ARM Holdings (LSE:ARM) is a unique company, it has a unique product line, it neither manufactures nor distributes anything, but consumer appetites are driving a growing worldwide demand for products that contain products that are derived from ARM’s products.

Things were looking all that good for ARM back on 17 July this year when its share price reached a low of 469.00. ARM shares closed on a shortened Christmas Eve trading day at 770.50, a slight drawback on the half day but up more than 64% since 17 July. The real escalation in share price came after the company announced its third quarter results on 23 October.

ARM posted a 17% YTD increase in revenue over 2011 YTD, an increase of £58 million from £354 million to £412.7 million. The third quarter was a big contributor with a 20% gain in revenue year-on-year from £120.0 million to £144.6 million. Pre-tax profits for the third quarter were up 22% from £55.7 million to £68.1 million in 2011. YTD profits increased by the same percentage from £160.7 million to £196.6 million.

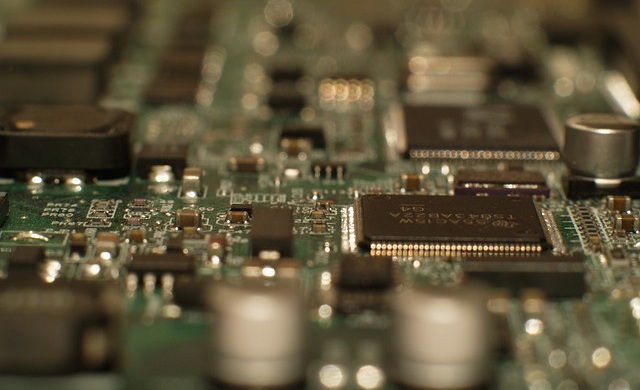

ARM licences highly advanced computer chips of its own design to an electronics market that is burgeoning with innovative products. Both the manufactures of the products and their customers are demanding faster, lighter, and more secure circuitry and power in everything from TVs to PC’s to mobile phones, tablets, and pads. Smaller, lighter, and faster are the bywords in the mobile phone business. You can’t make a phone thinner and give it a bigger screen without smaller, but more powerful circuitry that also doesn’t suck the battery dry. With a market cap of £10.6 billion and an army of elite engineers, ARM is a force to be reckoned with.

On the investing side, one of the things that makes ARM particularly interesting is its future revenue picture. Although not easy to see, it has about double the amount of deferred income (contracted but not invoiced) as is does current income. Combine that with a 46% operating profit margin and you are looking at some real money.

ARM is in the leading position in the fastest growing business sector in the world. Unless someone drops massive EMP bursts all over the world and drives us back to the stone age, ARM’s future is looking bright. Come to think of it, they’ve probably got a circuit design already that would turn all electronic devices back on.

Hot Features

Hot Features