Shares of African Barrick Gold plc (LSE:ABG) closed at an all-time low today as the gold miner admitted it missed its production target of the yellow precious metal in 2012, its fourth year in a row since it enlisted on the London Stock Exchange and set a further lower expectation for 2013 for a fifth year run.

At the close of trading, nearly five million shares switched hands and brought the share price of the FTSE 250 firm down by 39 pence, or 11.4% to 302 pence, as investors were advised the company will produce between 540,000 and 600,000 ounces of gold by the end of 2013, lower than the 626,212 ounces ABG produced in 2012, itself nine percent lower than 2011 production.

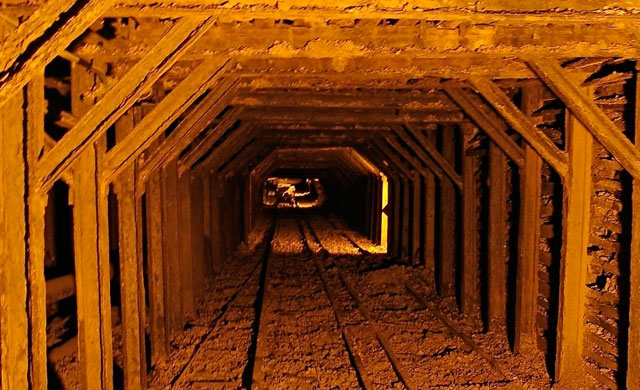

ABG’s 2012 performance had been hit by lower head grades from three of its mines and the loss of “skilled employees” after the Government of Tanzania revised its pension statutes, resulting to early retirement of nearly 300 staff, leaving a shortfall in manpower and subsequently dropping production levels from its flagship mine, Bulyanhulu.

Cash cost per ounce increased by 37% from US$692 in 2011 to US$949 in 2012 due to higher energy and maintenance expenses, it said, whilst average realised gold price for the previous year only increased by 5% to US$1,668 an ounce, resulting in a reduction of cash flow by as much as 31% to US$401 million.

Despite that, ABG is to give out dividend to its shareholders to secure their support at US$0.163, the same as that in 2011, whilst urging them to “stick with us” during the current year.

The Board of ABG has authorised an operational review in January this year of the business “with the aim of recalibrating our operations so as to drive improved returns from the asset base whilst enhancing the certainty of delivery” the earliest results of which is set to be felt by the second half of 2013.

Hot Features

Hot Features