market.

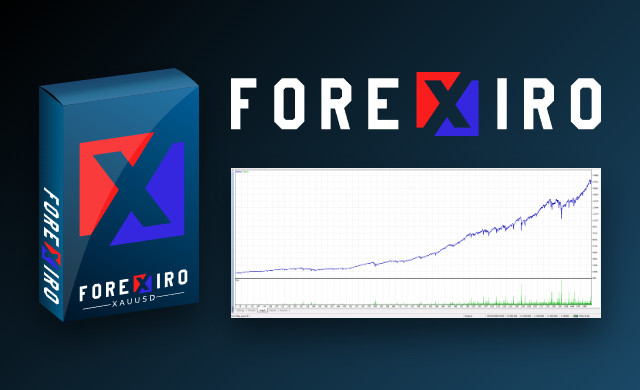

Forexiro offers traders a structured, data-driven approach to navigating market volatility on the gold market. It is designed to enhanced the execution of trades with algorithm-driven strategies, equipping users with real-time market insights for great precision and control.

The system addresses the limitations of traditional static indicators, redefining the way traders approach fluctuations in the gold price.

Navigating Gold’s Dynamic Market

Gold is one of the most volatile and liquid assets, and it is influenced by factors such as geopolitical uncertainty, macroeconomic events and central bank policies. This volatility can mean traders struggle to time their entries and exits effectively – leading to unnecessary risk exposure and missed opportunities.

Forexiro integrates a comprehensive, multi-layered analysis that addresses this challenge by ensuring that each trade aligns with prevailing market conditions and risk parameters. It evaluates momentum shifts, price patterns and liquidity zones, equipping traders with the insights needed to make more informed, confident decisions.

This methodological approach emphases quality over quantity, instead of just relying on rapid execution or high-frequency trading. Traders can filter out market noise, to focus solely on high-probability setups.

Traders Demand Smarter Trading Solutions

Financial markets are becoming increasingly competitive and driven by data. Traders want systems that combine automation with strategic execution. This demand for precise, structured trading environments continues to grow as market participants seek better ways to navigate gold price fluctuations while maintaining control over their risk exposure.

Forexiro is rapidly being adopted worldwide by gold traders because of its effectiveness in delivering optimised solutions that resonate with traders worldwide. It is designed to combine advanced technology with an intuitive interface, and continues to evolve to meet the changing demands of the market.

The continued expansion of automated trading solutions signals a shift toward structured, rule-based execution rather than impulsive, reaction-based trading. Forexiro stands at the forefront of this evolution, helping traders execute smarter, more disciplined trades in gold markets worldwide.

James Patel, Global Marketing Director at Forexiro, says, “The rapid global adoption of Forexiro underscores our commitment to providing AI-optimised gold trading solutions that resonate with traders worldwide.”

FAQs

1. Is Forexiro easy to use?

Forexiro has an intuitive and user-friendly interface, making it accessible to everyone trading forex at all levels of experience. Whether you’re a seasoned professional or a novice trader, navigating and using Forexiro’s features is straightforward and hassle-free.

2. What help can I get with using Forexiro?

There is a dedicated customer support team available 24/7 to assist you with any questions or issues you may encounter. The team also offers personalised consultations with experienced traders who will provide tailored guidance and advice. There is also a wealth of educational materials and resources, from comprehensive tutorials to in-depth market analysis, that are designed to enhance your trading skills.

3. What risk management options does Forexiro offer?

Forexiro lets you set fixed stop loss and take profit levels to define your risk parameters and protect your capital. You can customise your risk profile to match your trading style and risk tolerance. It also adjusts position sizes dynamically based on market conditions and risk factors.

4. What trading pair and timeframe does Forexiro use?

Forexiro is designed to trade the XAUUSD pair on the H4 timeframe.

5. What technology does Forexiro use?

Forexiro uses an innovative martingale technology that dynamically adjusts position sixes to cover loss positions, potentially turning losing trades into winners.

About Forexiro

Forexiro (https://forexiro.com/) is an expert advisor (EA) built for XAU/USD trading on the H4 timeframe. Designed for precision and risk management, it combines advanced algorithms, martingale technology and trend analysis to optimise trade execution. With a user-friendly interface, it empowers traders of all levels to capitalise on gold market opportunities.

Hot Features

Hot Features