A day after the Cypriot government reached an agreement with the Eurogroup for the terms of the 10-billion euro bailout package, a new set of directives were given to bank managers today as citizens marched on the streets of Cyprus’ capital, Nicosia, in protest of the bailout terms.

In a report presented by BBC’s Paul Mason, bank managers across the troubled island-economy were provided instructions today in relation to the capital controls imposed on banks as agreed last week that include a limit on weekly withdrawals and use of debit and credit cards and prevention of encashment of checques and withdrawal of fix-term deposits when the banks open on Thursday.

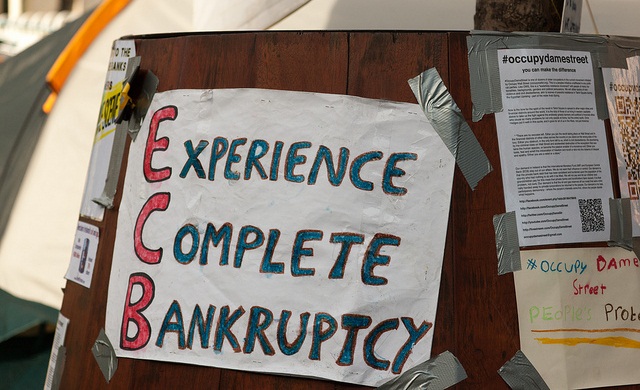

Banks in Cyprus have been closed for business since 15th March as the government negotiated for rescue funds with the Eurozone, the International Monetary Fund, and the European Central Bank – collectively referred to as the “troika” – to prevent the euro-member economy from collapsing.

The instructions given ahead of the opening of the banks on Thursday to prevent the threat of a run at the banks, seen by others as a likely scenario after the government agreed that uninsured deposits – those beyond the 100,000 euros guaranteed by EU laws – will take a “haircut” to raise the 5.8 billion euros as part of the bailout deal.

What is “unclear” in the instruction, Mr. Mason said, is that there were no definite figures in the limits to be set, which added to the anxiety in the already uncertain scenario of the outcome of the bailout.

Yesterday, Cyprus and troika agreed to split the country’s second biggest bank, Laiki (Cyprus Popular Bank) into a good bank and a bad bank, with the latter to be wound down whilst the former to be fused into Bank of Cyprus, the country’s biggest.

The two banks had posted heavy annual losses after being exposed to Greece’s debt and its bondholders, shareholders, and depositors of accounts beyond 100,000 euros – the uninsured deposits – ordered to take part recapitalising themselves as part of the overhaul of Cyprus bloated banking sector.

The uncertainty on the allowable amount that depositors who are expected to flock the banks across the country on Thursday is heightened by the statement of Cyprus’ Finance Minister, Michael Sarris, on the total amount to be levied from the uninsured deposits to raise the 5.8 billion euros.

In an interview with Bloomberg, Mr. Sarris said depositors may see cut by as much as 40% of their deposits, collectively estimated to be around 60 billion euros.

Amidst the chaos felt in the country, the Chairman of the Bank of Cyprus tendered his resignation as about 1,500 students are protesting on the streets of the capital, which has little economic activity on an otherwise busy working day.

Later today, the government is to lay down further details on the restructuring of the two largest banks.

Hot Features

Hot Features