Markets in both Asia and Europe have traded down on Thursday, as investors react to Federal Reserve Chair Jerome Powell’s recent comments that the current economic situation is unprecedented.

“The scope and speed of this downturn are without modern precedent, significantly worse than any recession since the second world war.” Powell said, In a webcast with the Peterson Institute for International Economics on Wednesday May 13.

Outlining the effect of the ongoing Covid-19 crisis on income inequality in the United States, the Federal Reserve has released data finding that 40 per cent of households earning less than $40,000 included someone who has lost a job since February.

Powell recognised what he described as “a level of pain that is hard to capture in words.”

More than 20 million Americans have already lost their jobs as a result of the countrywide shutdowns imposed to prevent the spread of the novel coronavirus

Since March, both the Federal Reserve and Congress have undertaken almost unprecedented interventionist action in order to limit the economic devastation. The US central bank has cut interest rates to zero, stepped in to the corporate bond market and sought to sure up dollar liquidity, while Washington has passed a record-breaking $2.9trn (£2.4trn, €2.7trn) in financial stimulus.

Powell dubbed such actions as “both timely and appropriately large” but admitted: “it may not be the final chapter, given that the path ahead is both highly uncertain and subject to significant downside risks. Additional fiscal support could be costly but worth it if it helps avoid long-term economic damage and leaves us with a stronger recovery.”

The hints at further stimulus would normally buoy market sentiment and thus indices. However, fears that Powell could introduce negative interest rates in some form or another have overridden any potential enthusiasm.

Powell has consistently resisted such a policy, but with President Donald Trump pushing for negative rates and the likes of the Bank of England signalling their openness to the idea, investors are increasingly fearful. Furthermore, with rates already at 0-0.25 per cent, and a hike extremely unlikely, there is not much further for Powell to go.

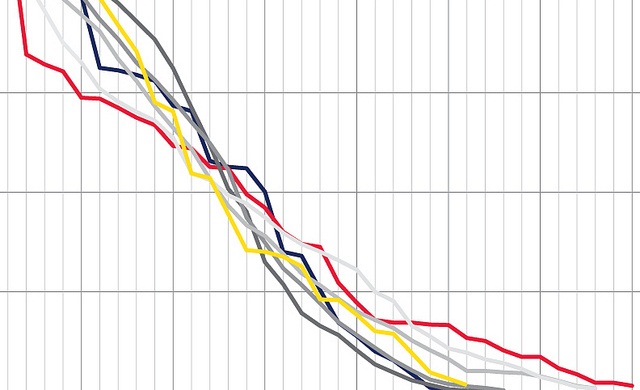

By early-afternoon Thursday trading, the FTSE 100 stands down 2.47 per cent, the Euro Stoxx 50 has fallen 2.03 per cent and Tokyo’s Nikkei 225 Index closed down 1.74 per cent.

Hot Features

Hot Features